Uddrag fra Zerohedge:

25 or 50?

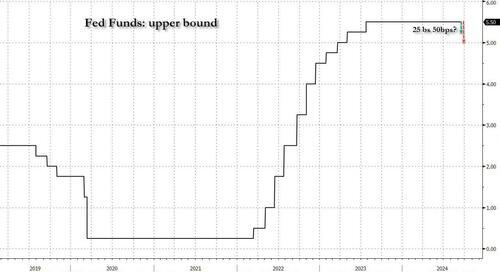

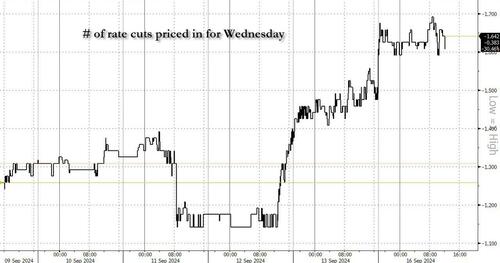

For markets, the only thing that matters this week is whether the Fed will opt for a 25- or 50-basis-point cut on Wednesday. Traders see that as a very close call, especially after the narrative made it seem for much of the past month that a 50bps cut would be tantamount to the Fed admitting there is some behind the scenes “panic” about the economy thus sparking a selloff in stocks. However this narrative took a back seat in the past week as the market made it clear that the bigger the cut the better (especially with elections looming for a decision that is as much about politics as it is about monetary policy). As a result, rate markets boosted bets on a larger move today after virtually discounting the possibility entirely last week, following several new media trial balloons, with a WSJ op-ed by Greg Ip and a BBG essay by nevertrumper Bill Dudley adding to the “jumbo cut” chorus following last week’s reports from Timiraos and the FT.

The dramatic repricing in rate cut odds sent the yield on two-year US bonds back toward the lowest level in two years and weighed on the dollar; analysts at Edmond de Rothschild summed up the mood, writing that “there has rarely been so much uncertainty over central bank intentions.”

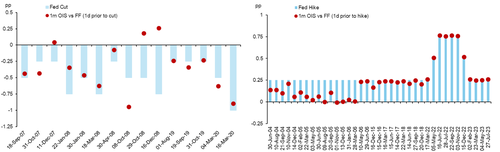

This statement can be affirmed by looking at what various banks and trading desks are saying this morning and over the weekend. Let’s start with Goldman derivatives trader Brian Garrett who writes in a note (available to pro subscribers) that “50 or 25” is pretty much all you are reading this morning. Garrett then ran data on “futures pricing” vs “fed action” going back 15+ years and found the following:

- Hiking cycles: the Fed has typically delivered close to what is priced going into the meeting, and has never surprised the market on hikes since Bernanke.

- Cutting cycles: the Fed has surprised on the dovish side during crises (GFC / Covid) but has also under-delivered cuts vs expectations on some occasions (e.g. Sep 2019).

So despite the barrage of dovish trial balloons, will the Fed underdeliver? According to Goldman head of hedge fund sales, Tony Pasquariello, there is no reason why Powell would pick 50bps over 25bps, to wit (from his weekend note available to pro subscribers):

“It seemed clear from last week’s commentary — our last waypoints into the blackout period — that the intention for next week is to start with a 25 bps clip, while the forward threshold to 50 bps is low. Furthermore, the CPI print didn’t favor the argument for 50 bps … and history suggests 50 bps increments are usually reserved for an environment of significant stress. So, those are the practical considerations for 25 bps. At the same time, however, isn’t there a real argument to go bigger given that (1) the starting point of 5.375% looks increasingly out of place; (2) you don’t want to be held hostage by the bond market; (3) it could feel like a very long seven weeks from September FOMC to November FOMC, a period that includes two payrolls prints, so why not take out a small bit of insurance now?”

At the same time, Goldman’s derivative sales trading desk writes that while “the rates market is evenly split between 50 and 25, pockets of the equity market are seemingly front running a 50bp cut (see RTY +2.5%, Non-profitable tech {GSXUNPTC Index} +3.6%, etc). RTY vol screens rich here, but there are other ways to play for a real economy bounce back without paying the high vol levels RUT is at right now: RSP or DIA calls. We think these have room to rally on continued optimism around a 50 bps cut” (full note available to pro subscribers)

In a far more sarcastic note from Nomura’s Charlie McElligott (also available to pro subscribers), the cross-asset strategist takes a much more acerbic view of the shift in the narrative in the past week, saying that what the Fed has done is effectively “send in the clowns” to wit:

Greg Ip—Chief Econ Commentator at WSJ and former “Fed Whisperer”—throws his hat in the ring and advocates the Fed launching with a 50bps cut in an article released Sunday (“Interest Rates Are Too High. The Fed Should Cut by a Half Point” featuring the sub-header: “With Rates so far from ‘neutral’ and the labor market cooling, it’s better to start big”), seemingly all but ending this “25bps or 50bps” debate for the September FOMC, after the Committee felt the need to launch a number of “clean-up in aisle 5” -articles spamming out of “Fed watcher” realm late last week and over the weekend, in order to apparently rebalance market-pricing away from what had previously settled into markets anticipating a “25bps cut” cycle launch.

We beg of you….”Say Less:” And yet again, the Fed has apparently been forced to utilize financial media to finish the job for them, after only sowing more confusion with sadly now-standard incoherent cross-speak from Committee members in the dying moments ahead of the Fed blackout

To McElligott, the fact remains that the final Fed-speak which failed to affirm the 50bps option confusingly conflicted against the labor data’s downward trajectory since the previous update, and seemingly against even Chair Powell’s own prior guidance at Jackson Hole, where he crystalized the new Fed reaction function being based-upon this idea that the Fed “…will do everything we can to support a strong labor market” and that the FOMC “…do not seek or welcome further cooling in labor market conditions.”

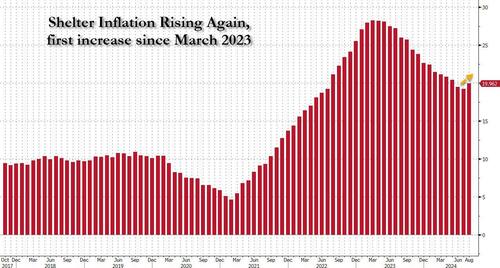

But this is where things get awkward, or as Powell would say, “stag” and “flationary”: assuming that the downshift in labor data since the prior update supporting a 50bps cut per Powell guidance (something which “nobody could have possibly anticipated”… except anyone who read our job market analyses from the past year) is that in the local lookback period, the inflation data over the short window since “Fed blackout” has awkwardly been quite hawkish with higher CPI, higher PPI, higher Manheim and revised higher Core PCE estimates, not to mention the first increase in shelter/OER inflation since March 2023…

… which is why September pricing still is not “full tilt” 50bps locked-in.

But as Powell noted in his Jackson Hole speech, the Fed has shifted the reaction function to the labor side of the mandate, and away from price-stability, as “…the upside risks to inflation have diminished” and so, as McElligott notes, “here we are.”

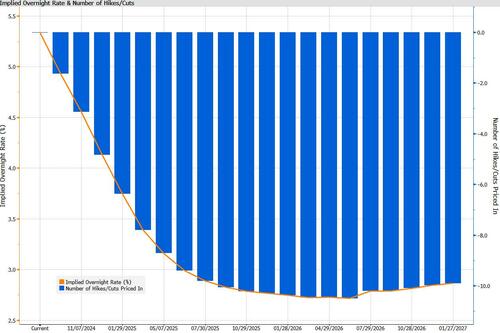

That’s why the Front-End markets shown above, had already begun moving their feet well-ahead of the Greg Ip piece and instead, got chopping after the initial WSJ (Timiraos) and FT (Smith) pieces late last Thursday, as Friday’s flows saw better Receiving and buying in Cash USTs, with big trading in FFV and resumption of Upside demand in short-dated SOFR:

To this point, Fed Funds futures are now implying ~40bps of cuts across the distribution for Sep, and through the Dec mtg, the market now sees ~121bps—i.e. a path which that has shifted towards that “50bps Sep + 50bps Nov…AND BEYOND” type scenario that would be present in a front-loaded Fed easing cycle commencement, because now that the market has priced 50bps, you’re “in it” or else the Fed risks creating its own massive “FCI tightening shock” if it disappoint versus the now-priced “dovish” path expectations, which then too can see Nov pricing tilted towards another “50bps cut” as it also is incrementally priced, or the Fed risks a “hawkish surprise” there as well

Which brings us to an interesting paradox: having “trial ballooned” a 50bps cut aggressively through the media, whether intentionally or not, anything less than the will trigger a selloff, the opposite of the equilibrium markets were in 2 weeks ago where a 50bps cut was viewed as Fed panic. McElligott explains below:

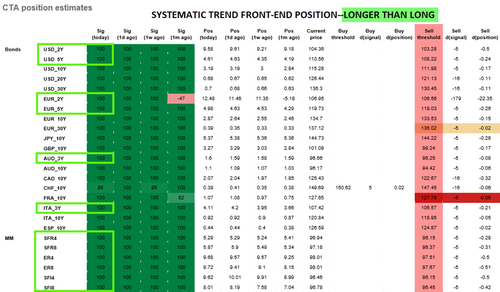

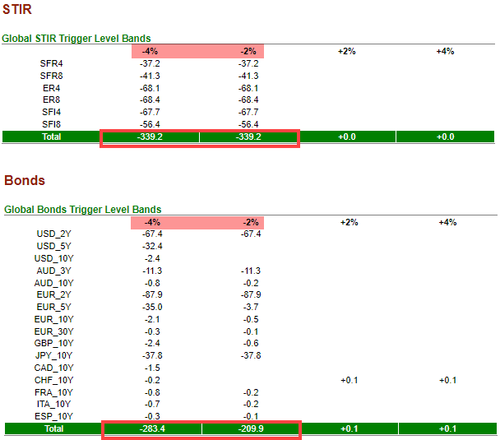

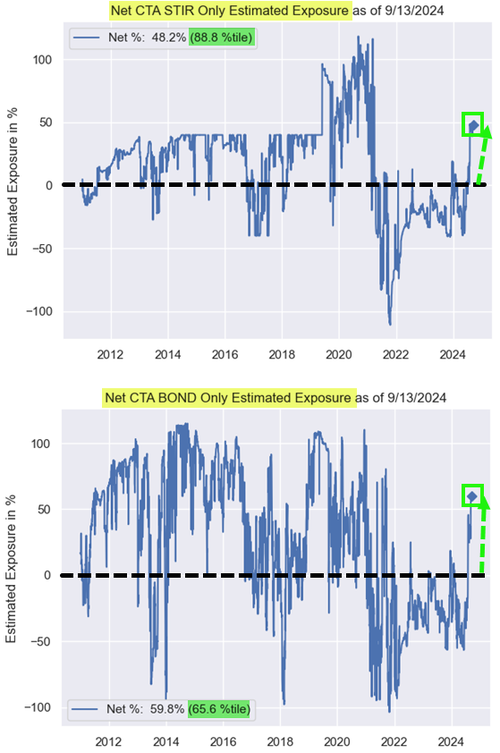

Why at this point a “25bps dovish cut” would trigger massive FCI tightening? Look at the Front-End / STIRS “Long” across Global Fixed-Income in our CTA Trend model as proxy for positioning accumulation in “Trend” (which too will looks a lot like Macro / Leveraged), where the Net Exposure across G10 Bonds for Managed Futures / CTA Trend is at highs since September 2021, and the aggregated Net STIRS position is at highs since March 2021… but also too, so deeply ITM (I think of CTA’s a lot like Options obviously) that we sit far from deleveraging triggers…so the point here being, there is potentially MASSIVE magnitude sell to deleverage flow, but you’d really need to shock hawkishly in order to get prices moving substantially in order to risk those “Sell triggers”

Putting it all together, McElligott writes that looking at today’s market, it is indeed the “QE Trade”-type market behavior we would expect in conjunction with a splash of “Pre FOMC Drift” phenomenon: US Stocks, USTs and Gold holding the big rally from last week, and US Dollar lower (and hence, the risk of major disappointment if the Fed does not deliver the 50bps that is now effectively consensus).

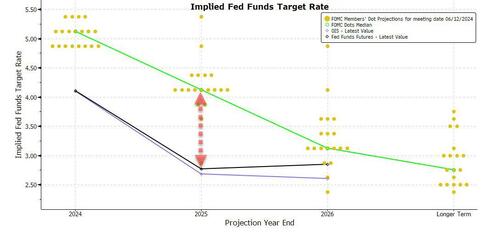

To summarize: if the Fed “disappoints” by cutting “only” 25bps (after the recent media campaign to position the market to expect a 50bps cut), expect a violent (if brief) downside shock to risk, as offside positioning is swept away and CTA triggers are stopped out. Yet just as much will depend on the next Fed dot plot, and how the Fed will adjust the rate glideslope into 2025 and onward to reconcile the huge chasm between market pricing (year-end 2025 OIS is at 2.765%) and the median 2025 dot (year-end 2025 median dot is 4.125%).

As the red arrow above shows, there is HUGE 1.5% delta between rate cut expectations as per the Fed’s Dot plot, and the OIS market through year-end 2025; as such, for the Fed to “catch down” to the market, nothing short of a recession may have to be factored in; alternatively failing that, the market will need to “motivate” the Fed to cut much more.

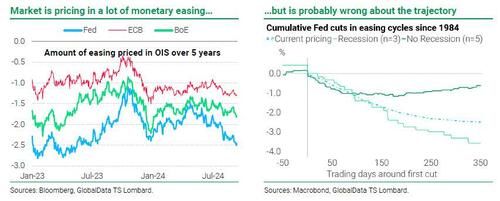

Translated: sharply lower stock prices, which price in the recession the Fed will have to defeat by cutting much more than it currently forecasts! The flip side is that the rate market may have gone way ahead of itself, and there is no recession to price in; which is why in a note from TS Lombard (available to pro subs here) the authors conclude that “the market is wrong about Fed cuts” and explain why as follows:

Disappointing data have been weighing on financial markets. A weak US July jobs report was followed by another below-expectation print in August. Global manufacturing continues to contract, judging from ISM and PMI leading indicators. Hard IP data paint a less dramatic picture, but not a particularly flattering one. Meanwhile, inflation has surprised somewhat to the upside.

Global central banks are bent on easing before a recession ensues. Inevitably, central bank bias has shifted towards easing, and markets have rushed to price in more and more cuts. We believe that central banks will succeed in averting a recession, owing to the lack of major financial imbalances that need correcting. Nevertheless, the risk of economic contraction has increased.

Markets are wrong about Fed cuts. Short-term rates are pricing in a Fed easing trajectory that differs from what the FOMC has tended to do in past episodes – whether there is a recession or not. If we do get a recession, the Fed will likely cut more than is currently priced in; if we do not, they will probably cut less. However, the two average trajectories broadly overlap in the first couple of months following the first rate cut, and that is what the market is pricing in. Thus, in the near term, market expectations are reasonable.

Needless to say, if we do get a recession – as both the bond and especially commodity markets are pricing in – stocks are trading far, far too high, and will tumble as the cross-asset imbalances are equalized.

While the above answers the question of what happens if the Fed does not cut 50bps – as is largely priced in today – in the short run, the question remains, what happens in the longer term? Here, there are several answers, starting with the most self-evident.

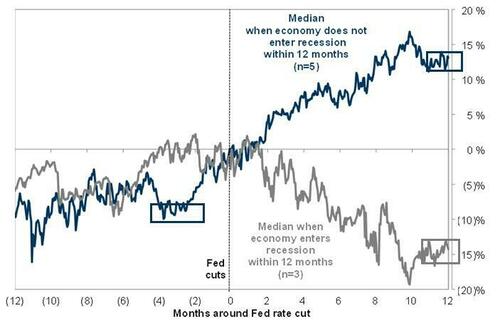

As we have discussed previously, the performance of the market during an easing cycle ultimately depends on the final destination.

- If a recession is averted, stocks rise by 14% in the 12 months after the first rate cut.

- Alternatively, if the US eventually goes into a recession within 12 months, the median return for the S&P 12 months after the first rate cut is negative 15% (note, on median basis, the S&P has actually rallied into the first the cut, blue rectangle)

Indeed, whether or not a recession is the endgame, is the key (obvious) question.

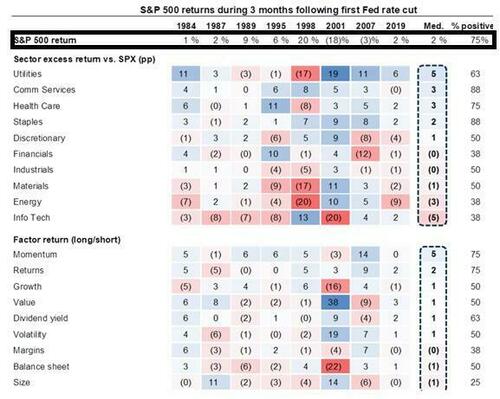

Drilling deeper, sector returns are very different…

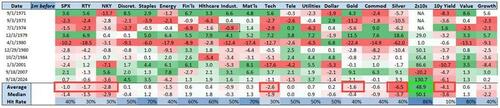

To get an even more granular answer, in a sperate note (also available to pro subs) Nomura’s McElligott looked at all prior instances of 50bps cuts to get maximum points in-sample, then screened the returns 1m going-into a 50bps cut (so you’ll see 9/18/24 on the build-up into this hypothetical), then 1m, 3m and 6m going-out:

- 1m Going-In: Generally seeing Stocks lower, US Dollar sideways, Metals lower, UST Curve Bull-Steepening, so some “fit” with current, save for USD and Metals moves this past month

- Going-Out: S&P is sideways, while RTY and NKY both see rallies with big Value (Some Cyclicals and Defensives) tilt over Growth (Tech / Secular), US Dollar higher, Metals raging higher, UST Curve Bull-Steepening…

To conclude, we should warn readers that there is the very real risk that Powell did not explicitly demand the barrage of media opinion pieces urging for a 50bps rate cut, especially with Democrat Senators now coming out with demands for a 75bps rate cut(!) – soaring home prices apparently be demand – suggesting that an outsized rate cut by the Fed will inevitably be viewed as a political move by Powell and could have election interference consequences.

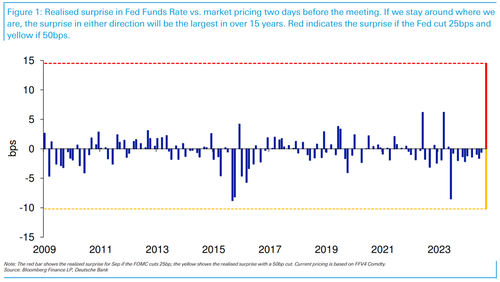

That is the contingency addressed this morning by Deutsche Bank’s Jim Reid who writes this morning that according to his analysis, including insights from the bank’s AI tool, suggests recent media hints towards a 0.50% cut are weaker compared to the lead-up to June 2022’s famous 0.75% hike. Nevertheless, current market pricing suggests a cut closer to 0.40%.

As DB’s Matt Raskin points out, and as Reid shows in today’s Chart of the Day, the surprise component of the Fed’s rate move two days out is now the largest in over 15 years, regardless of whether they go 25 or 50. Matt believes that we’ll either see further press-led communications that steer the market back to 25bps today or that ultimately the Fed will deliver 50bps on Wednesday.

DB’s conclusion is that a quiet day Monday/Tuesday in terms of informed Fed speak in the press will likely tip the scales towards 50bps on Wednesday.