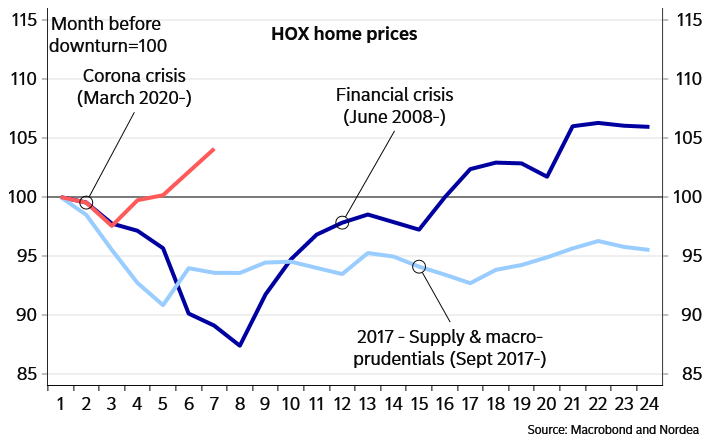

Huspriserne i Sverige er steget med hele 8,1 pct. i august, målt på årsbasis, og de har sat ny rekord. Det indikerer, at der er god gang i indenrigsøkonomien. Der er intet behov for en kick-start af økonomien. De fleste husejere har ikke oplevet job-tab som følge af coronakrisen, som Sverige har håndteret totalt anderledes end resten af verden.

Sweden Macro Review: Home prices further up in August

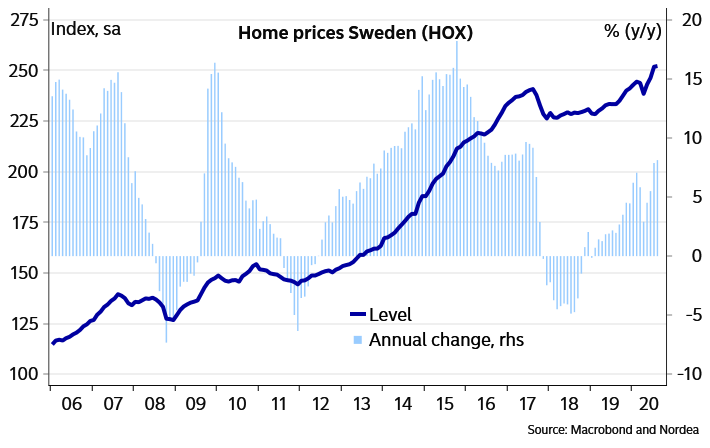

Home prices increased by 8.1 percent (y/y) in August and reached new all-time highs. Rising home prices give further support to the domestic recovery.

Home prices increased by 1.9% on the month and 8.1% (y/y) in August according to HOX/Valueguard home price index. Home prices have fully recovered and hit new all-time highs in August. Taking seasonal effects into account, home prices increased by 0.3% on the month.

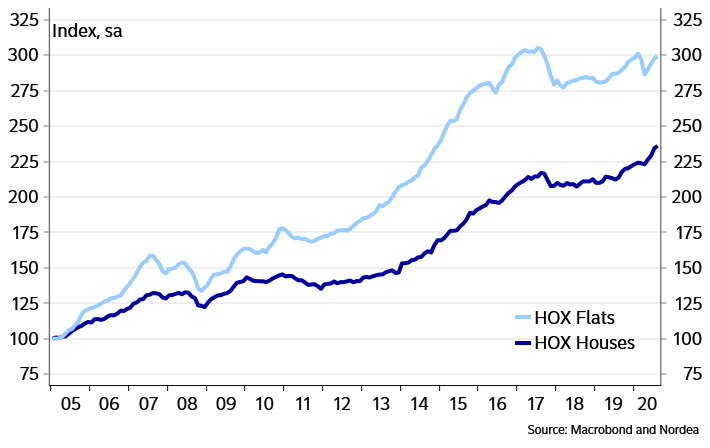

The increase in home prices is broad-based, although house prices are up more than apartment prices. House prices are up by 10.6% over the year, while apartment prices are up by 4.1%.

Households are optimistic about home prices, supporting home prices at these levels during the fall. Most home owners have been unaffected by job losses. In addition, low rates give further support. Today’s reading indicate some upside risk to our forecast that home prices will rise by 6 percent this year.

Rising home prices support the economic recovery and pave way for a healthy growth in domestic demand. Further out, risks related to household indebtedness rise, which should worry the Riksbank. Any additional measures to “kick-start” the economy is not necessary, and the Riksbank’s buying of covered bonds should be questioned.

Details, HOX, August:

Home prices (m/m), seasonally adj.: 0.3% (prior 2.0%)

Home prices (m/m).: 1.9% (prior 2.0%)

Home prices (y/y): 8.1% (prior 7.9%)