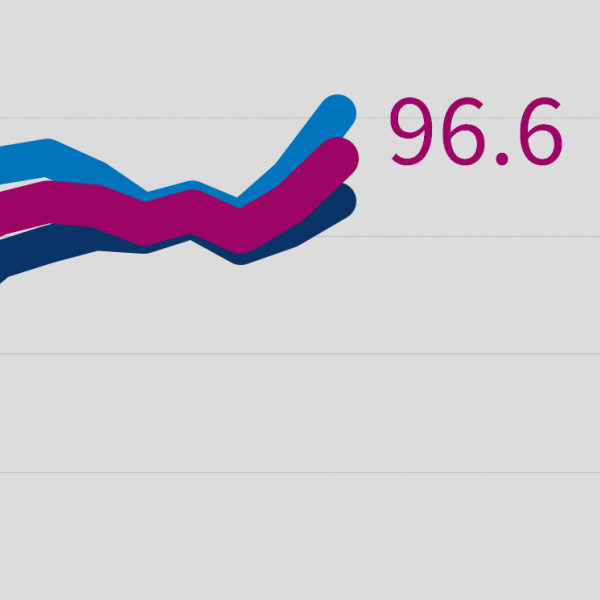

Ifo-instituttets måling i marts over det tyske erhvervsklima viser en markant fremgang fra 92,7 point til 96,6 point – det højeste niveau siden juni 2019. Det viser en betydelig tilfredshed med erhvervssituationen i dag – trods den tredje coronabølge – og indekset viser også en voksende optimisme for de kommende måneder. Optimismen ses også i servicesektoren, der ellers har været undertrykt under coronakrisen.

ifo Business Climate Index Rises Notably (March 2021)

Sentiment among German managers has improved noticeably. The ifo Business Climate Index rose from 92.7 points (seasonally adjusted) in February to 96.6 points in March. This is its highest value since June 2019.

Companies were clearly more satisfied with their current business situation.

Optimism about the coming months has also returned. Despite the rising rate of infections, the German economy is entering the spring with confidence.

In manufacturing, the business climate continued to recover. Companies were considerably more satisfied with their current business. Their expectations were the most optimistic they have been since November 2010. Demand for manufactured goods rose appreciably. The indications are for recovery across all industries.

In the service sector, the Business Climate Index rose markedly. Satisfaction with the current situation grew. As to expectations, cautious optimism returned for the first time since the fall. Business was particularly good for IT service providers. But hotels, restaurants, and tourism still find themselves in a very bad situation.

In trade, the Business Climate Index surged. The indicators for the current situation and for business expectations both rose sharply. In retail, however, the situation is still bad, albeit slightly less so than the previous month. Positive exceptions were supermarkets, bicycle dealers, and florists.

In construction, the Business Climate Index is back in positive territory. The indicator of the current business situation rose to its highest value in a year. Companies’ expectations also improved.