Resume af teksten:

Mangel på officielle amerikanske regeringsdata grundet nedlukningen skaber bekymring, men alternative rapporter viser svækkende forretningsaktivitet og et afkølet arbejdsmarked. Servicesektoren oplevede et fald med ISM-indekset ned fra 52 til 50, indikativt for flad aktivitet. Dette er det værste resultat siden pandeminedlukningen i maj 2020. Beskæftigelsen steg minimalt, men er fortsat under det neutrale niveau på 50. ADP private lønningslister viser en fortsat nedgang i jobmarkedet, og jobåbninger er nu færre end antallet af arbejdsløse. På trods af inflationsfrygt ser Fed ud til at prioritere den svækkede jobmarkedssituation, med forventede rentenedsættelser i oktober og december. Selvom tariffer påvirker priserne, er deres indvirkning langsommere end forventet.

Fra ING:

Although we may be lacking government-produced statistics, numerous other data reports have been released this week, and they’re not looking great. Weakening business activity and a cooling jobs market will likely trump lingering tariff-related inflation concerns, with the Fed set to cut rates again in October and December

The US shutdown means there’s little official US government data being released

Services activity cooled as hiring slides

The government shutdown means no ‘official’ economic data, but we continue to get numbers from other organisations. Today’s ISM services index for September has come in weaker than predicted, dropping from 52 (growth territory) to 50 (consistent with flat activity). The consensus prediction was 51.7, but the outcome was actually below all individual survey responses provided to Bloomberg.

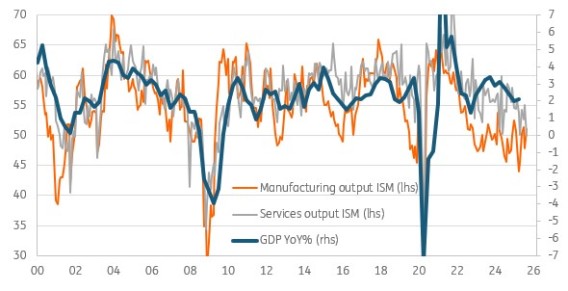

The details show business activity dropping to 49.9 from 55.0. This is the worst outcome since the shutdown period of the pandemic in May 2020, while new orders fell from 56.0 to 50.4. The employment component rose to 47.2 from 46.5, but because it remains below 50, this increase merely means that the pace of job losses slowed last month. The chart below shows the output measures of both the services and manufacturing ISM series versus annual GDP growth, and based on the historical relationship, points to the risk of slowing growth in the coming quarters.

GDP growth (YoY%) versus ISM output metrics advanced 6 months

Source: Macrobond, ING

Weaker jobs trumps inflation worries

While we didn’t get the jobs report today, the ADP private payrolls numbers earlier in the week suggest the jobs market continues to cool, while the job openings numbers within the JOLTS report show there are now more unemployed people in America than there are job vacancies. At the same time, a slowing quits rate – a measure of job turnover – is pointing to wage growth dropping below 3% in early 2026. This combination of sub-trend growth and weakening jobs numbers will, we believe, drive the Fed’s interest rate decisions.

There are lingering concerns about tariffs pushing up prices and inflation, with today’s ISM prices paid series doing nothing to dispel them – it rose to 69.4 from 69.2, so well above the 50 break-even level. However, tariffs have come through more slowly than feared in the key inflation metrics the Fed focuses on, of CPI and the PCE deflator. As such, the balance of risks to the Fed’s dual mandate of price stability and maximum employment justifies the central bank moving monetary policy closer to neutral with 25bp interest rate cuts at the October and December FOMC meetings expected.

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.