ING hæfter sig ved, at det førende tyske indeks, Ifo, steg kraftigt i februar til 92,4, og det er den største stigning siden juli. Det går rigtigt godt i industrien, og der er kommet gang i byggesektoren, mens servicesektoren stadig ligger stærkt underdrejet på grund af lockdown. ING advarer dog om, at traditionelle data som Ifo ikke giver et helt rigtigt billede af økonomien under coronakrisen. Bundesbank ser mere dystert på økonomien end indeksene giver udtryk for. Det ser ud til, at Ifo lige så meget udtrykker den optimisme, der råder på aktiemarkedet. Der er altså modstridende signaler, og derfor skal Ifo-tallene tages med et gran salt, mener ING.

Germany: The return of optimism

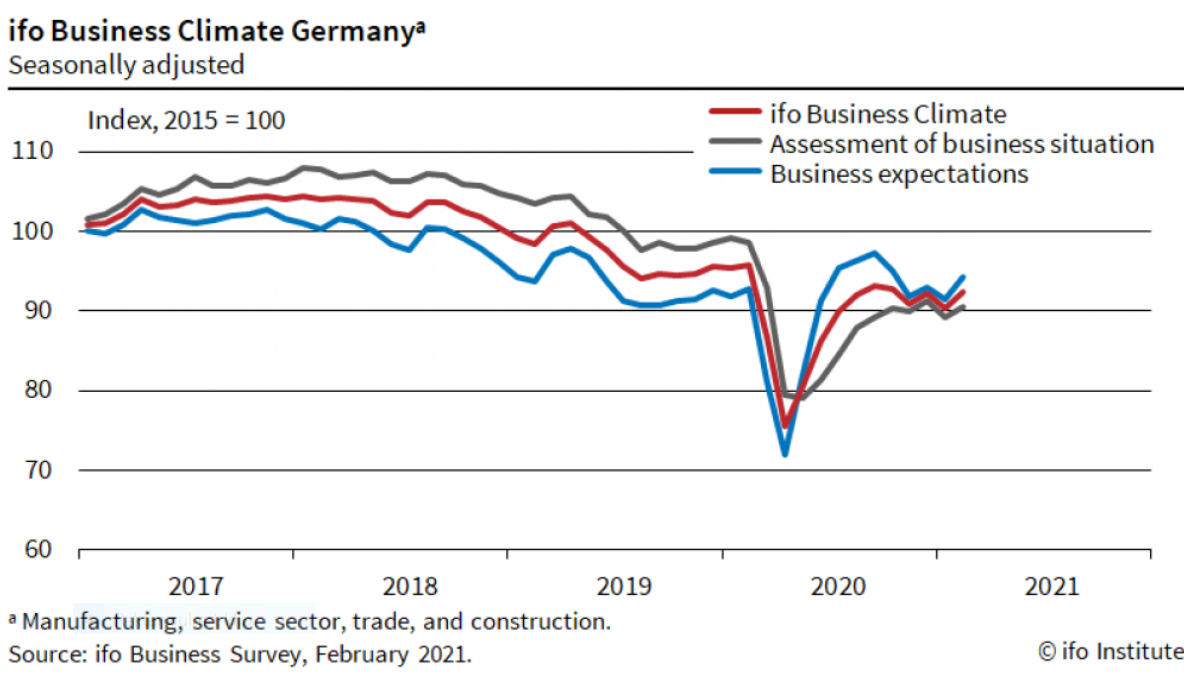

The latest Ifo index numbers show that optimism has returned to the German economy as many businesses seem to have joined financial markets in looking through any adverse short-term effects from ongoing lockdowns and the slow start of the vaccination rollout

Germany’s most prominent leading indicator rebounded in February. The Ifo index increased to 92.4, from 90.3 in January, the strongest monthly increase since July last year. Both the current assessment and the expectations component improved, with expectations posting the largest monthly increase since June last year.

Today’s Ifo index shows that German businesses, particularly in the manufacturing sector, seem to be following financial markets in looking through the negative impact from ongoing lockdowns.

Vaccinomics and a bag of mixed signals

While obviously at the headline level the outlook for the German economy remains mainly determined by the lockdown and vaccinomics, there are at least two additional drivers shaping the short and longer-term outlook.

The first driver is the impact of the winter weather during most of February. Expect it to have a significant impact on the construction sector in the first quarter.

The second driver is the more structural divergence of the manufacturing and service sector. Larger parts of the service sector remain significantly affected by the lockdown measures. At the same time, strong activity in the manufacturing sector helped to avoid a contraction of the entire economy in 4Q, and the positive momentum seems to be continuing in the first months of the new year as well.

Last week’s PMIs signalled another acceleration of the manufacturing sector in February, despite increasing supply-side pressure. Interestingly, the PMI for the entire economy is still above the 50-threshold, pointing to positive GDP growth. On the other hand, the Bundesbank’s activity tracker, points to a shrinking economy. A mixed bag of signals.

These days, we remain cautious about interpreting traditional leading indicators. In our view, they are of only very limited use for nowcasting of GDP growth rates. Alternative data is of more use, even though mobility data might currently give a worse picture of actual economic developments than in 2020, simply due to adaptions to the new situation.

With this in mind, as encouraging as today’s Ifo index readings are, they should be taken with a pinch of salt. What the Ifo index shows is that German businesses have followed financial markets in looking through negative short-term effects from lockdown measures and slow vaccinations. Nothing more, nothing less.