Resume af teksten:

Bank of England har sænket renten til 3,75%, men beslutningen var mere stram end forventet, hvilket holdt markedsrenterne højere og styrkede pundet lidt. Der er usikkerhed om yderligere rentenedsættelser i februar eller marts. Det forventes, at inflationen vil falde, hvilket kan føre til to rentenedsættelser i første halvår af 2026. Komitéen er tydeligt splittet, men flertallet tror stadig på flere nedsættelser næste år. Ser man fremad, kan yderligere rentenedsættelser medføre, at Storbritannien ses som mindre af en inflationsafviger. Pundet har haft en begrænset stigningsreaktion. EUR/GBP forventes at stige mod 0,90 i 2026, og GBP/USD kan nå 1,34 ved årets udgang og derefter 1,36 i 2026 på grund af en svagere dollar og stærkere euro.

Fra ING:

The Bank of England has cut rates to 3.75%, but the decision was more hawkish than expected, leaving market rates higher and sterling slightly stronger. It’s a close call whether the Bank cuts again in February or March. But we think the UK will soon look like less of an inflation outlier, and we’re expecting two cuts in the first half of 2026

The Bank of England delivered a hawkish holiday rate cut

The Bank’s decision was more hawkish than expected

Going into Thursday’s Bank of England decision, there was a sense that data this week – weak jobs, rapidly falling wage growth and lower inflation – would unlock a more dovish message from officials.

That doesn’t seem to have been the case. The Bank, while cutting rates down to 3.75% as widely expected, did concede that upside risks to inflation look “less pronounced”. But it also said that future decisions would become a “closer call” – a nod to the fact that rates are getting closer to neutral. And while the Bank rarely tells us what neutral actually means in practice, it’s generally assumed most officials think it’s between 3-3.5%.

What’s also striking is how the lines have become more blurred between the doves and the hawks. In November, the dividing line was clear: the doves, worried increasingly by slack in the jobs market, wanted to crack on with rate cuts. The hawks all pointed to model evidence suggesting inflation is statistically more likely to stay higher for longer once it rises above 3%, together with the risk that rising inflation expectations would fuel a more persistent bout of price pressure.

All of that is still largely true – five members, including Governor Andrew Bailey this time, voted for a cut, while the four hawks remained opposed. The committee is visibly divided.

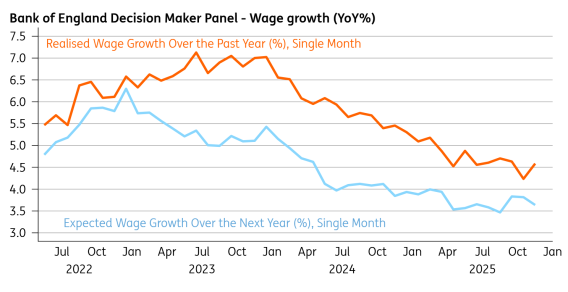

But in the meeting minutes, hawks and doves alike point to surveys which show wage growth expectations have levelled out in the 3.5-4% range in recent months. The implication is that actual wage growth, which has tumbled, may not have much further to fall. The Bank’s own surveys of CFOs (Decision Maker Panel) will be released again in early January, and it is clearly going to be key.

Wage growth expectations have levelled out, according to a BoE survey

Source: Bank of England

On the flip side, some of the hawks appear more comfortable with inflation after the recent Autumn Budget included measures which will bear down on headline CPI in the new year. Long-standing hawk Catherine Mann described her vote against a rate cut as “finely balanced”.

That said, we don’t view today’s decision as a game-changer. Fundamentally, the Bank – or most officials at least – still think further cuts are likely. It has not changed our mind that the Bank will cut rates twice more next year.

The timing is admittedly uncertain. We narrowly expect another cut in February, but it’s a close call. There’s only one more round of inflation and wage/jobs data before then, suggesting the views of the committee won’t shift enormously over the next eight weeks.

If it’s not February, then we think it’ll be March. Fundamentally, the UK should look like much less of an inflation outlier next year. Headline CPI should be very close to 2% by May – maybe even below. That’s why we expect another cut in the second quarter, leaving the Bank Rate at 3.25% thereafter.

Sterling enjoys a limited relief rally

Perhaps a slightly less dovish BoE rate cut than expected has triggered a modest relief rally in sterling. Remember that asset managers went into this meeting substantially short sterling and needed something dovish. In the end, what was on offer failed to meet their needs, and traders have shifted their expectations on the size of the 2026 BoE easing cycle. Here, the Sonia interest rate contracts out to December 2026 have sold off around 5-6 ticks as the market has pared back the second potential 25bp rate cut next year. In the gilt market, we’ve seen a little bearish flattening as the BoE tips a little cold water on the magnitude and speed of the easing cycle.

Looking ahead, and based on the view that the BoE still delivers two cuts next year, we suspect EUR/GBP continues to find support ahead of 0.87. We see no reason to change our forecast calls of EUR/GBP trending gently higher through 2026 towards the 0.90 area, with some extra upside risks around UK local elections in May. Equally, today’s news is helping GBP/USD towards our 2025 year-end target of 1.34, and we are mildly positive here in 2026, looking for 1.36 as the weaker dollar and stronger euro trend start to dominate.

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.