Resume af teksten:

Lønvæksten i Storbritannien aftager hurtigt, samtidig med at arbejdsmarkedet køler ned. Private sektors lønninger stiger nu med 3,9% årligt, ned fra næsten 6% ved årets start. Denne nedgang i lønvækst understreges af tre måneders årlige vækstrater på kun 3%. Arbejdsmarkedet viser tegn på afmatning med et fald i antallet af ansatte på virksomheders lønningslister med 0,5% i år, især i detail- og hospitality-sektoren. Offentlig sektoransættelser, der engang holdt væksten oppe, er også faldet i tre måneder i træk. Dette peger på at UK ikke længere er en udpræget undtagelse i forhold til inflation, og et rentefald forventes på torsdag, med to yderligere nedsættelser i første halvår af 2026.

Fra ING:

Wage growth is slowing quickly, at a time when the wider jobs market keeps cooling. The UK is becoming less of an outlier on inflation, and we expect a rate cut on Thursday and two further moves next year

Wage growth is losing steam as the broader job market continues to cool

Ask any Bank of England official, and they’ll tell you that sticky wage growth has been one of the central reasons it’s been cautious about cutting rates over the past couple of years. But that is changing – and rapidly.

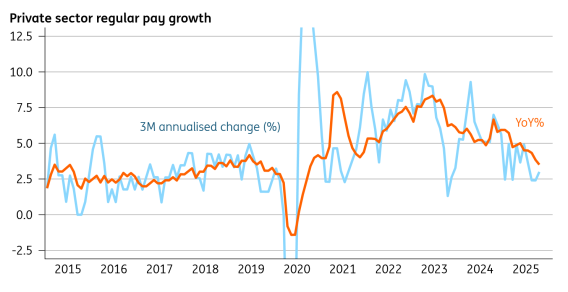

Having started the year close to 6%, private sector pay is now rising by 3.9% in annual terms. In fact, wages are rising by just 3% in three-month annualised growth terms, which gives a clear sense of just how much momentum has slowed through the summer. Those annual growth rates should steadily move lower over the coming months.

Private sector wage growth is slowing rapidly

Source: Macrobond, ING

Admittedly, that is baked into the Bank of England’s most recent forecasts. But remember the Bank is extremely divided on the question of inflation persistence – and the hawks have been sceptical that wage growth would in fact move lower, after so many forecast misses over the past couple of years.

All of this comes amid further signs of cooling in the UK jobs market. The number of employees on company payrolls is down 0.5% this year so far, and more significantly so in the private sector. Companies – especially in retail and hospitality – have been shedding workers this year, partly because of earlier tax and minimum wage hikes. Hiring surveys remain weak.

Until recently, that was helpfully offset by resilience in government hiring, but that appears to be changing. Public sector employment has also now fallen for three consecutive months, judging by those payroll numbers.

Public sector employment has started falling alongside the private sector

Source: Macrobond, ING

This epitomises one of our key calls for 2026, which is that the government is going to be less of a tailwind for growth than it has been in 2025. Where real departmental spending has grown by close to 4% in both the previous and current fiscal year, it will rise by less than 2% in FY2026. This comes as the deficit is projected to drop by a full percentage point to 3.5%, owing to the ongoing freeze in income tax brackets.

Altogether, slowing wage growth combined with further signs of cooling in the wider jobs market hints at the UK becoming less of an outlier on inflation. A rate cut on Thursday is highly likely, and we expect two further moves in the first half of 2026.

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.