ING har analyseret chip-produktionen og vurderer, at der i lang tid vil være mangel på chips, bl.a, fordi 5G-teknologien fører til en massiv efterspørgsel. Markedet for chips vil vokse med to-cifrede rater. Forbrugsprodukter som computere og smartphones aftager langt de fleste chips. Manglen på chips vil fortsætte ind i 2022, og det vil især ramme bilproduktionen. Producenterne investerer heftigt for at klare efterspørgslen, med TSMC og Samsung i spidsen. Stort set hele produktionen af chips og grundmaterialerne (wafers) finder sted i Østasien.

Why semiconductors are as scarce as gold

A shortage of semiconductors is a continuing and major issue. The squeezed market is forcing manufacturers to slow down, weighing on recovery. And ongoing strong demand keeps the pressure on. A ramp-up of capital investment to boost production capacity helps, but it’s going to take time before demand and supply are structurally in sync again

Demand and supply shocks squeeze chip markets

Computer chips are in short supply due to a sudden spike in demand linked to Covid-19. This demand shock is primarily caused by consumers who can’t splash the cash on services such as restaurants and travel and who are now spending more on consumer electronics. The strong demand for home office equipment and faster than expected recovery from other sectors are also not helping.

The roll-out of 5G networks isn’t helping

On top of that, 5G cellular networks are rolling out and there’s a subsequent rise in demand for new compatible smartphones. While most semiconductor factories operate at maximum capacity, breakdowns at four Texas facilities due to extreme cold and a fire at a Renesas Naka factory north of Tokyo worsened the situation going into the second quarter.

Suppliers of game consoles and smartphones are having real trouble meeting the demand for their products due to the semiconductor shortage. You can also see it in the automotive industry where there’ve been production cuts and planned interruptions.

Structural demand for chips is growing rapidly

Although part of this demand shock is temporary, there’s a structural dimension to rapidly expanding semiconductor usage. The market is expected to grow by double digits again in 2021 according to IC insights. Many devices that used to be completely analogue are now digital and supported by integrated circuits. For example, smart thermostats or light bulbs compatible with home systems contain significant computational power to support their functionality as well as digital connectivity.

Cars and trucks also require an increasing number of semiconductors thanks to the extension of integrated Advanced Driving Assistance Systems (ADAS) and board computers. The rise in the production of electric vehicles and future steps in autonomous driving will push demand up still further.

Supply issues may spill into 2022

Current lead times for chips can be as long as 26 weeks and up to a year for some specific variants. Recent incidents at facilities in the US and Japan put the lead times further under pressure. Despite significant planned investments in semiconductor production facilities, capacity will remain scarce well into the second half of 2021. Even if the acute shortage is resolved in the second half of the year, semi-conductor manufacturing lines will remain operating at near full capacity in the coming years making the industry sensitive to future supply shocks.

Capital investment boost will raise capacity, but this takes time

In order to meet growing demand, chipmakers started to ramp up investments. The Taiwanese company, TSMC, is boosting capital expenditure from USD17bn in 2020 to USD28bn in 2021. On top of that, the company plans to invest still more, to the tune of some USD100bn in the next three years to grow capacity.

Samsung also plans to increase semiconductor-related capital expenditure by 20%, up to USD31bn this year and announced there’s more to follow. Although these soaring investments will let supply catch up, this takes time and won’t bring much relief this year. Remember, chip production machines have long lead times. In the meantime, we notice that chip manufactures are ending volume discounts and some are also raising prices.

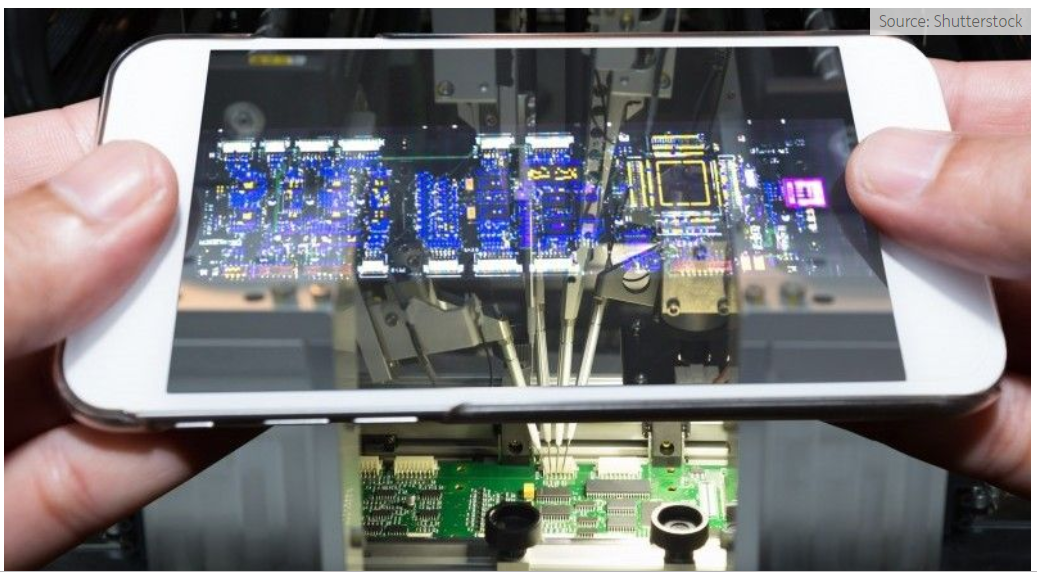

Most wafer production capacity concentrated in Asia

Manufacturers of electronic devices generally outsource their semiconductor production partially to large so-called foundries such as TSMC which produce wafers for third parties. Most installed wafer capacity (the capacity to process blank silicon wafers into chips) is based in Taiwan and South Korea. China and Japan also represent a significant share. Altogether 70-75% of supply is sourced from Asia.

Only a small portion is produced in Europe, making the continent dependent and sensitive to delivery issues. That’s why the EU aims to create more capacity in its own region, and the US also intends to ramp up chip production as part of President Biden’s recently announced stimulus plan.

Consumer electronics uses almost 75% of chip supplies

In a digitalising world with fast-growing data volumes, various production sectors are increasingly dependent on chip supplies. Manufacturers of laptops and smartphones are obviously the largest consumers of chips, taking almost 75% of the pie. The remainder is delivered to the automotive sector, other manufacturers and infrastructure purposes. However, as we’ve just mentioned, with objects being increasingly connected and with more intelligence being built-in, demand for semiconductors from all sides is on the rise.

Automotive production takes a hit around the globe

The automotive industry has been especially hit hard by the semiconductor shortage. This is partly due to the common just-in-time manufacturing strategy. When automotive production was down 40% in the early days of the pandemic, many orders for car parts including semiconductors were cancelled. As demand for semiconductors recovered more quickly than expected, the spare production capacity has been allocated away from clients in the industry.

Carmakers seem to have overestimated availability. In the second half of 2020 manufacturers were struggling to get their hands on semiconductors Consequently these manufacturers cut or suspended production at sites worldwide for short periods.

Continuing chip shortage limits car production recovery in 2021

Chip shortages led to around a million fewer cars being produced in the first quarter of 2021, according to IHS Market; that’s some 5% of total production and there were fewer cars being made than in the previous quarter. Compared with last year, global production is starting to recovery, but it’s not easy to keep up with demand due to supply issues. Order books are full and lead times for new cars are up. We still expect global new car registrations to bounce back moderately but recovery is expected to remain limited and we’ll see just a few percentage point rise.

Shortages add to disruptions felt by manufacturing countries

In terms of impact, the disruption will be felt most in countries with a relatively large dependence on automotive manufacturing, such as Germany. Due to the popularity of lean- manufacturing among automotive companies, production cuts will also be felt by automotive parts suppliers.

Consumer electronics companies are also facing supply chain issues resulting from the semiconductor shortage, which will hit the likes of South Korea. However, this is partly a result of the strong performance of the historically high demand for consumer electronics. Compared to car makers they seem to be in a better contractual position. Nevertheless, the industry would surely perform even better without the capacity constraints it’s facing.