INGs analyse af ECBs forsigtige stimulering af økonomien viser, at ECB ikke “gør hvad der er nødvendigt” eller ikke har styrken til det. Der er ingen Fed-bazooka. Der er ikke den handlekraft, som blev set efter finanskrisen i 2008. Skal økonomien styrkes, er det op til politikerne.

Uddrag fra ING:

ECB: No ‘whatever-it-takes’ 2.0

The European Central Bank announces its first package to tackle the market turmoil and economic fallout from Covid-19. It’s a collection of measures, and it clearly hopes that targeted but smaller actions can make a difference

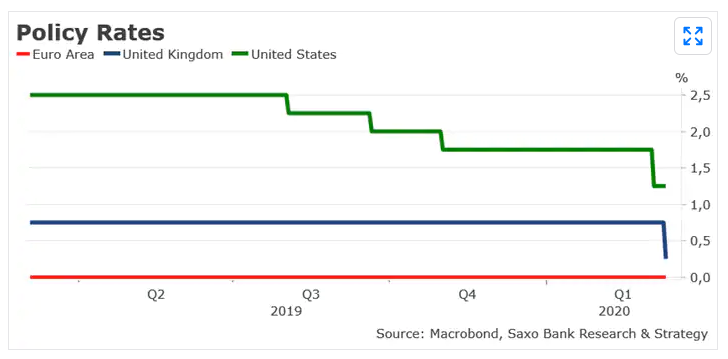

What did the ECB decide? Firstly, all interest rates remain unchanged even though ECB President Christine Lagarde remarked, during the press conference, that the central bank had ‘definitely’ not yet reached the reversal rate. The ECB is mainly focussing on providing additional liquidity and stabilising markets by additional QE.

Here’s the detail:

- The ECB announced additional LTROs, at the average deposit rate

- The ECB will change the conditions of the TLTROs between June 2020 and June 2021. These TLTROs will be conducted under even more favourable conditions than those previously. The TLTROs will be priced at the repo rate minus 25bp. For banks keeping their lending portfolio stable, the TLTROs will be priced at the deposit rate minus 25bp. In previous TRLTOs, banks had to show an increase in their lending portfolios. While these changes were partly presented as being aimed at small and medium-sized enterprises, they are, in fact, a measure to support the entire banking sector. That suggests it was tough to come up with a pure tailor-made approach to SME lending.

- The ECB announced an additional ‘envelope’ of euro 120bn of net asset purchases until the end of the year. During the press conference, Lagarde said the ECB would use all flexibility when spending the euro 120bn on assets. Temporary deviations from the capital key are possible.

At the same time, the ECB also used its other role, that of bank supervisor, to bring some relief to the banking sector, deciding on some temporary relief in capital requirements. There’s more on that here.

No ‘whatever-it-takes’, but targeted measures

The brief time ECB watchers were able to discuss the motive of Christine Lagarde’s brooch is over. The ‘wise owl’ is all of a sudden confronted with a multi-layered shock: an unprecedented combination of supply-side and demand-side shock, together with financial market turmoil and the increased risk of a negative feedback loop into the real economy. At the same time, however, the ECB is also well aware of negative side-effects of its monetary policy stance and, more generally, the fact that it has almost run out of ammunition.

The wise owl is all of a sudden confronted with a multi-layered shock

All of this explains why the ECB took today’s decisions without taking out the big bazooka. As Christine Lagarde said, she had no intention of having her own ‘whatever-it-takes’ moment. This is a package aimed at supporting the banks and preventing the sort of credit crunch that we saw in 2008. In fact, it is highly questionable whether any big bazooka would help, at least not right now. The only thing which could really stop fear, uncertainty and turmoil would be a vaccine and certainly not monetary policy easing.

Today’s measures are an attempt to tackle market turmoil and support the economy in a targeted manner. Judging from initial reactions, it wasn’t enough to tackle the first. Whether it will be sufficient to support the real economy we’ll only find out in a couple of months. And that will also highly depend on fiscal policies.

Christine Lagarde did not have her whatever-it-takes-moment today. Let’s hope governments will have theirs soon.