Resume af teksten:

Beskæftigelse i den private sektor i Storbritannien faldt yderligere i august med 43.000 ansatte, hvilket er det største fald uden for pandemien siden 2014. Dette fald kan føre til, at lønvæksten falder til under 4% ved årets udgang. Dette scenarie kan åbne op for yderligere lempelse fra Bank of England, selvom forventningen om en rentenedsættelse i november er usikker. Selvom beskæftigelsesmarkedet køler af, har ansættelsesundersøgelser vist en lille oplysning siden foråret. Lønpresset i den private sektor er faldet fra over 6% til 4,7% årligt, med tre-måneders annualiseret vækst på 3,6%. Inflationsdata, der offentliggøres snart, vil spille en vigtig rolle i beslutningen om en rentenedsættelse.

Fra ING:

Private sector employment fell further in August, which should help take wage growth below 4% by year-end. That keeps the door open to further Bank of England easing, though our call for a November rate cut hangs in the balance

The UK jobs market is still cooling

The UK jobs market is still cooling, though crucially, not materially faster than it was in the spring, following April’s big tax and minimum wage hike.

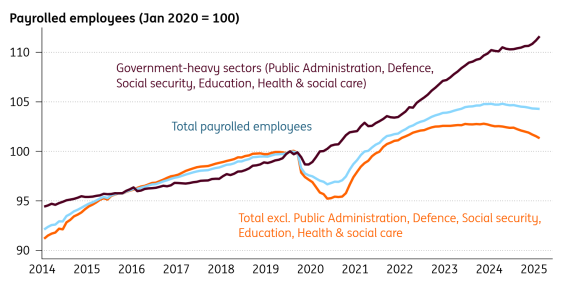

The number of private sector workers on company payrolls fell by a further 43,000 in August. That is not nothing, and in fact is the largest fall, outside of the pandemic, we’ve seen since the data was first published in 2014. But given the tendency of these numbers to be revised up, it’s likely that August’s decline in employment will end up looking comparable to the steady falls we’ve seen through this year. Private sector payroll numbers are down by a percentage point since the end of last year.

The jury’s out on what happens over the rest of the year. Generally, hiring surveys have turned slightly brighter since the spring, though the Bank’s own Decision Maker Panel survey suggests the opposite. Our base case is that the gradual cooling we’ve seen so far this year continues.

Private sector employment is falling

Source: Macrobond, ING

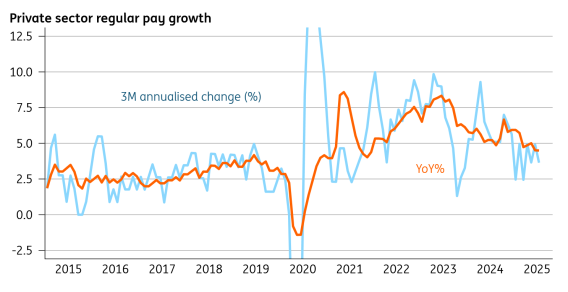

That cooling does appear to be – gradually – translating into reduced wage pressure. In annual terms, private sector pay growth is down at 4.7% from above 6% at the turn of the year. And in fact, the three-month annualised rate of growth is at 3.6%. We expect the annual numbers to fall to those kinds of levels by the end of this year, which would be in line with what the Bank of England’s survey of CFOs is telling us.

Private sector wage growth should be below 4% by year-end

Source: Macrobond, ING

That’s one of the reasons we still expect further rate cuts from the Bank of England. A move is highly unlikely this Thursday, and admittedly, this latest jobs report doesn’t really move the needle one way or another on a November cut, which we still narrowly expect. The Bank was surprisingly relaxed about the cooling in the jobs market back at its August meeting, and there’s not much that’s likely to have changed that.

Instead, tomorrow’s inflation data will be more important. Services inflation is likely to dip, though a big upside surprise – one not driven by volatile categories – would probably prompt us to take a November cut out of our forecasts.

For more on what we expect from the data ahead of the November Bank of England meeting, click here .

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.