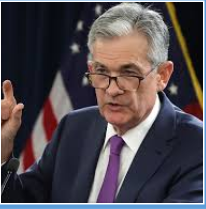

Chefen for den amerikanske centralbank, Jerome Powell, bekræftede i går, at centralbanken sætter renten i vejret i marts, og banken tager også fat på en reduktion af den enorme obligationsbeholdning på 9 trillioner dollar. Men han ville ikke sige, om der kommer yderligere rentestigninger i de kommende måneder. Det har der været forventning om. Det afhænger helt af udfaldet af krigen i Ukraine.

Fed’s Powell confirms March lift-off

March hike on its way, but no preset path

The Federal Reserve has released Chair Jerome Powell’s semi-annual testimony to the House Financial Services Committee and in it he confirms the Fed’s desire to raise rates on 16 March. “With inflation well above 2% and a strong labour market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month.”

He reiterated that raising the Fed funds rate is the “primary” tool used to tighten monetary policy, but the Fed will also shrink its $9tr balance sheet. This will “commence after the process of raising interest rates has begun, and will proceed in a predictable manner primarily through adjustments to reinvestments”.

Of course, the uncertainty and the economic hit from sanctions following Russia’s invasion of Ukraine was addressed, but there is only so much that the Fed can say and unsurprisingly he kept to stating that there will be no preset path to policy tightening and that the Fed will respond to the newsflow/data as it comes. “Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways. We will need to be nimble in responding to incoming data and the evolving outlook.”

Russia situation requires a ‘nimble’ Fed

After Powell’s hawkish shift at the January Federal Open Market Committee (FOMC) meeting, markets went as far as to price a 90% chance of a 50bp Federal Reserve hike on 16 March and up to 160bp of interest rate hikes for the year. However, expectations have been scaled back sharply in response to Russia’s invasion of Ukraine. As of yesterday, it has shifted lower to a mere 25bp hike in March and 120bp in total by the December FOMC meeting.

However, the positive domestic growth assessment by Powell and the clear desire to get inflation under control shone through in today’s testimony. He stated: “We understand that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials like food, housing, and transportation. We know that the best thing we can do to support a strong labour market is to promote a long expansion, and that is only possible in an environment of price stability.” This has given the market a little more confidence in the tightening path and while it is still priced for a March 25bp hike we are now back up to 140bp of tightening by year-end.

Case for tighter monetary policy remains strong

Given the situation in Ukraine, this will remain highly volatile and our own forecasts are subject to a huge degree of risk. Russia’s actions undoubtedly make the outlook far more uncertain and pose clear challenges for the global economy through higher commodity prices, more strained supply chains, and heightened anxiety.

Nonetheless, the US economy is growing strongly, has very low unemployment, and is experiencing inflation at 40-year highs. The US is also more economically insulated from the crisis than Europe through less direct trade and banking linkages and by virtue of being an energy producer.

It is obviously difficult to call how the geopolitical backdrop will evolve, but our central case for now is the Fed responds with six hikes this year and announces a gradual, passive run-down of its $9tr balance sheet in late 2Q.