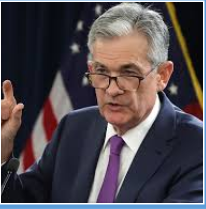

Efter måneders forventning om en snarlig aftrapning af de enorme amerikanske obligationsopkøb, var det en forsigtig formand for den amerikanske centralbank, Jerome Powell, der trådte frem for offentligheden i fredags. En begyndende aftrapning i september er mulig, men det afhænger af jobudviklingen og pandemien. Han erkendte, at inflationen er steget “kraftigt”, og selv om han længe har sagt, at en højere inflation er forbigående, så sagde han, at “vi ikke kan tage for givet”, at inflationen flader ud.

Uddrag fra ING:

Cautious Powell wants to wait on Fed taper

After the recent barrage of Federal Reserve speakers making the case for an early and swift tapering of QE asset purchases its Chair, Jerome Powell, takes a more cautious line in his speech at the Jackson Hole symposium. A September taper announcement remains possible, but a strong jobs figure next Friday is critical

Powell wants to wait on jobs and Covid

Many of his colleagues have been making the case for a September announcement with tapering beginning in October and concluding in late 1Q 2022/2Q 2022. However, Jerome Powell merely suggests it “could” be appropriate to begin the taper this year, and the decision-making process involves a delicate balancing act between the data and the spread of the Delta Covid variant.

He acknowledged that the recovery has beaten expectations and that there has been a “sharp” run up in inflation. He also recognises policymakers “cannot take for granted that inflation due to transitory factors will fade”. However, while the Fed have probably got to the point where “substantial further progress” has been made on inflation “we have much ground to cover to reach maximum employment”.

His caution is further emphasized by the statement that, an “ill-timed policy move unnecessarily slows hiring and other economic activity and pushes inflation lower than desired”. In an environment of “substantial” labour market slack this could be “particularly harmful”.

He is also at pains to disconnect any QE tapering from eventual interest rate rises, stating that “the timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff”.

Friday’s jobs report critical for September announcement

Jerome Powell’s softer tone relative to his colleagues has given the market food for thought. The resurgence of Covid certainly poses risk to the outlook, but the general commentary from other Fed officials is that the economy is proving to be resilient thanks to the success of the vaccination programme. It is also important to point out that there is evidence that Covid cases are topping out in some of the hot spots such as Florida and Missouri.

Today’s data showed the Fed’s favoured measure of inflation is at a 30-year high and with supply chain issues and labour shortages unlikely to ease in the near-term the Fed can justifiably say they have achieved their aim of “substantial further progress”.

It is a different story of employment, which remains 5.7mn below the level of February 2020. Nonetheless, it was down 22.4mn at the low point and after two consecutive months of 900k+ jobs figures we must surely be getting to the point of “substantial progress” here too.

Jerome Powell and the Fed Governors cautious attitude, which seemingly favours a November announcement and December start point for the taper, contrasts starkly with those of the assessments from the regional Fed Presidents.

Next Friday’s labour market data should be good, but may not be enough to seal the deal for a September taper announcement that would see asset purchases scaled back from October. The consensus is looking for 750,000 job creation for August while we are think something closer to 675,000. It may be that we need to see another 900k figure to tip the odds back in favour of a September taper.

The technical arguments underpinning the taper remain convincing

We have a front end super anchored from this, while the back end is looking more un-tethered, angling for a steeper curve from the back end in recent days. However Chair Powell’s tone did not go far enough to really sustain this, so we head into the weekend with long rates easing off the week’s highs. The next cue will some from bid data ahead, as from that we will infer the likely outcome from the September FOMC meeting where taper certainly remains up for discussion. Any material decent data and acceleration of taper should then re-steepen the curve from the back end. But we are not there yet.

It is fitting that the tapering discussion coincides with record volumes going back to the Fed through the reverse repo window, now structurally in excess of USD1trn a day on the overnight. While the Fed asserts that the facility is doing its job (and it indeed is), it is still an anomalous situation for the Fed to be injecting liquidity into the system on the front window to the tune of USD120bn per month while at the back window its getting chunks of this back. It’s not quite as simple as that of course, but the optics play into the notion that a Fed not doing anything in the guise of a near term taper would look all wrong.

2022 rate hikes still favoured

As for eventual rate hikes, we remain upbeat on growth and expect employment will be back to pre-pandemic levels next year. Meanwhile, lingering supply chain issues will add to costs in an environment of decent corporate pricing power while higher wages will add an extra impetus that continues to keep inflation well above target. This would allow the Fed to start hiking rates in late 2022 – a view shared by 7 of 18 Fed officials in June.

FX: Dollar rally takes a pause post Powell

FX markets welcomed a benign Jackson Hole speech from Powell by taking the dollar anywhere from 0.3% to 1.0% lower against a broad range of currencies. News that progress was being made towards a taper later this year was tempered by the fact the Delta variant had not (yet) hit US growth too sharply plus a reminder that the test for the first Fed tightening would be ‘substantially more stringent’ than that used for tapering.