Markedet venter en mere høgeagtig holdning i ECB, så hvis der bliver kun en overraskelse, hvis ECB på sit møde i dag indikerer, at den vil sætte renten i vejret – i juli – med mere end 50 basispunkter, vurderer ING. ECB kommer med prognoser for inflationen til 2024.

EUR & ECB preview: No hawkish surprise unless Lagarde hints at 50bp hike

Thursday’s European Central Bank meeting will raise the question of why it’s delayed tightening and whether a 25bp rate rise in July is a done deal or if there’s room for more. Any message that does not signal an openness to a 50bp hike would likely fall short of the market’s hawkish expectations and push EUR/USD closer to 1.0500

What to watch at the June ECB meeting

As we’ve already discussed in our ECB preview article above, it’s unlikely that the Governing Council will surprise with a rate hike on Thursday, and markets will instead focus on:

- New staff projections, especially the 2024 inflation figures

- Any hint that the ECB may hike more than the 25bp in July and September signalled by President Lagarde and Philip Lane

- How President Lagarde will address the “sequencing” topic and how she’ll answer questions about delaying tightening until July

Bar for a hawkish surprise set relatively high

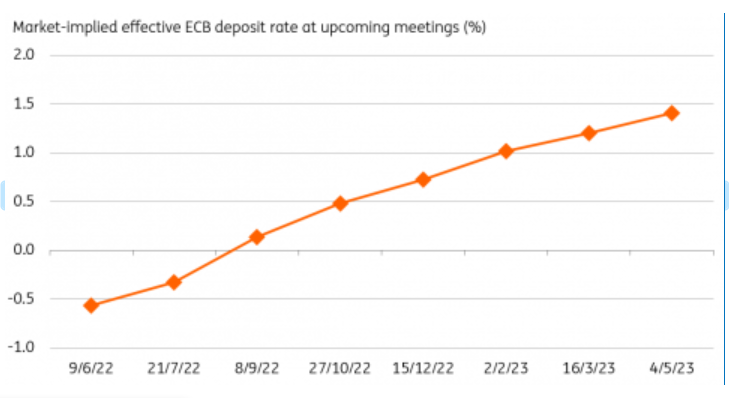

Market expectations for a rate hike this week are close to zero, while 25bp increases in July and September are fully in the price, in line with recent ECB communication. However, markets are pricing in a total of 130bp of tightening by year-end, which would imply a 50bp hike at one of the four remaining meetings – after the June one – this year, as you can see in the chart below.

Given the market’s aggressive expectations on tightening, we think it will take some quite clear openness by the Governing Council to a 50bp rate hike in July to surprise on the hawkish side this week.

Our estimates on EUR/USD reaction

Should President Lagarde merely reiterate the previously outlined plans for 25bp hikes in July and September, the market may well be tempted to price some tightening out of the curve for later in 2022 and 2023. In the table below, we estimate how a change in rate expectations – measured by the EUR 2-year swap rate – would impact EUR/USD. The calculations are based on our short-term fair value model and assume that all the other variables (the USD 2-year swap rate, relative equity performance and global risk sentiment) remain unchanged and are based on the current EUR/USD spot: 1.0700.

While we cannot exclude a hawkish surprise, we see a greater risk that President Lagarde will stick to her recently outlined plan for 25bp hikes in July and September, ultimately raising the risk of some dovish repricing across the EUR swap curve; for EUR/USD this means that the balance of risks appears slightly skewed to the downside. A return to 1.0500 in the coming weeks remains our base-case scenario.