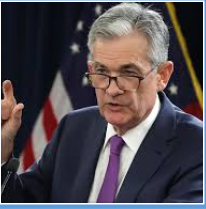

Spekulationerne på det amerikanske finansmarked er fyldt med rygter om udskiftning af centralbankchefen, Jerome Powell. “Afstemninger” på websites viser dog, at 80 pct. venter, at Powell genudnævnes af præsident Joe Biden, som Powell sadsynligvis har talt med for nylig. Kun 10 pct. tror på Lael Brainard. Hun er medlem af centralbankrådet. Men skulle hun alligevel erstatte Powell, så tror markedet ikke, det vil føre til nogen forandring, medmindre der kommer en ny finanskrise. Hun er anelse mere due-agtig end Powell og mener, at Fed i sin pengepolitisk skal tage hensyn til beskæftigelsen. Med hende ved roret bliver renterne i hvert fald ikke sat hurtigere i vejret end forventet.

Uddrag fra Fidelity/Reuters:

Powell or Brainard Fed? Markets relaxed either way

Speculation is mounting that Federal Reserve Chair Jerome Powell’s renomination is imminent. But even if distant-second favorite Lael Brainard gets the nod, markets would hardly notice the difference.

A flurry of activity on betting websites late on Thursday ramped up the probability of Powell being renominated to over 80%, and slashed Fed Governor Lael Brainard’s chances to less than 10%. Reports circulated that Powell had just visited the White House.

Despite the odds, Brainard remains the most likely replacement if the Biden administration decides not to replace Powell, so the implications of a Brainard-led Fed is still a factor for financial markets attempting to spec out all options.

Widely viewed as the most dovish member of the Federal Open Market Committee, investors would most likely see her ascension to the Chair as a sign of looser monetary policy relative to what is currently discounted.

Initially, and probably on the margins, this could mean some of the tightening projected for the next couple of years is dialed back, a steeper Treasury yield curve, higher longer-term inflation expectations, a softer dollar, and a ‘risk on’ rise in equity and credit markets.

But with his pledge to stay patient on raising rates, insistence that current inflation is transitory, and commitment to fulfilling the employment side of the Fed’s mandate, Powell is already chairing a committee delivering policy that is laying the ground for most of these scenarios.

How much more dovish would monetary policy be under Chair Brainard?

“Brainard would be ‘pass the baton,’ not a change in viewpoint,” reckons Scott Kimball, co-head of U.S. fixed income at BMO Global Asset Management.

“A Brainard Fed would be largely the same as the current Fed, unless financial stability became a real issue. She would be more aggressive on macro-prudential policy,” said Phil Suttle, founder of consultancy Suttle Economics in Washington.

LABOR WAY

When market players, commentators and watchers invoke Fed ‘credibility,’ they are almost always referring to the central bank’s commitment to meeting the inflation-targeting half of its mandate, rarely the maximizing employment side.

Yet Powell has spent all year stressing that interest rates will not rise until the U.S. economy is back to something approaching full employment, a stance Brainard fully endorses.

In Powell’s post-meeting press conference on Wednesday, there were 60 references made to employment or unemployment, the second most in the COVID-19 era after the 67 in March this year.

The number of references to employment in his virtual post-meeting press conferences has steadily risen this year from 24 in January. So has the number of references to inflation, as you would expect, but the 64 mentions on Wednesday were significantly fewer than the 94 and 86 in June and July, respectively.

Brainard has worked on labor market issues in various roles as a professor in the private sector and government official in the public sector. She would surely share Powell’s commitment to helping the U.S. economy recover as many of the 4.2 million jobs lost from the pre-pandemic peak before raising rates.

Although some measures of inflation are the highest in 30 years and a rates lift-off is coming closer into view, Brainard is of the view that the global forces pushing down on inflation for decades largely remain in place.

She and Powell both believe the economy can be run hot to push maximum employment without generating lasting inflation. And both may be willing to shift the goal posts for maximum employment as they gather more information on what the post-pandemic structure of the jobs market looks like.

“But if the labor market stops improving? That would put them in a difficult spot,” reckons Brett Ryan, senior U.S. economist at Deutsche Bank.