USA er blevet verdens største olieproducent, og derfor vil uroen omkring Iran ikke føre til højere oliepriser og vil dermed heller ikke påvirke økonomien og virksomheders indtjening, mener Merrill.

Uddrag fra Merrill:

The U.S.-Iran confrontation has induced a sharp degree of volatility into the global

capital markets. Our base case, however, is that the latest geopolitical shock does not

lead to a sustained oil price increase, thereby having a minimal and limiting effect on

global growth, corporate earnings and risk premiums. History never repeats itself, but

geopolitical shocks in the past have triggered sharp and short market pullbacks, followed

by subsequent market rebounds. We believe this time will be no different.

Why?

Because U.S. economic growth and earnings remain supported by an accommodating

Fed, the U.S.-China trade truce, sturdy U.S. economic fundamentals (housing, consumer

spending, and employment), and global reflationary policies in such locales as Japan,

China and Europe. Another critical support to our sanguine view lies with the Permian

“put”—or the fact that America’s energy independence has never been as great as it is

today, thanks to the U.S. energy renaissance, with soaring output from the Permian Basin

at the forefront.

Owing to three ingredients—(1) pro-market policies at the state and local level,

combined with (2) revolutionary technologies like horizontal drilling and hydraulic

fracturing, and (3) good old American entrepreneurship/risk-taking that upended the

energy patch—America’s buffer against unrest in the Middle East is basically itself,

America. While the U.S. isn’t immune to a global oil shock, America’s energy revolution of

the past decade and a half has taken the sting out of potential supply disruptions from

the Middle East. Hence the general easing in oil prices after an initial move upward.

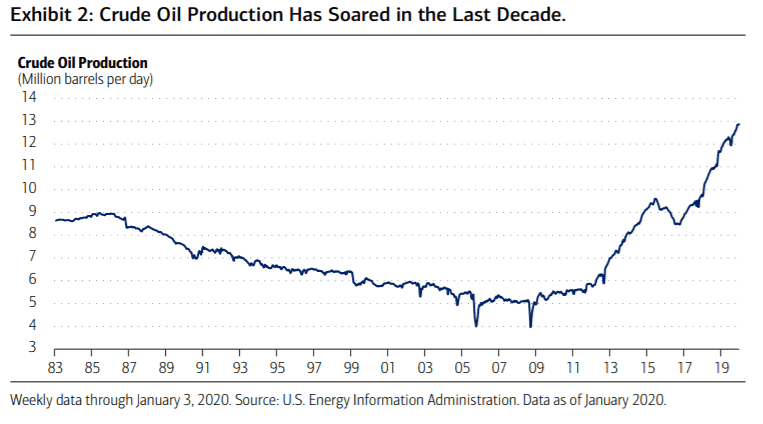

Exhibit 2 highlights the stunning surge in U.S. oil production since the early 2000s. U.S.

crude oil production averaged more than 8 million barrels per day (b/d) over the 1980s,

although daily oil output declined over the 1990s and into the first decade of this century.

A cyclical low was reached in September 2005, when U.S. crude production dropped under

4 million b/d. Ironically, the tide began to turn in the oil patch just about the time the U.S.

economy and financial markets imploded on the account of the global financial crisis of

2008/09. The U.S. is now producing almost 13 million b/d; America eclipsed both Russia and Saudi Arabia in 2018 to become the largest oil producer in the world.