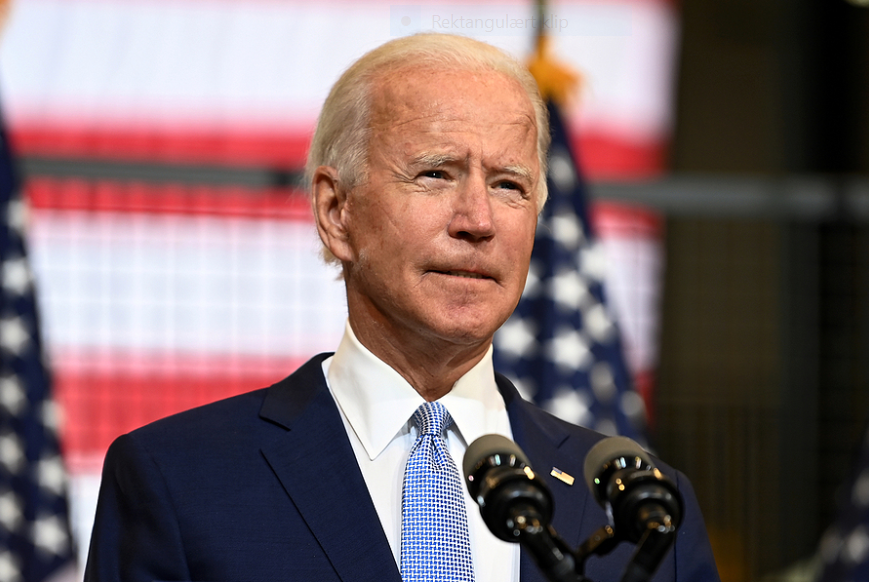

USA’s præsident Biden vil gøre det lettere at komme efter bankdirektører: I et statement fra det hvide hus hedder det blandt andet: ”the President believes Congress can and should do more to hold senior bank executives accountable. Congress must take action to strengthen the ability of the federal government to hold senior management accountable when their banks fail and enter FDIC receivership. Specifically, when banks fail because of mismanagement and excessive risk taking, it should be easier for regulators to claw back compensation from executives, to impose civil penalties, and to ban executives from working in the banking industry again.” Herhjemme vedtog Folketinget i april 2023 skærpede ansvarsregler for bankledelser, kun 13 år efter den foregående danske bankkrise, som var mangefold værre herhjemme end i vores nabolande på grund af slap governance og løse kreditbevilliger. Det er dog tvivlsomt, om der i realiteten er tale om en skærpelse af tidligere praksis.”

Hvordan skal virksomheders ESG-rapportering måles, så det giver relevant og korrekt information til investorer og stakeholders. I forskningspapir hedder det, at “the rise in importance of environmental, social and governance (ESG) factors has exposed market participants and investors to a flood of new and complex information, which is hard to process without tools to synthesise it. This, in turn, places the focus on infomediaries, ie, providers of ESG ratings, scores and indices. The growing centrality of such infomediaries has attracted the interest of regulators that seek to ensure that infomediaries both improve market decisions, and facilitate, and not hinder the green transition. In June 2023 the European Commission published a long awaited proposal to regulate ESG ratings providers , giving rise to broad discussion about whether the EU approach is broadly right or incoherent . The discussion typically hinges on whether ESG infomediaries are more like credit rating agencies, benchmark (index) providers or financial advisors. In a recent working paper , we propose a different approach.”

Kunstig intelligens kan via sproganalyse af transcripts fra investormøder afslører corporate risks. I et forskningspapir med titlen: “From Transcripts to Insights: Uncovering Corporate Risks Using Generative AI”, hedder det: “We examine the potential of Generative AI technologies, specifically large language models (LLMs) such as ChatGPT, to assess corporate risks from firm disclosures, assisting stakeholders in making well-informed decisions amidst rising uncertainty. Recent studies develop textual measures of corporate risks generally by calculating dictionary-based bigram frequencies. This methodology relies on the coexistence of risk-related terminologies within pre-constructed lexical dictionaries. For instance, bigram-based search algorithm recognizes instances where “economic policy” is cited alongside the term “risk”. Such literature has undeniably enhanced our comprehension of corporate risks. Yet, what we find in our study is that AI can offer deeper, more sophisticated insights into textual data, providing a layered understanding of diverse corporate risks. Conceptually, generative language models, such as ChatGPT, offer two pivotal advantages in risk analysis. First, their expansive knowledge enables a comprehensive understanding of a given text. These models, which have been trained on extensive data, are capable of generating insights combining knowledge from a myriad of related documents.”

EU-kommissionen vil næste år arbejde på at forenkle virksomheders regnskabsrapportering. I gennemgang oplyses det, at ”The 2024 CWP recognizes that streamlining reporting requirements ‘is a long-term effort that will require focus for the foreseeable future’ (see p 5). Starting 2024, the Commission will report on its advancement towards the 25% goal in the Annual Burden Surveys . As next steps, the Commission plans to: *establish a baseline of reporting requirements to be able to measure progress. For this, the Commission has invited stakeholders to give feedback on burdensome reporting requirements in a call for evidence ;*identify particularly difficult issues and areas of prioritization through additional consultations with companies, experts from EU Member States, and other stakeholders; To support implementation, the Commission wants to develop AI tools to identify reporting requirements in EU legislation and analyse their sector-specific effects. Also, to increase the use of e-platforms for data gathering and sharing purposes.”

Morten W. Langer