Fra Zerohedge:

Earlier this week we reported that, according to Nomura’s calculations, CTAs were about to cover their recent S&P short positions and turn increasingly longer the higher the market rose. And sure enough, the US stock market has only risen higher, with the latest two upside catalysts being the positive WSJ headline related to US-China trade talks on Thursday and today’s Bloomberg report that China would seek to reduce its trade surplus with the US.

As a result, Nomura’s Masanari Takada writes, the bank’s quant models suggest CTAs continued short-covering on major stock index futures like the S&P500 or Russell 2000 and adds, somewhat redundantly, that “US equity markets seem to have enjoyed such mechanical purchasing pressure by algo investors.”

Additionally, there has been some modest improvement in recent economic data (at least that which is released) and the US economic surprise index (which is missing a lot of recent components) which Nomura views as one of the most important indicators in gauging the sustainability of the current market rally, improved to -3 yesterday (although it tipped back down to -6.90 after today’s big miss in the UMich Sentiment) which more importantly was followed by a gradual increase in overall exposure to US equity markets by hedge funds.

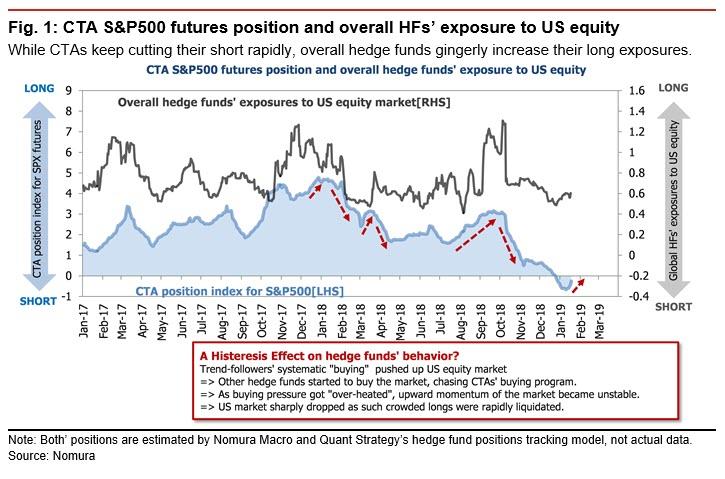

Indeed, this stacked waterfall effect of investors following other bullish investors into risk assets, which some call simply FOMO, is what Nomura defines as the “histeresis effect” on hedge fund behavior, and is as follows:

- Trend-followers’ systemic buying pushes US stocks up

- Other hedge fund start to buy the market, chasing CTAs buying programs

- As buying pressure gets “overheated”, upward momentum of the market becomes unstable

- US market sharply drops as such crowded long become rapidly liquidated.

This is shown schematically in the chart below:

And yet with stocks surging to new one-month highs, as the brief Christmas Eve S&P500 bear market has been cut in more than half, what Nomura is carefully monitoring at this moment is whether its gauge of US equity market sentiment is leveling off slightly after having rapidly improved over the past few days.

What is surprising, according to the Japanese bank, is that a recovery in sentiment into positive territory (i.e., risk-seeking phase) “appears so close yet so far away.” Specifically, unlike CTAs and other systematic funds, many US equity investors – especially macro hedge funds and risk parity funds – remain hesitant to impatiently begin following an equity market rally that is not sufficiently justified in the context of fundamentals.

Going back to the “histeresis example”, Takada notes that we experienced a similar situation in which algo investors, mainly in trend-following programs, led the significant upturn of the market last January, March and September. What happened next is that other investors – including major hedge funds – rushed to jump in the stock market uptrend, such “crowded” buying pressures caused an over-heating of momentum and overall market positioning became very unstable with outsized reactions to insignificant headlines and small volatility shocks before subsequently experiencing sharp drops.

So going back to the question we asked in the headline, why do investors – or rather human investors – refuse to buy into this rally, the reason according to Nomura is that most investors – except algo players – now seem to be wary of the future “pitfalls” of such a machine-led stock rebound because of past experiences, are maintaining a conservative approach at present.

What this means, somewhat ironically, is that while everyone was blaming the algos for the December meltdown, even though nobody has “accused” the algos of creating the ongoing meltup, investors and traders know very well that the move higher is not organic, but is purely the result of systematic, algo and various other quant traders forcibly buying as a result of key technical market levels being hit.

Unfortunately for the few humans left trading stocks, this is not a buying signal, which likely means that just like in January of 2018 when retail investors finally capitulation and rushed into stocks just ahead of the February 2018 correction, so this time too it is likely that the algos will keep buying until everyone else jumps into the pool… at which point the market will once again take the elevator down.