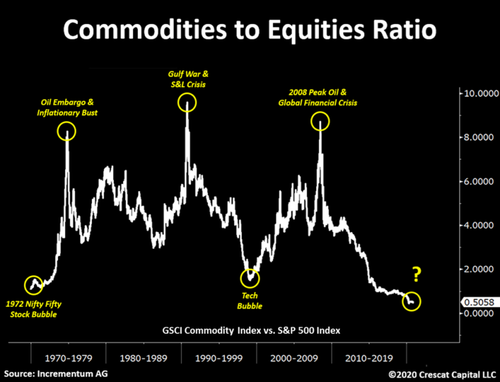

Markets are cyclical. Today, stocks trade at record high valuations while commodities are historically undervalued in relation. The setup is in place for a macro pivot in the relative performance of these two asset classes. Comparable conditions were present with the 1972 Nifty Fifty and 2000 Dotcom bubbles as we show in the chart below.

As capital seeks to redeploy towards the highest growth and lowest valuation opportunities, we expect analytically minded investors will soon be rotating, if not stampeding, out of expensive deflation-era growth equities and fixed income securities and into cheap hard assets, creating a reversal in the 30-year declining trend of money velocity.

Today’s Modern Monetary Theory world with its double barreled fiscal and monetary stimulus is crashing head on with an accumulation of years of declining investment in the basic industries such as materials, energy, and agriculture. In our analysis, the “end game” for the Fed’s twin asset bubbles in stocks and bonds is inflation. We can already see it developing on the commodity front.

The scarcity of jobs and abundance of debt were factors preventing the economy from reaching its full growth potential even before Covid-19. Such have been the concepts underlying the output gap, the theoretical paradox that is thought to have held inflation in check over the course of the last business cycle. But based on comparable historic periods, the macro setup for inflation is more likely to be kicked off by an input gap, i.e., shortages in the primary resources needed for both a strong reserve currency and economic growth at the same time as policy makers pull out their biggest bazookas yet to boost aggregate demand. We expect a new wave of rising commodity prices, set up by past underinvestment in basic resources, to soon ripple through the global supply chain creating a headwind for real living standards. Welcome to the Great Reset.

The global economy is at risk of commodity supply shock inflation, something we have not experienced since the 1970s. Both the Bloomberg Commodities Index and the US 30-year inflation expectations are now re-testing a 12-year resistance line. A significant breakout from here would be a big shift in the macro investing landscape. Yes, the aging demographics problem and significant technological advancements are deflationary tailwinds. But in our view, the key reason why consumer prices have not gone higher is due to a long-standing period of depressed commodity prices, a trend which we think is about to change.