Fra Zerohedge

BofA Securities, previously Bank of America Merrill Lynch, published a new S&P500 Target Update on Tuesday, which indicates the top is in for the S&P500 this year.

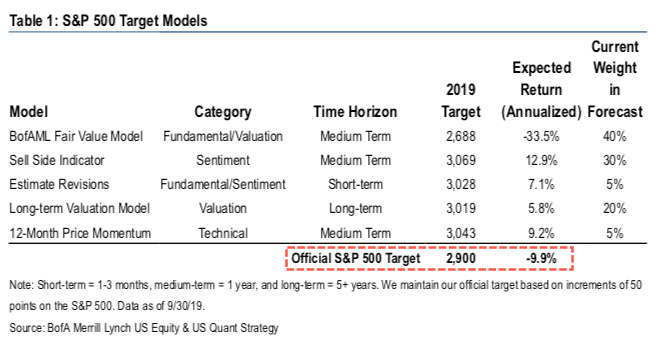

BofA’s 2,900 year-end S&P500 target is about 50bps higher from current levels (2,884) at 11:30 am est. The firm warns that increasing macroeconomic headwinds seen in the US manufacturing complex this week shifted its view on the S&P500 to “neutral.” This means their upside S&P500 target was reduced from a bullish target of 3069, to now 2,900.

“Supportive central banks, bearish sentiment and attractive yield opportunities are supportive of stocks. But ongoing trade uncertainty and signs of macro deterioration (ISM manufacturing data today was below consensus, at post-crisis low, and suggests a continued contraction in manufacturing activity) leave us neutral on the S&P 500 for 2019. Moreover, recent liquidity crashes worry us as they could manifest themselves in the S&P. Thus, even though our Sell Side Indicator yields a bullish target of 3069, the rest of our signals temper that signal and bring our 2019 S&P 500 year-end target to 2900.”

BofA modified their stance from bullish on stocks to now neutral, and suggested that “trade tensions/global growth concerns/geopolitical risks plus signs of margin compression and further downward risk to estimates are likely to limit upside going forward.”

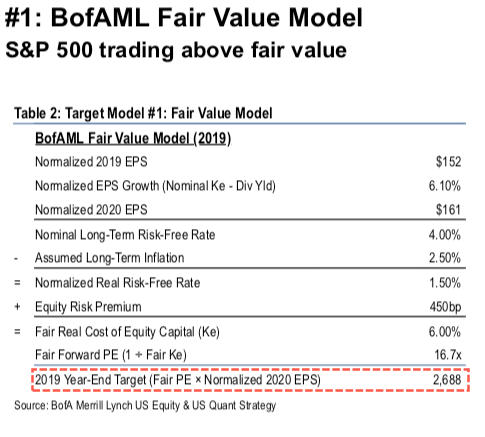

The note said, this continues to be “one of the most hated bull markets on record,” and in one fair value assessment of the S&P500, it has price with downside risks to 2,688.

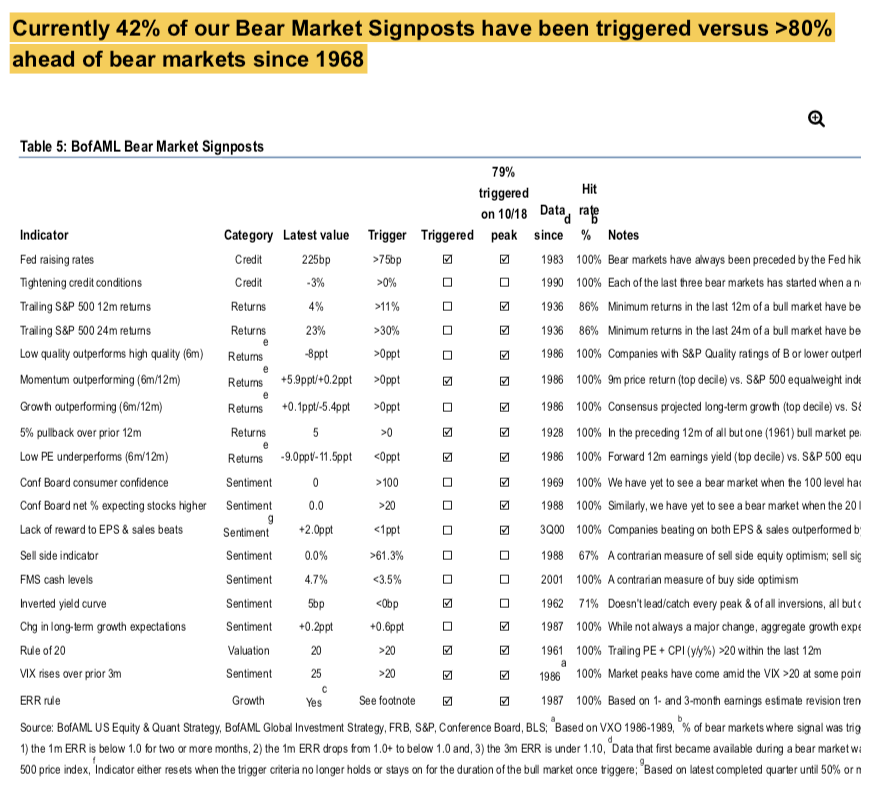

BofA ended the note by saying, “42% of our Bear Market Signposts have been triggered versus >80% ahead of bear markets since 1968.” The bank’s recession checklist is below:

And while the ugly ISM miss was the short-term macro-catalyst, the S&P500 is now trading below BofA’s 2,900 year-end S&P500 target. If the 2,900 level is rejected, technical forced selling will exaggerate the markets’ volatility and could send price down to the bank’s 2,688 fair value target.