Fra Mauldin Economics:

In the Middle of a Massive Monetary Policy Error

I would argue that the Great Recession was a result of a massive monetary policy error: keeping rates too low for too long, which, when coupled with lax or no regulation in the mortgage markets, resulted in a housing bubble and a crash, which bled over to global markets. This outcome should not have been a surprise to anyone. A number of us were writing as early as 2004–05 about the problems that were the primary triggers for the Great Recession.

As noted above, it was central bank errors in 1919 and 1920 that caused the 1920-21 depression. And pretty much everyone agrees that the Federal Reserve had a big hand in causing the Great Depression. Certainly, the wrong monetary policies resulted in the recessions of ’80 and ’82. Note: it was not the policies of Paul Volcker that caused the back-to-back recessions but those of his immediate predecessors who allowed inflation to get out of control. Volcker’s hand was forced, and he had to act aggressively. I lived through that time as a businessman, and I vividly remember borrowing at 18%. It was not fun.

I believe we are again suffering the effects of a massive monetary policy error. The error has already been committed, but we have just begun to endure the consequences. We are still living in a dream, but we’re nervous, much like we were in 2006. The Federal Reserve has repeated the mistakes of the last cycle. They have kept rates too low for too long, but this time they have outdone themselves, clinging desperately to the zero bound. In doing so they have financialized the economy and made it hypersensitive to interest rate moves.

Ben Bernanke made a big mistake by opting for QE 3. Arguably, if he had begun to normalize rates rather than to create a “third mandate” for the Federal Reserve to support stock market prices during and after QE 3, we would not be in the situation we are in today, where the very hint of normalizing rates sends the markets into a frenzy.

Bernanke should have looked the stock market straight in the eye during the Taper Tantrum, summoned his inner Paul Volcker, and told the market, “I am not responsible for stock market prices.” The markets probably would have suffered a rather quick, sharp correction and moved on. And it might not even have been much of a correction. Markets often correct, as they did in 1987 or 1998, without becoming lasting bear markets if there is not a recession.

Admittedly, a normalized short-term interest rate today would likely still have a “2 handle” or even lower. Short-term rates, at least in normal times, have tended to be in the vicinity of inflation. The 10-year Treasury bond rate has had a close relationship with nominal economic growth.

I would prefer to allow a market mechanism (rather than a committee of 12 people who are prone to enormous biases) to determine short-term rates. A committee that prioritizes the interests of the stock market above the interests of savers and retirees and pension funds is a dangerous committee.

If the FOMC had begun to normalize rates in 2012 rather than looking at the stock market as a primary indicator of the health of the economy, the economy and the stock market would be doing much better today, and savers would at least be getting some return on their money. And perhaps, if rates were normalized, the governments of the world would be motivated to control their deficits. (I know, that last statement proves I’m a dreamer.)

Greenspan had monstrous confidence in the wealth effect and how it would trickle down. The data is now in; the papers have been written; and the nearly overwhelming conclusion is that the wealth effect is, at best, inconsequential. What we have is another instance of the Federal Reserve ignoring Winston Churchill’s maxim: “However beautiful the strategy, you should occasionally look at the results.”

Yet, the policy geniuses at the Fed appear certain that the wealth effect is going to trickle down to Main Street any day now.

How Do You Mess Up the Easiest Prediction in the World?

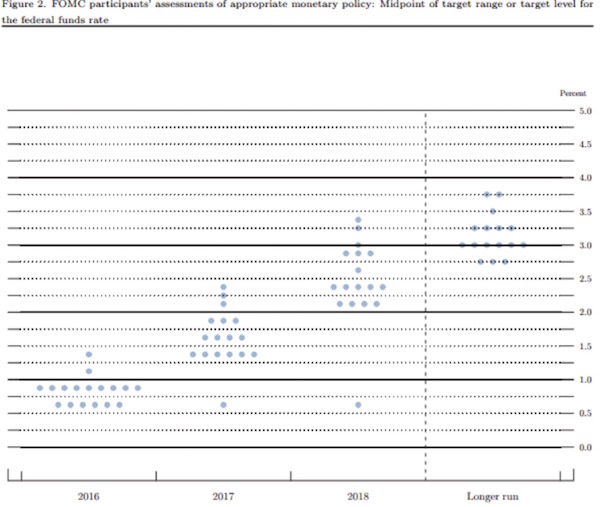

A few weeks ago we got the new dot plots showing where FOMC members expect interest rates to be in the future. If you were to look at this predictive path in isolation, you would make the rational assumption that interest rates are going to rise by 2% or more in the next two years. The chart below shows their expected rate increases four months ago: In June, by a margin of two to one, FOMC members were expecting at least two rate increases, if not more, this year.

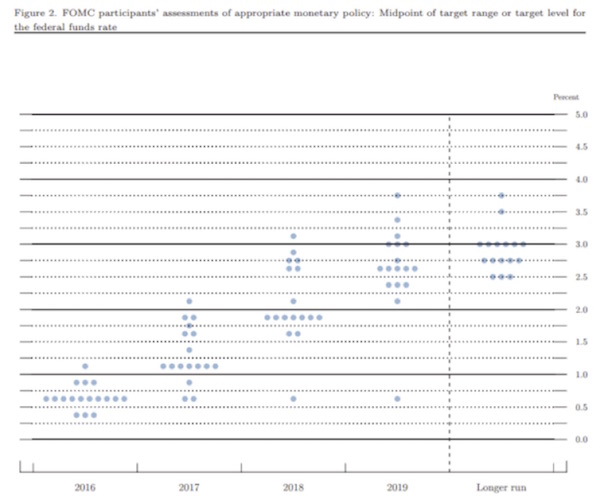

Has the economy changed much since then? Not really, but somehow, afraid of their own shadow, FOMC members are now projecting by a three to one margin that there will be only one rate increase this year, of 25 basis points or less. Here is the plot from theSeptember meeting:

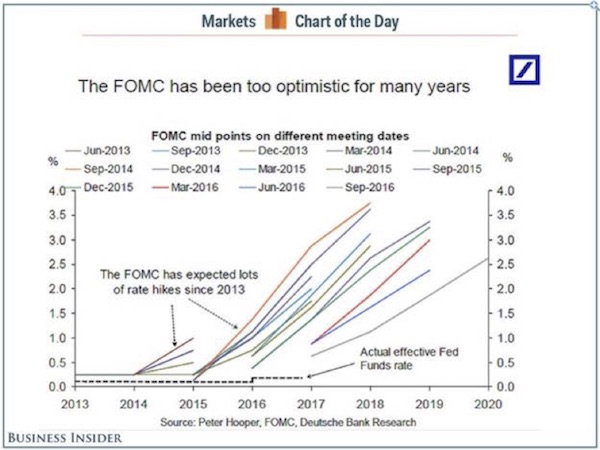

This constant rethink is not just a recent phenomenon. We have seen it ever since the FOMC began to give us their forecasts for interest rate hikes. Less than two years ago they were expecting rates to be around 3% today and to reach 4% by the end of 2018! Each subsequent quarterly plot is revised downward, but the pattern always remains the same. Rates are going to “normalize” in a time frame that is always just around the corner but never seems to arrive. The chart below, from Business Insider, shows the paths of their rate predictions, and the dotted line down at the bottom shows what has actually happened.

This reveals an interesting dichotomy. The Fed determines what interest rates will be. So what they are doing is predicting what their own decisions will be. And while Federal Reserve economists have basically gone “0-fer” with all their predictions for the growth of the economy – a predictive task that is orders of magnitude more difficult than predicting what they will decide on interest rates – they have also gone 0 for 11 quarters with their predictions for their own monetary policy!

While I have been known to change my mind now and then, the FOMC members have been thinking seriously about interest rates every quarter for as long as there has been an FOMC. They know they have to make forecasts. They meet regularly, and I am sure they have phone calls and private dinner meetings and conferences, just like any other board of directors would. The easiest prediction in the world should be to tell me what they are going to do with policy rates.

The dot plot tells us what they think should happen, but between the time their forecasts are made and the time they actually have to make a decision, something always happens to keep them from pulling the trigger. I think that something is Yellen and her inside crowd of ultra-doves in the leadership of the Fed.

Dr. Stanley Fischer, vice chairman of the Fed, when asked his views on negative rates, said:

Well, clearly there are different responses to negative rates. If you’re a saver, they’re very difficult to deal with and to accept, although typically they go along with quite decent equity prices. But we consider all that, and we have to make trade-offs in economics all the time, and the idea is, the lower the interest rate the better it is for investors.

Stanley Fischer is the intellectual leader of today’s Federal Reserve. He is one of the most respected members of the “policy community.” During the last crisis, when he was head of the Bank of Israel, in pursuing his quantitative easing he bought literally anything in Israel that was not nailed down. So when he says that he must put the interests of investors in the stock market ahead of the interests of savers and retirees because he thinks that is best for the overall economy, you have to realize that this is the dogma being whispered into the ears of every FOMC member.

And while there is a growing drumbeat from banks and serious members of the “policy community” in Europe and Japan that negative interest rates are damaging the system, you are not hearing that from Stanley Fischer and Janet Yellen and the other leaders of this Federal Reserve. Yves Mersch of the ECB talked about the problems banks are having and said, “The longer [rates] remain low, the more pronounced the side effects will be.” Deutsche Bank and other major European bank economists are starting to sound semi-apocalyptic as they bemoan the policies of the ECB. Here at Mauldin Economics, we are doing some in-depth research based on a few small reports about how desperate the European insurance community is. Understand that European insurance funds are several multiples the size of their banking community.

Low interest rates have traumatized US pension funds and basically made it impossible for funds to meet their investment targets. And the consultants to whom the funds pay large fees are still showing them models (based on gods know what assumptions) that say it is okay to project 7% to 7.5% compound returns for the future.

So here we are, in a weak recovery that grows longer in the tooth with each passing month. I have discussed the assorted potential crises that could set off the next recession. You know the list: China, Japan, Italy, Germany (99% of investors do not understand how vulnerable Germany is), our own elections here in the US, or just a gradual slowdown as consumers lose the will or ability to spend. Something will happen to set off another shock, and it will probably happen in the next year or two. Then what?

This brings us to perhaps the biggest danger of all: People are losing faith in the Federal Reserve. Not without reason, either. Ben Hunt says the Fed is “losing the narrative.” By that he means that most Americans are skeptical of the Fed’s happy talk and no longer believe that Fed policies will result in the economic growth projected.

Sadly, that group of “most Americans” does not include Federal Reserve governors and bank presidents. All evidence suggests they believe their policies are working out swell. Unemployment is down, so Janet Yellen is happy. Stocks are up, so Stanley Fischer is happy. They invited all their friends to Jackson Hole to plan the next party, in which they will spin the bottle on negative rates and try to get Congress to eliminate $100 bills. They think it will be fun. Many in the economics profession want to party with them.

We will have another financial crisis and/or recession, probably soon, and we can’t trust the Fed to respond correctly. We’ll be lucky if whatever comes out of their Frankenstein lab is only ineffective. There’s a very real risk they will make the situation far worse. The masses of unprotected people are in no mood to swallow more monetary policy medicine, much less any additional remedies that globalist plutocrats may try to shove down their throats.

In an ideal world we might be glad to see the Fed stand aside and let markets adjust themselves. The problem is that said adjustment will now be extremely painful for a large part of the population. So the Fed may be damned if it does and damned if it doesn’t.

I have no idea how the election will turn out. It seems to me that Donald Trump now needs a very good debate Sunday night. But win or lose, Trump is a huge canary in the political coal mine, and the political and monetary-policy elite should listen up. Brexit was a warning, and Austria and Italy and Germany – indeed all of Europe – are sending a similar warning. The Unprotected are beginning to push back, and not just at the edges. The center is not holding. A new center is going to be created, one that the elites may not appreciate.

The Protected elites of both major US political parties may genuinely think they are acting in the best interests of the country. But middle- and lower-class Americans are learning that politics and economics as usual mean diminished lifestyles and futures, not only for them but for their children