Fra Zerohedge:

Update: The most prescient recession indicator the market just inverted for the first time since 2007.

Don’t believe us? Here is Larry Kudlow last summer explaining that everyone freaking out about the 2s10s spread is silly, they focus on the 3-month to 10-year spread that has preceded every recession in the last 50 years (with few if any false positives)… (fwd to 4:20)

“Actually we’re reading the spread wrong,” Larry Kudlow says of the flattening yield curve. “There’s no recession in sight right now.” #DeliveringAlpha https://cnb.cx/2zOaKgh

As we noted below, on six occasions over the past 50 years when the three-month yield exceeded that of the 10-year, economic recession invariably followed, commencing an average of 311 days after the initial signal.

* * *

On the heels of a dismal German PMI print, world bond yields have tumbled, extending US Treasuries’ rate collapse since The Fed flip-flopped full dovetard.

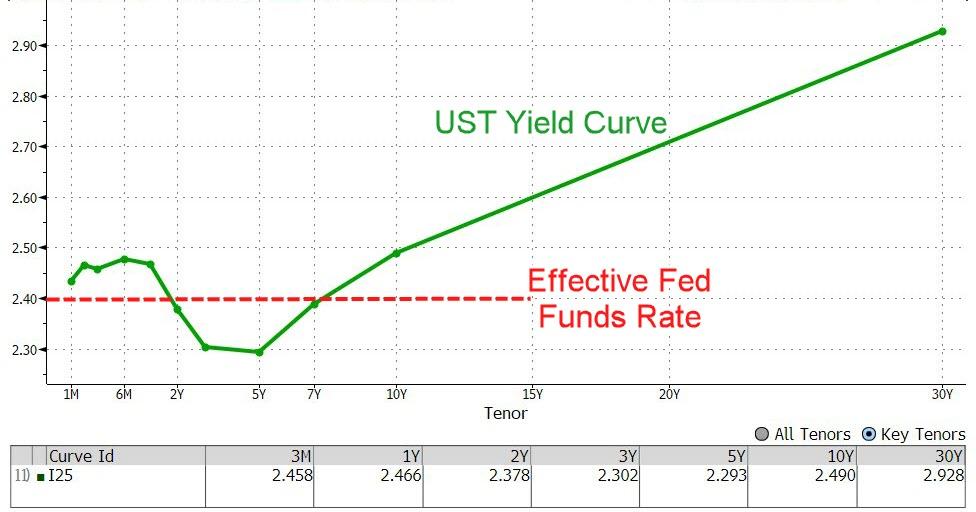

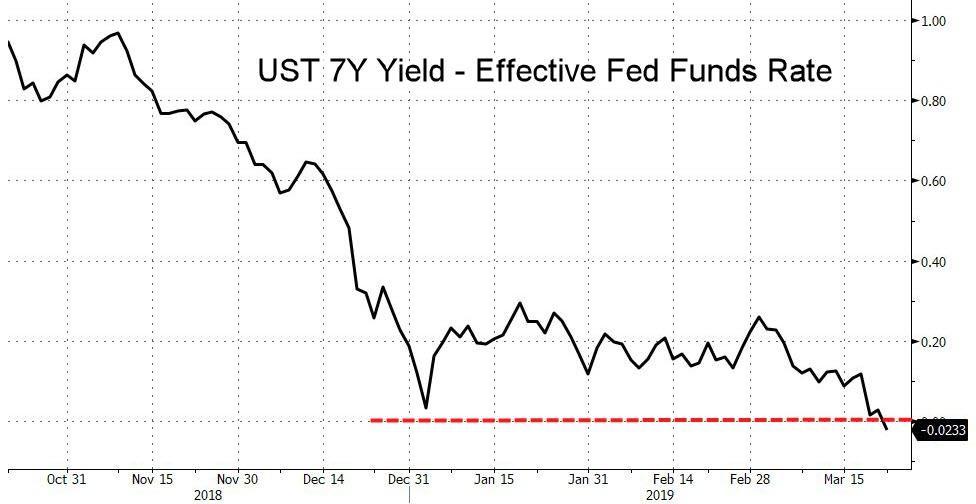

The yield curve is now inverted through 7Y…

With the 7Y-Fed-Funds spread negative…

Bonds and stocks bid after Powell threw in the towell…

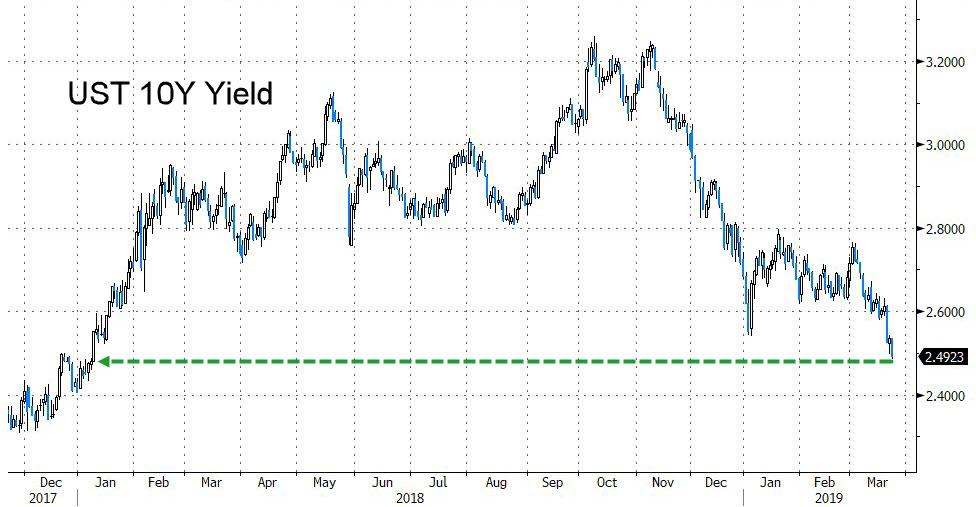

But the message from the collapse in bond yields is too loud to ignore. 10Y yields have crashed below 2.50% for the first time since Jan 2018…

Crushing the spread between 3-month and 10-year Treasury rates to just 2.4bps – a smidge away from flashing a big red recession warning…

Critically, as Jim Grant noted recently, the spread between the 10-year and three-month yields is an important indicator, James Bianco, president and eponym of Bianco Research LLC notes today. On six occasions over the past 50 years when the three-month yield exceeded that of the 10-year, economic recession invariably followed, commencing an average of 311 days after the initial signal.

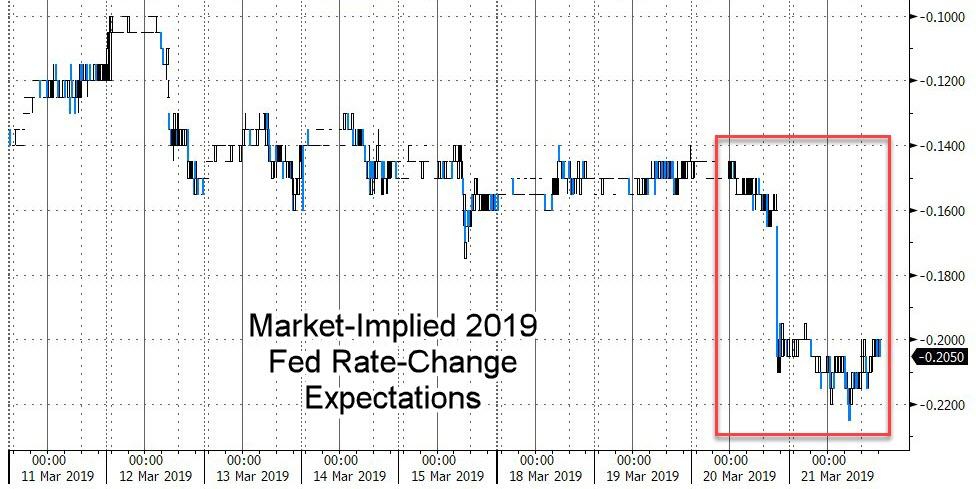

Bianco concludes that the market, like Trump, believes that the current Funds rate isn’t low enough:

While Powell stressed over and over that the Fed is at “neutral,” . . . the market is saying the rate hike cycle ended last December and the economy will weaken enough for the Fed to see a reason to cut in less than a year.

Equity markets remain ignorant of this risk, seemingly banking it all on The Powell Put. We give the last word to DoubleLine’s Jeff Gundlachas a word of caution on the massive decoupling between bonds and stocks…

“Just because things seem invincible doesn’t mean they are invincible. There is kryptonite everywhere. Yesterday’s move created more uncertainty.”