- *FED: STOCKS’ FORWARD P/E RATIOS WELL ABOVE THREE-DECADE MEDIAN

- *FED: STOCKS VULNERABLE TO A TERM PREMIUM RETURN TO NORMAL

Remember, “don’t fight The Fed” unless of course she says “sell.”

Valuation pressures have generally stayed at a moderate level since January, though they rose for a few asset classes. Forward price-to-earnings ratios for equities have increased to a level well above their median of the past three decades.

Although equity valuations do not appear to be rich relative to Treasury yields, equity prices are vulnerable to rises in term premiums to more normal levels, especially if a reversion was not motivated by positive news about economic growth.

It appears The Fed has been reading:

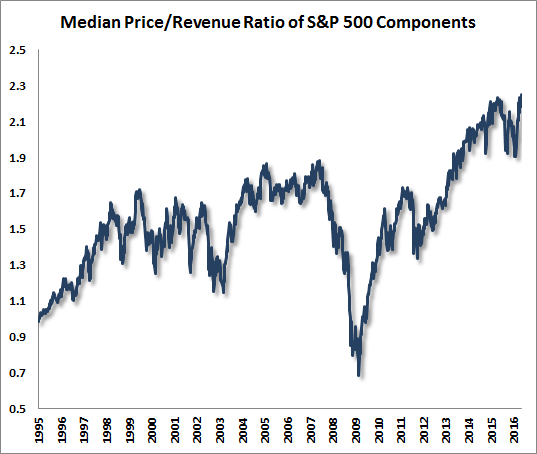

Finally, the chart below shows the median price/revenue ratio of S&P 500 component stocks, which recently pushed to the highest level in history, exceeding both the 2000 and 2007 market peaks. In recent quarters, the broad market has deteriorated, even in the most reasonably valued decile of stocks, but the most richly valued decile has held up for a last hurrah, as it did near the peaks of previous bubbles. This dispersion has created a headwind for hedged-equity strategies in U.S. stocks, particularly value-conscious strategies, but investors should understand that beneath the surface of this short-term outcome is singularly the most extreme point of overvaluation for the median stock in history.

* * *

Full monetary policy report: