Fra Zerohedge:

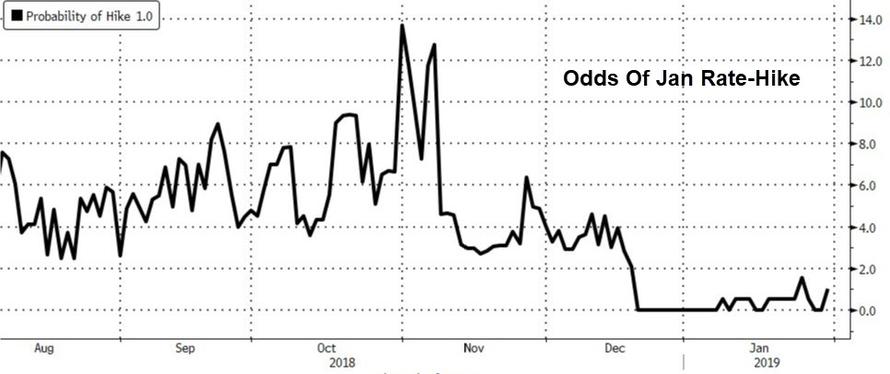

With a 1% probability of a rate-hike today, all that matters is The Fed’s tone (better be uber dovish) and any language shifts on the balance sheet normalization. And, by the looks of things, the now “patient” Fed capitulated to both Trump and the market:

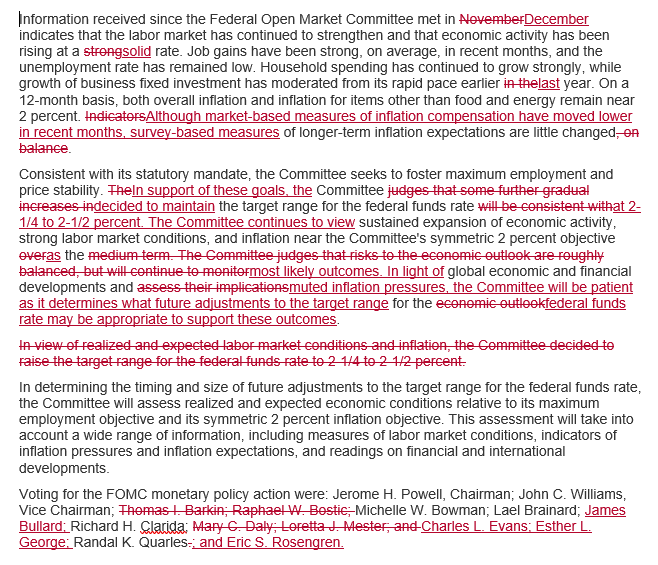

“In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.”

* * *

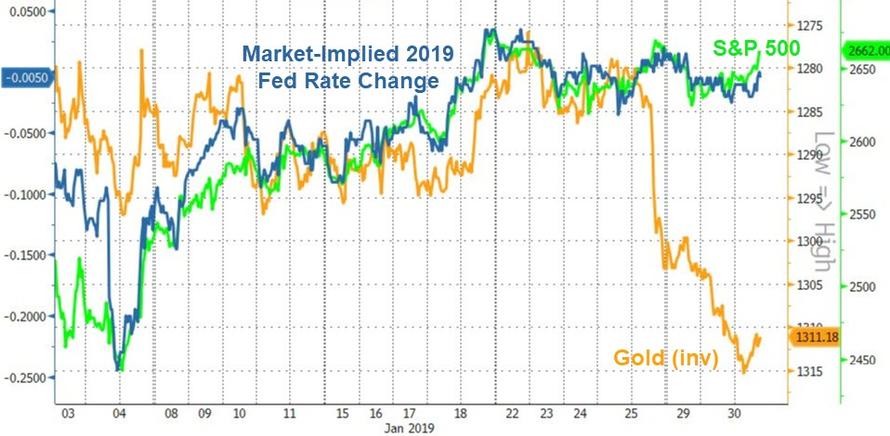

Since The Fed hiked rates in December, Gold is the clear winner…

But we note that stocks and the market’s perception of The Fed’s dovish/hawkish-ness are joined at the hip…

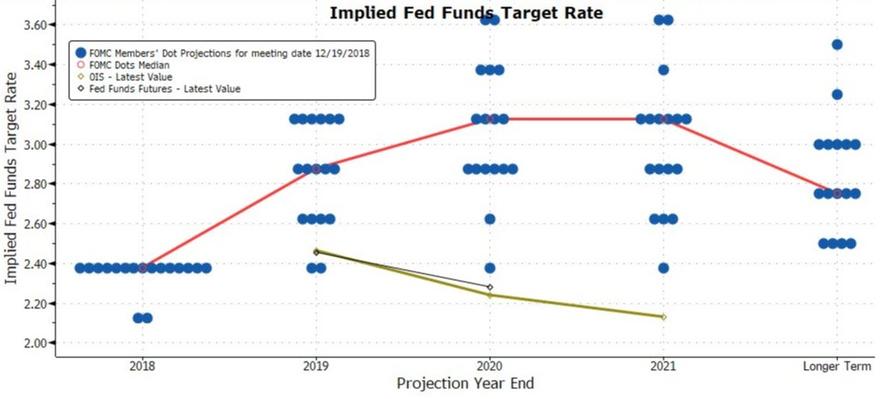

Somehow, The Fed has got to slowly but surely jawbone its outlook down to the market’s uber-dovish perception without spooking investors that something very serious is going on…

Markets faded from their highs into the Fed Statement:

So, did The Fed deliver?

They appeared to do so – folding entirely to the market –

- Fed removes reference to further gradual rate increases

- Fed says it plans to continue with current floor approach

- Fed says it’s prepared to adjust balance-sheet normalization

- Fed reiterates federal funds target is primary policy tool

- Fed says economic activity rising at solid rate, jobs strong

- Fed says labor market strengthened, unemployment remained low

- Fed says spending grew strongly, investment moderated

- Fed says core and headline inflation remain near 2%

So The Fed is saying everything is awesome with the economy but we are panicking out of our rate-hike and balance sheet normalization process because the market shit the bed?

The biggest change, as Goldman previewed:

the FOMC adds “patient” rate outlook amid muted inflation and global developments, and introduces flexibility in balance-sheet normalization.

The Fed removes a statement about “some further gradual increases.”

The line about “balance of risks” is also removed, replaced by a line about policy “patience amid muted inflation and global economic and financial developments.”

As for the one main thing the market was looking for, namely guidance future path of the balance sheet unwind, the Fed folded here too, stating that “the Committee is revising its earlier guidance regarding the conditions under which it could adjust the details of its balance sheet normalization program” and said it wants to maintain “an ample supply of reserves” to ensure that monetary policy is conducted through interest rates, adding that “The committee is prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial developments.” Here is the full statement:

After extensive deliberations and thorough review of experience to date, the Committee judges that it is appropriate at this time to provide additional information regarding its plans to implement monetary policy over the longer run. Additionally, the Committee is revising its earlier guidance regarding the conditions under which it could adjust the details of its balance sheet normalization program. Accordingly, all participants agreed to the following:

- The Committee intends to continue to implement monetary policy in a regime in which an ample supply of reserves ensures that control over the level of the federal funds rate and other short-term interest rates is exercised primarily through the setting of the Federal Reserve’s administered rates, and in which active management of the supply of reserves is not required.

- The Committee continues to view changes in the target range for the federal funds rate as its primary means of adjusting the stance of monetary policy. The Committee is prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial developments. Moreover, the Committee would be prepared to use its full range of tools, including altering the size and composition of its balance sheet, if future economic conditions were to warrant a more accommodative monetary policy than can be achieved solely by reducing the federal funds rate.

In other words, the Fed not only capitulated to the market, but just set the stage for QE4.

Commenting on the Fed’s surprise balance sheet announcement, Futures Firts’s Rishi Misra said that “Operating under a regime with “an ample supply of reserves” – that’s basically saying B/S would remain large! And that they are willing to amend it anyway if required!”

Bloomberg’s Ira Jersey had a more nuanced take, pointing out that the catalyst that triggers the Fed to delay the balance sheet run off will be when the Fed Funds rate surpasses IOER for a “prolonged period”, which means all stock traders will soon become IOER “experts” too.

“In regards to the Fed’s balance sheet, the Fed said they are ready to adjust the path of runoff, but did not make any changes. We suspect this could placate the market for now.

We think the Fed would likely halt runoff if the fed funds effective rate set above IOER for a prolonged period, fed funds trading volumes increased measurably, or if banks began large T-bill purchases to replace reserve balanced used for capital ratio purposes.”

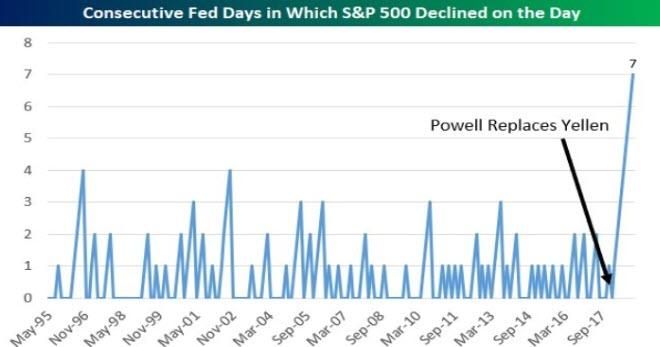

Bear in mind that the S&P 500 Index has declined on the day of each of the seven decisions he’s presided over. According to Bespoke Investment Group, that’s the longest Fed-Day losing streak on record.

* * *

Full redline Fed statement below: