Fra Zerohedge:

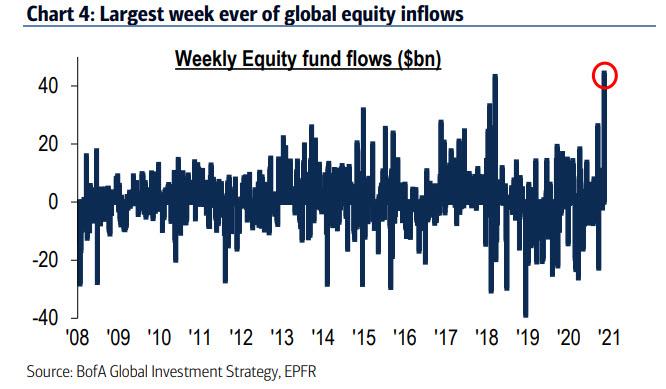

To say that this week’s Pfizer virus news was seen by markets as positive for risk assets would be an understatement: according to BofA’s Chief Investment Strategist Michael Hartnett, this week’s inflow into equities was an all-time record of $44.5 billion…

… which consisted of:

- US equities $32.5bn inflow = 2nd largest ever;

- EM equities $6.5bn inflow = 5th largest ever;

- Tech $2.0bn inflow = 12th largest ever;

- Energy $1.5bn inflow = biggest since Apr’15;

- Financials inflows ($1.3bn), US Treasury redemptions ($4.0bn) both largest in 6 months.

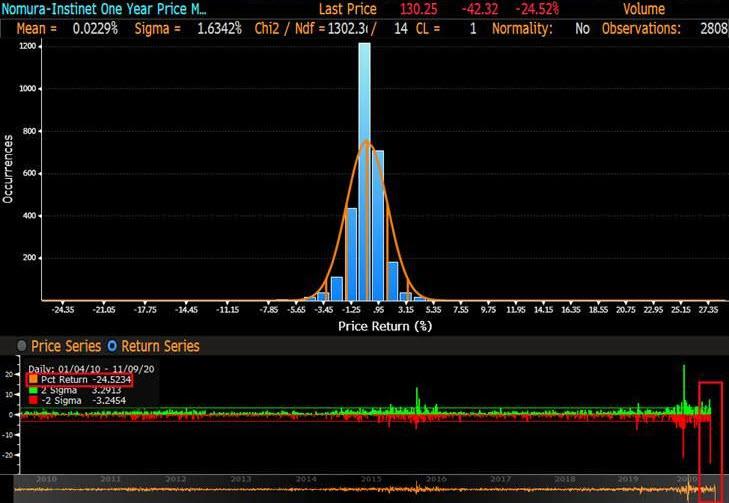

At the same time, another $10.2Bn went into bonds, $0.8bn into gold, with $17.8bn leaving money market (cash) funds, which is a testament to the groundbreaking nature of the news, which if actually results in a successful cure would indeed have tremendous consequences for markets as Monday’s 15-sigma rotation out of momentum and into value showed.

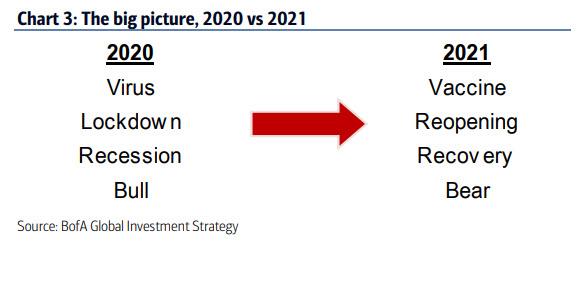

This can be explained by the dramatic shift in investor sentiment, one which goes from…

- 2020: a year of virus, lockdown & recession, and which according to BofA is bullish for Wall Street, to…

- 2021: a year of vaccine, reopening & recovery, and which is ultimately bearish for Wall Street

Looking back, Hartnett does a more granular take of 2020, which he breaks down by quarters as follows:

- Q1 = COVID-19 crash,

- Q2 = lockdown rally,

- Q3 = reopening rally,

- Q4 = vaccine rotation

More importantly, going by the numbers that is no disputing that 2020 was very bearish for fundamentals:

- COVID-19 deaths >1.2mn,

- US unemployment claims up 50mn,

- global GDP down $9tn;

Which, of course, is why stocks soared amid the unprecedented bullish policy response which included monetary and fiscal stimulus of $21tn (global central bank asset purchases have equaled $1.2bn per hour), and US corporate bond issuance > $3tn (backstopped by the Fed’s direct intervention in corporate bond markets).

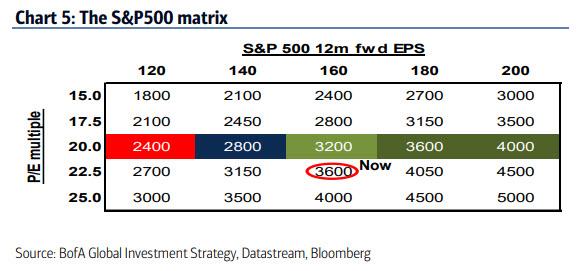

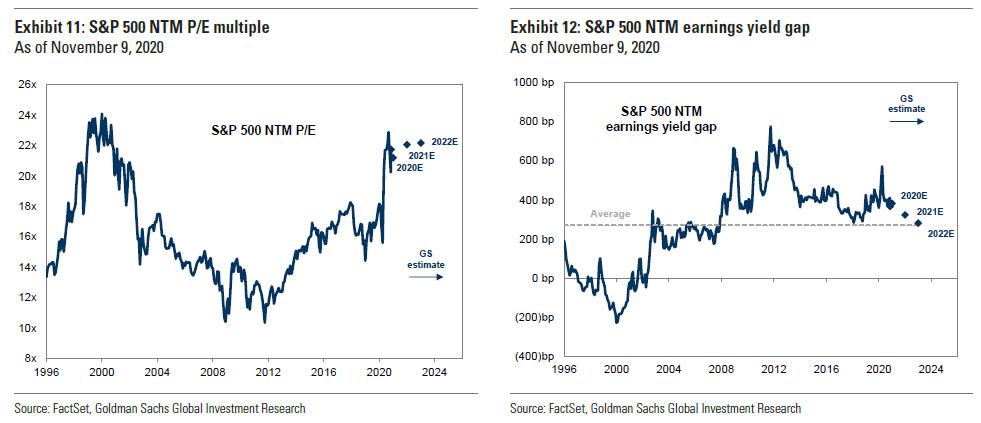

And yet, despite this unprecedented intervention, the S&P is still struggling to break decisively above the 3300-3600 range Hartnett previously highlighted as key for US stocks. Notably, Hartnett points out that SPX 3600 is 22x forward $160 EPS, or a 20% YoY increase.

This reminds us that when discussing Goldman’s laughable forecast for 2022, which sees the S&P rising to 4,600, we were amused that this price target was based on a 22.1x PE multiple:

And while David Kostin had no problems with this outlandish forward PE because “accommodative Fed policy and low interest rates make equities appear attractive on a relative basis vs. fixed income alternatives, pushing investors out on the risk curve”, here BofA’s CIO appears to also be laughing, because unlike most of his peers which include JPM (with a 4,500 2022 target), Goldman (with 4,600) and even Morgan Stanley, which sees the bull market continuing indefinitely, he valiantly takes the opposite position and says that SPX > 4000 requires belief in EPS >$180 (+33% YoY) and/or 25x multiple.

Then, in a direct mockery of his uber-bullish colleagues, he writes that it is “silly to think big stock market gains from here won’t provoke negative political (higher taxes), economic (higher inflation) & financial (higher yields) response.“

Lest he is accused of being outright bearish, and to provide a balanced take on where stocks may go next, Hartnett then refers to his preferred approach of evaluating markets by looking at the 3 Ps (Positioning, Policy, Profits) and writes that…

- On Positioning: bulls will argue cash on sidelines ($4.3tn in money market funds), BofA Bull & Bear Indicator far from dangerously bullish; bears will say equity flows show laterally capitulation has begun, BofA Global Breadth Rule triggers “sell” signal.

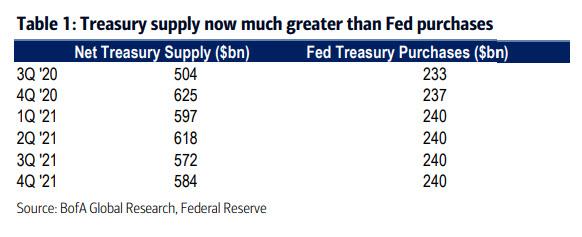

- On policy: election = fiscal gridlock; big jump in central bank QE in coming month likely a response to prevent disorderly rise in bond yields, e.g. GT10>1¼%, GT30>2%; note that US Treasury supply will significantly outstrip Fed purchases in Q4 & Q1 (Table 1); bottom line “peak policy” imminent.

On profits: successful targeting of higher asset prices by policy makers have caused a. household wealth effect (BAC credit card spend +7% YoY), b. corporate balance sheet reflation; plus China/Asia/global manufacturing PMI recovery = BofA global EPS growth model = +2.3% next 12 months vs -10.5% consensus; and while momentum heading into ‘21 can be temporarily stalled by surging virus cases, positive vaccine news means consensus rapidly raising GDP/EPS/SPX forecasts Nov’20.

Putting all this together, Hartnett has a decisively different take on what happens next compared to his big bank strageist peers, and concludes that the right trade is to Sell the vaccine:

“we are sellers-into-strength into vaccine in coming months…peak positioning, peak policy, peak profits likely coming months; best analog is 2018 when US tax cuts caused peak positioning, policy, profits early that year; 2021 (vaccine) sees early peak in asset prices on higher interest rates; watch XHB, RPAR, HYG, DXY for signs rate rise becoming disruptive.”

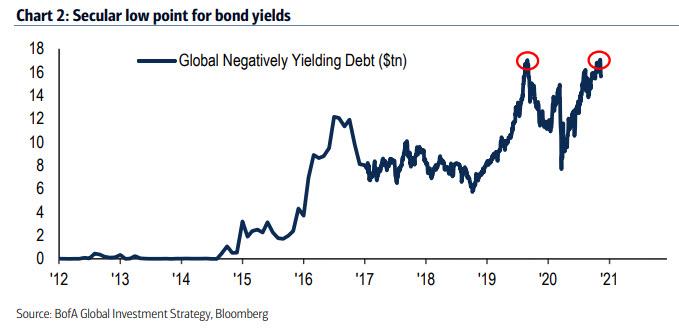

To bolster his bearish position, Hartnett points out two more things. First, total global negative-yielding debt is back at its $17 trillion record, which is a double-top (with Aug’19), and which suggests that 2020 is a secular low point for bond yields (note RBNZ passing on opportunity to take policy rates negative)…

… and that according to the BofA GLobal Beadth Rule, a “sell” signal has been triggered with 91% of MSCI equity country indices above 50dma & 200dma. To Hartnett this is an “early warning signal equity that topping process has begun (he cites a successful backtest with similar conditions in ‘07, ‘10, ‘18 and early-2020).

Of course, Hartnett couldn’t simply tell clients to sell everything here (such calls tend to have a catastrophic impact on Wall Street careers), so his suggestion is after selling the vaccine, to “Buy the reopening” as follows:

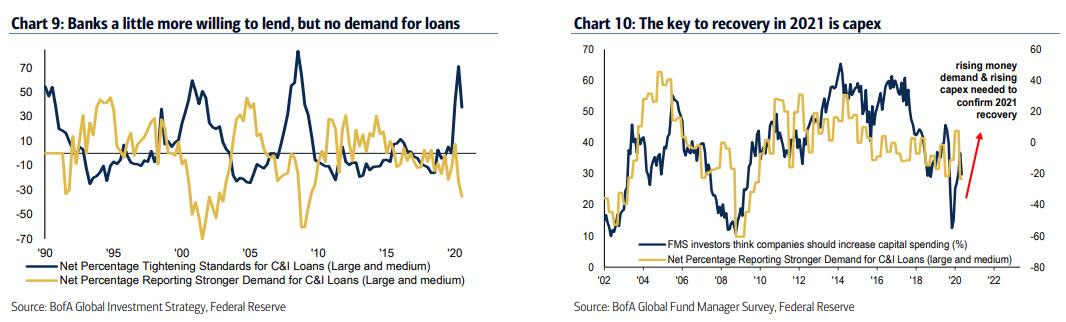

Good news for investors is higher yields = HY>IG, EM>SPX, small>large, value>growth (Chart 8); yes investors likely to barbell cyclical exposure (we prefer “global cyclicals” & “reopening cyclicals” to “distressed cyclicals”) with conservative large cap tech plays until vaccine arrives and with it unambiguous signs of corporate animal spirits (higher demand for money & capex – Charts 9 & 10);

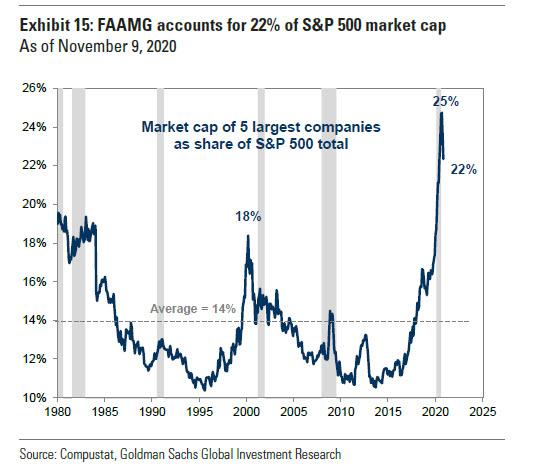

To keep it simple, however, at the end of the day Hartnett sees the bull story of 2021 as “a reopening rotation story”, one which however would have a dire impact on the tech stocks which have been market leaders for the past 3 years, and where just the 5 FAAMG stocks now account for 22% of the S&P’s market cap.

How traders can possibly “rotate” out of those handful of tech stocks without unleashing a cascade of selling remains a mystery.