Fra Bank of America/ Deutsche Bank/ Zerohedge:

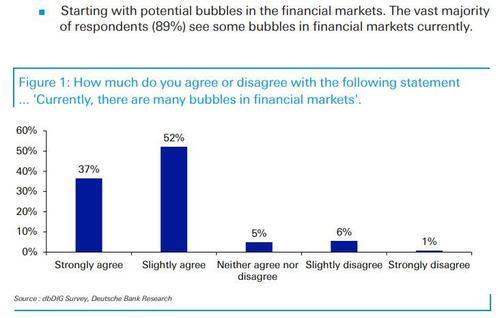

Earlier today, coinciding with the release of the latest Bank of America Fund Manager Survey, Deutsche Bank also published its latest monthly survey (Jan 13-15) polling 627 market professionals, and which found that just a paltry 12% of respondents saw no bubbles in financial markets.

So with almost 9 out of 10 survey participants now agreeing there is a bubble, where is it?

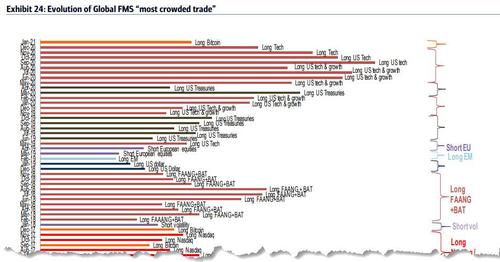

Perhaps this is just Wall Street projecting, jealous of 16-year-old Robinhooders (who have recently purchased lambos) who truly are long cryptos, even as most professionals refuse to chase the cryptocurrency ever higher while piling into such bubble names as Tesla.

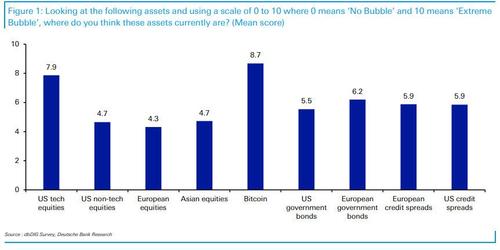

Not surprisingly, and also identical to the BofA survey, US tech equities saw a 7.9 score on this scale. 83% scored it at 7 or above. The third highest was European government bonds that was ‘only’ at 6.2.

This was followed by US and European credit, US govt bonds which by the way, is the biggest bubble in the history of the world thanks to the Fed buying $80BN every month with money printed out of thin air, and is the reason for all other assets bubbles, and so on.

Some other findings from the full survey:

- Most didn’t see a taper tantrum in 2021 (55%) but a sizeable minority did (33%). 71% didn’t see the Fed actually tapering in 2021.

- Most thought the vaccine roll-out so far was disappointing with the exception of those in the UK.

- Inflation expectations were the highest since DB started asking the question.

- The willingness to take a vaccine within the first month of it being available to respondents increased from last month but the timing of when they expected to be vaccinated slipped over the period.

- 3 month positive sentiment in US/Euro equities hovers round the survey history highs but positive 12 month sentiment continues to dip from its November peak.

- 3 and 12 month expectations for US/Euro bond yields are all at survey high levels. So higher yields is certainly a heavy consensus.

The full survey results are below: