Fra Zerohedge/ BAnk of America:

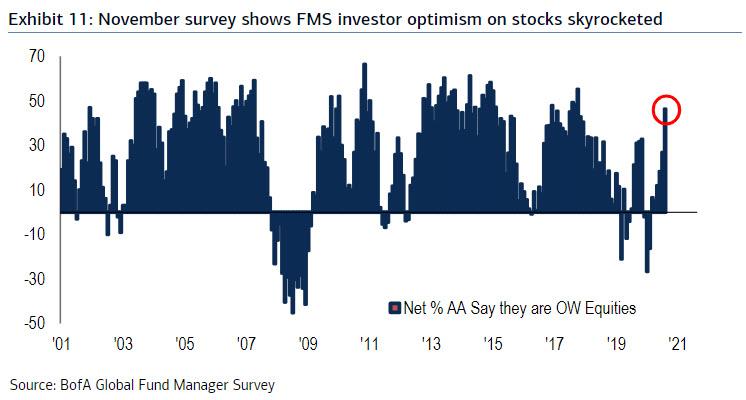

Specifically, according to the survey conducted Nov 6 through Nov 12, investor optimism about stocks soared to the highest level since January 18 (net 46%) as a “topping process gets underway” (extremely bullish >50%), while contrary to some false media reports that investors remain on the sidelines, hedge funds’ equity exposure remains high (41%).

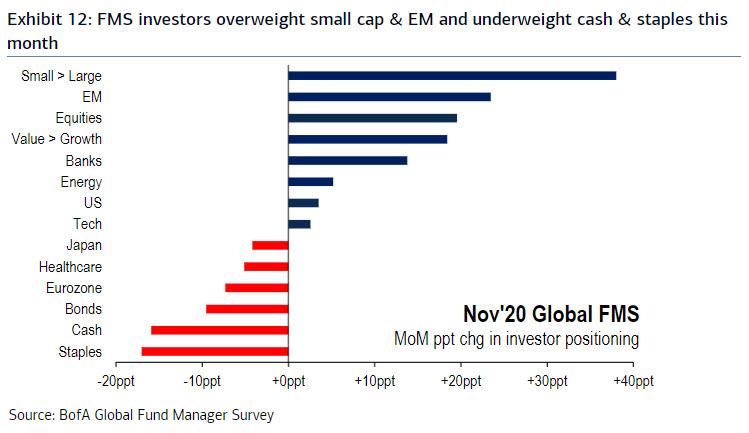

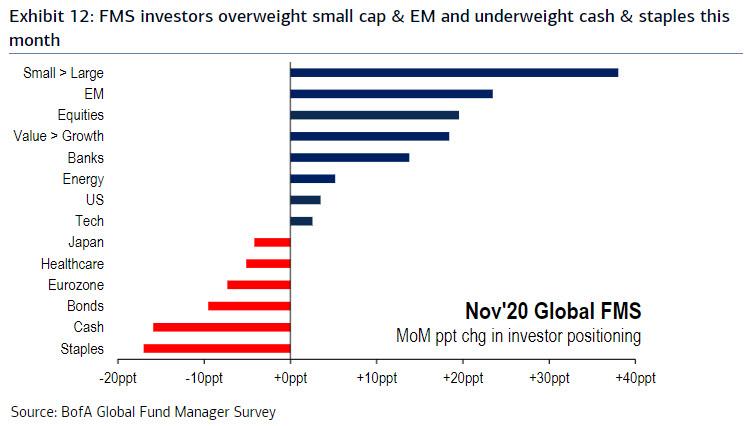

The survey also found that the “fully bulled” up managers were going all in the the value rotation, deploying more money into emerging markets, small-cap stocks and the banking sector on hopes a COVID-19 vaccine will turn around these hard-hit market segments.

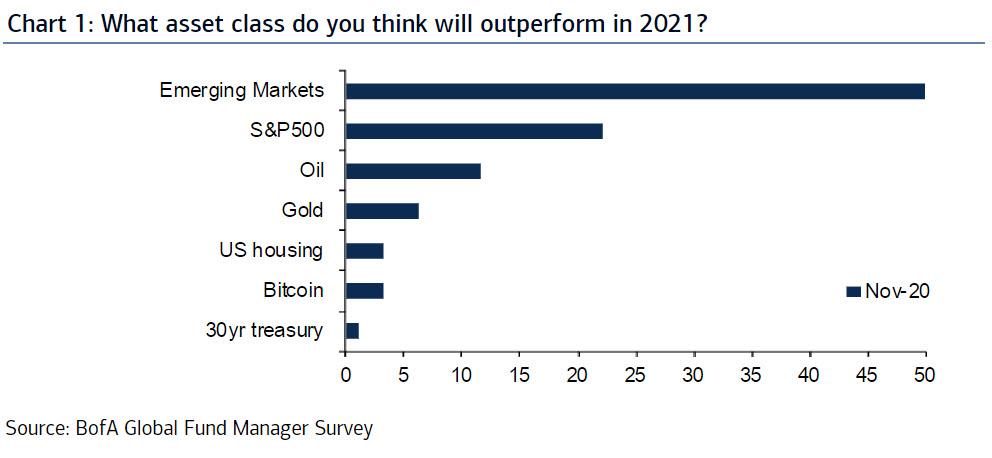

When asked what their 3 favorite trades for 2021 were, FMS investors said 1) long Emerging Markets, 2), long S&P500, and 3) long oil.

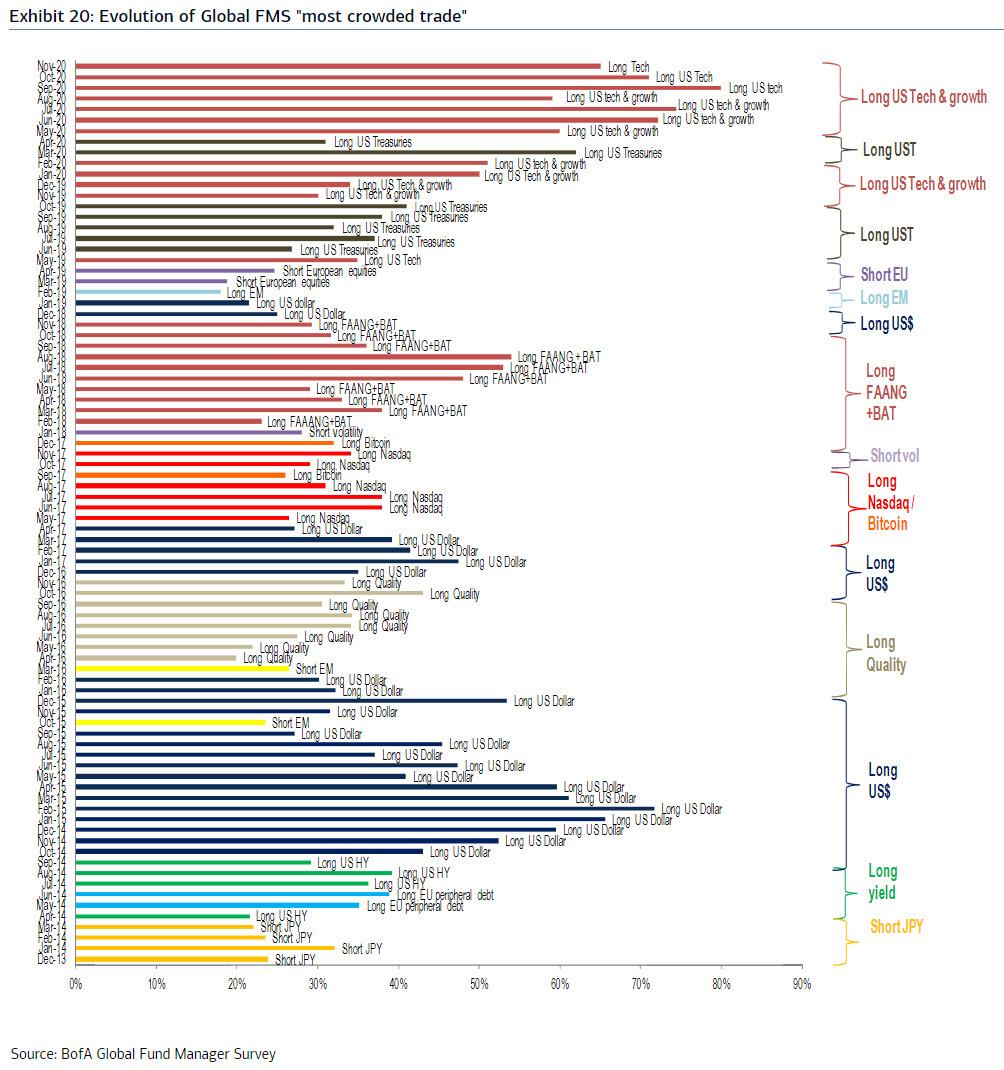

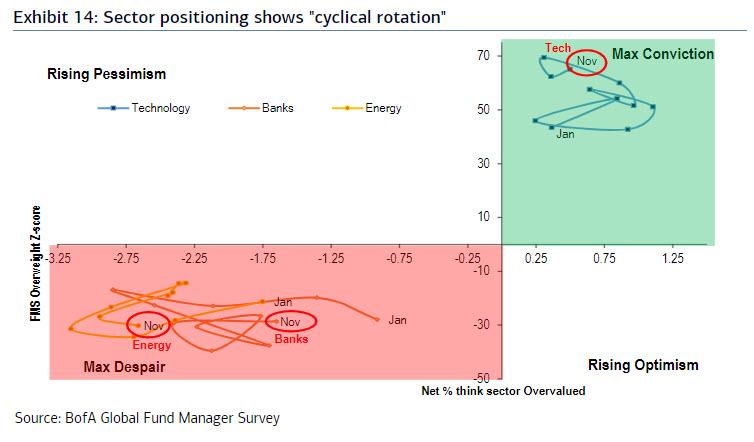

Even as they self-reportedly rotated into value, FMS investors still regarded long tech as by far and away most “crowded trade” in Nov’20, the 7th consecutive month.

What is ironic about this survey – as we have discussed frequently in the past – is that it seems to represent not what Wall Street managers are doing but what they wish they were doing, especially since the latest 13F report showed clearly that hedge funds actively bought even more tech stocks in the 3rd quarter.

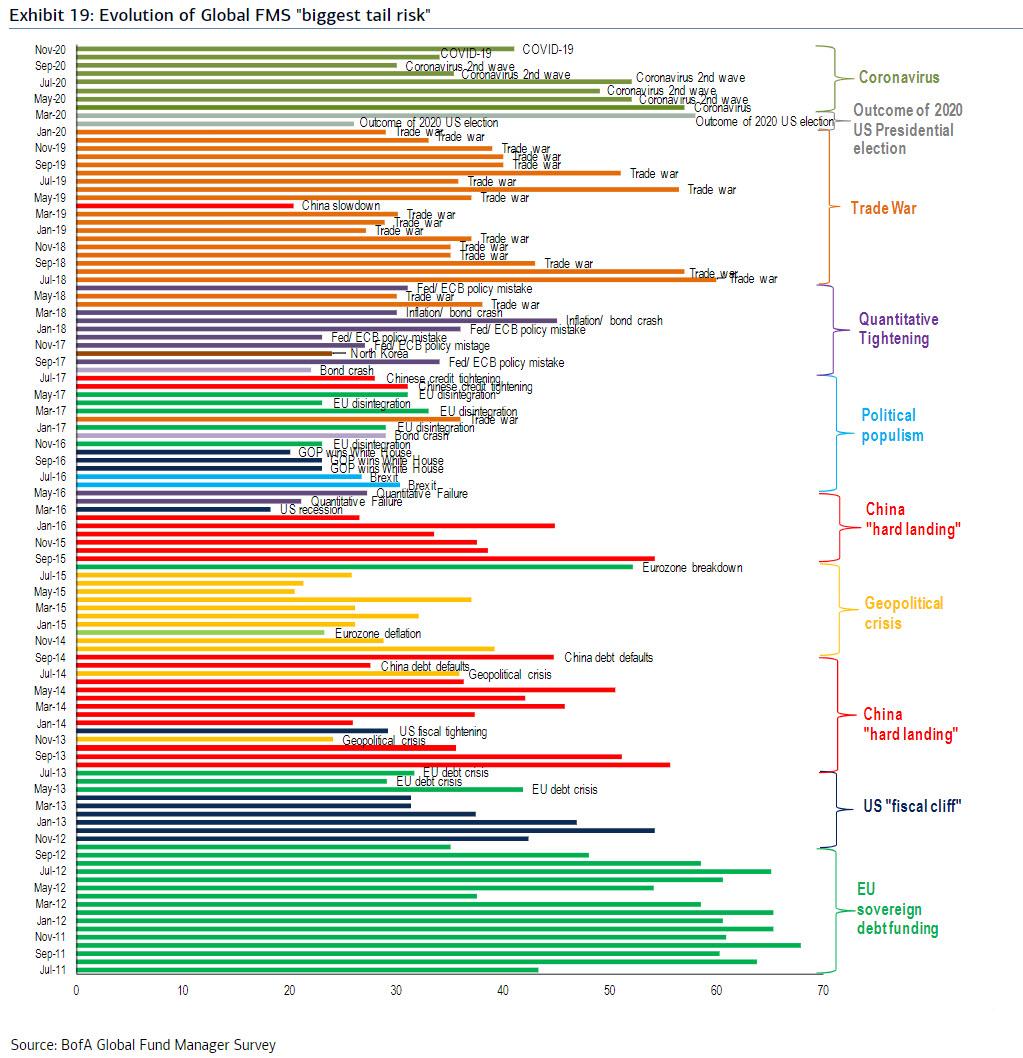

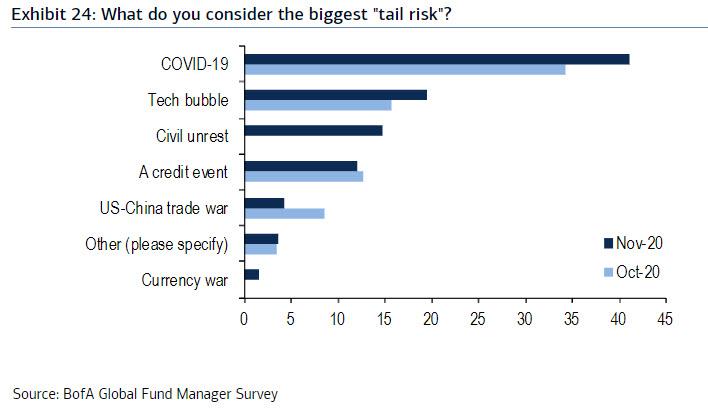

Going back to the survey which sadly is now far more noise than signal, we also learn that while COVID-19 remains the top “tail risk”…

… followed by tech bubble, civil unrest, a credit event, US-China trade war….

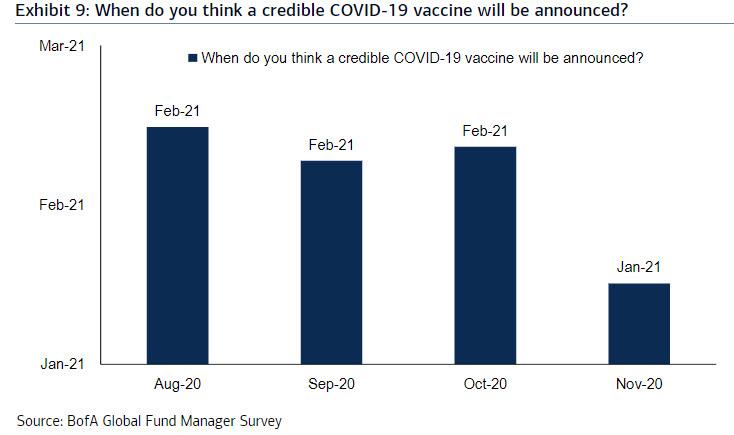

… FMS investors continue to pull forward their timing of “credible vaccine”, now expected Jan’21 (was Feb’21).

This early vaccine optimism led to a cascade of downstream optimism, pushing global growth optimism…

… and profit expectations to a 20-year high.

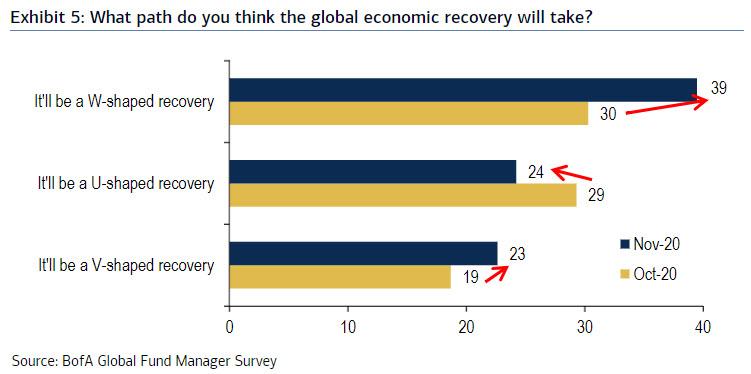

Alongside this spike in optimism, one month after the U and W-shaped recovery crowds were virtually tied, this month, the W-shaped respondents took a sizable lead, from 30% to 39%, while the U-shapers slumped from 29% to 24%.

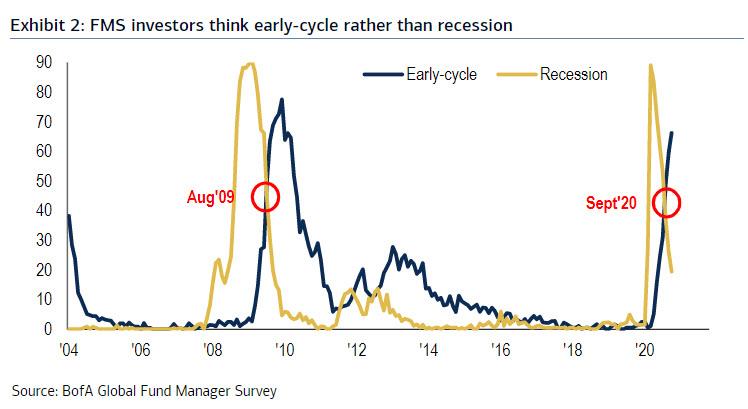

Just as remarkably, after everyone was expecting a record number of respondents expected a recession in March and April, now a big majority (66%) say macro in “early-cycle” growth phase:

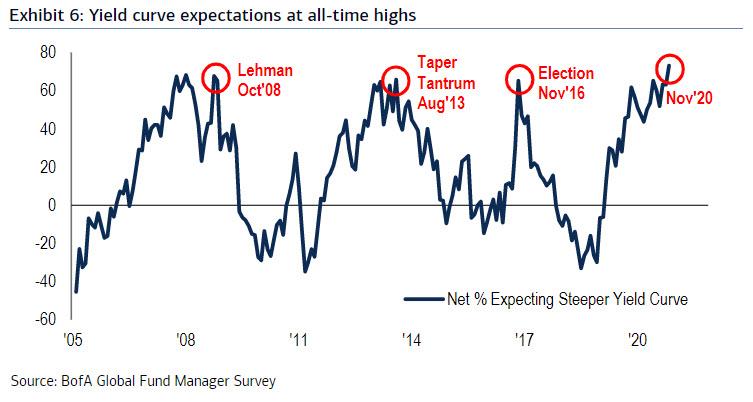

Alongside this, a record net 73% of investors expect a steeper yield curve, a number higher than 2008 Lehman bankruptcy, 2013 Fed Taper Tantrum & 2016 US Election.

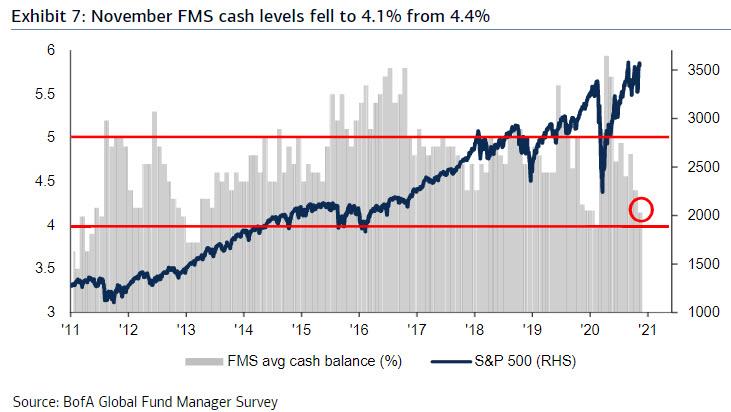

The euphoria sent investors’ cash levels down to 4.1% in November, from 4.4% last month, to pre-COVID-19 levels last seen in January, and down 1.8% in the past 7 months, fastest drop ever.

This was also the first red flag as the cash level is now close to triggering Bank of America’s “sell signal” by FMS Cash Rule (cash <4%).

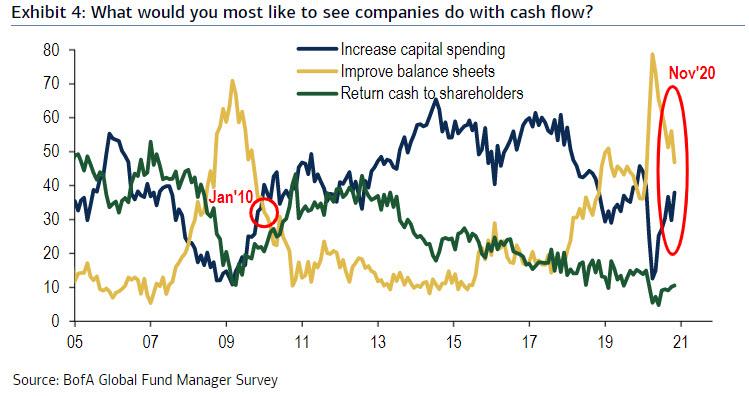

Amid all this optimism, a small majority of CIOs still want CEOs to improve balance sheet (47%), but desire for capex (the 2021 key to sustained economic recovery) on the rise (38%), while buyback “desires” remain subdued.

With global economic growth and profit expectations running at a 20-year high among the investors surveyed, the “reopening rotation” into oversold business sectors is likely to continue in the fourth quarter, Hartnett said, while pointing out that in terms of asset allocation shifts, the October FMS showed a big increase in exposure to small caps, EM, stocks, value & banks, coupled with a big reduction in exposure to staples, cash, bonds, Europe & healthcare.

Alongside this, Hartnett siad that Q4 contrarian bulls should position for completion of “full bull” reopening rotation via longs in Japan, Eurozone, UK, and energy stocks, while contrarian bears would position for flatter yield curve trades e.g. long staples heading into late-20/early-21 “top”.

Also confirming that a the “reflation” or “cyclical rotation” trade is anything but contrarian, the latest survey showed that “cyclical rotation” resumed in Nov after election with buyers in rally laggards, however we should note again that as the latest 13F releases showed, the “sellers strike” in technology remains.

Finally, going back to last Friday when Hartnett already hinted that it’s time to fade Wall Street’s booming euphoria, the BofA CIO advised clients that the “reopening rotation is complete once EAFE & energy rally; vaccine ultimately induces “The Full Bull” and should be sold.”

His bottom line: “the most bullish Fund Manager Survey (FMS) of 2020 on the back of vaccine, election, macro; Nov FMS shows a big drop in cash, 20-year high in GDP expectations, big jump in equity, small cap & EM exposure; reopening rotation can continue in Q4 but we say “sell the vaccine” in coming weeks/months as we think we’re close to “full bull”. “