Source:

The blame game of who has done what in Gamestop continues. One thing is sure, people have made and lost fortunes. There is another angle to it that has not received much attention, yet, namely the entire business of passive tracker funds just doing trades automatically as ETFs are re balancing. The Gamestop case is basically exposing some extremely important aspects/flaws of passive tracking investments.

Retail ETF, XRT, has squeezed “to the moon” as Gamestop has surged. Note the extreme volumes over past days. Investors tracking this have basically all been busy loading up on Gamestop without even thinking about it.

Source; Refinitiv

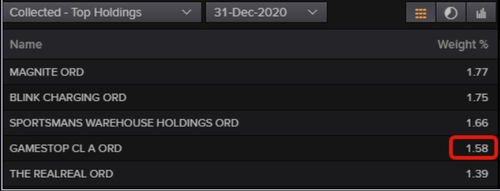

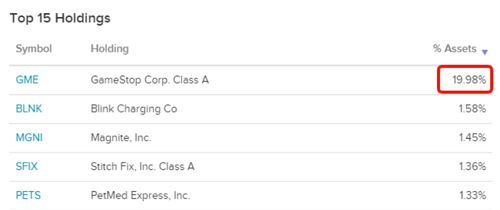

On Dec 30 2020 Gamestop had a weight of some 1.5% in the XRT. Per Friday close it stands at 20%. Would you like to be tracking the XRT loading up with Gamestop shares at these levels, just in order to track something?

Source; Refinitiv

Source; ETFBD

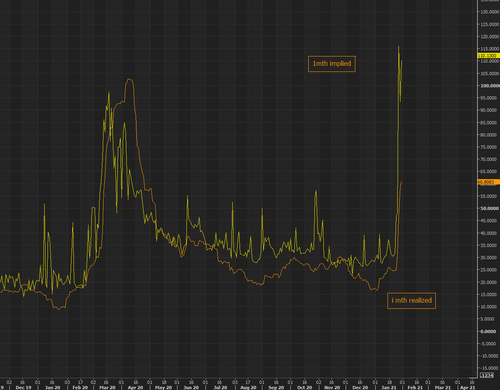

Last chart shows the explosion of vols in XRT. 1 month implied vols have surpassed levels we saw during the peak of the corona panic. This just shows how much this entire situation has affected pricing of assets beyond Gamestop. Very interesting plays here if you have a clear view of direction and/or pace of this one going forward.

1 month at the money vols trade around 110%, basically pricing almost 7% daily moves of the XRT.

Source; Refinitiv

The biggest irony of this “trade” is that there will be many losers of Gamestop if/when it comes back to earth without even knowing they were getting involved in Gamestop longs up here.

Time to reconsider index tracking as the default strategy?