Fra Zerohedge/ Goldman:

Just days after OPEC slashed its oil demand forecast as a result of the slowdown in China’s economy due to the Covid-19, moments ago Goldman has doubled down on its bearish oil take and has cut its oil price target by $10 to $53 in Q1 through the end of the year, as a result of what it now estimates is a loss of as much as 4 million barrels per day out of China.

In a note from Goldman’s Damien Courvalin, the commodity strategist writes that fundamental uncertainty in the oil market is exceptionally high, adding that “the loss of Chinese and global oil demand from the coronavirus outbreak is significant but remains unknown in both scale and duration while the timing and scale of a potential OPEC+ production cut remains highly uncertain as well.”

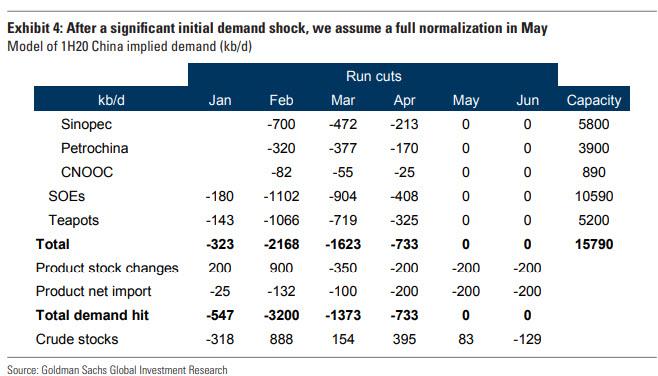

As a result, in his first attempt at measuring this hit on Chinese demand points to a peak of 4 million b/d yoy loss in demand currently.

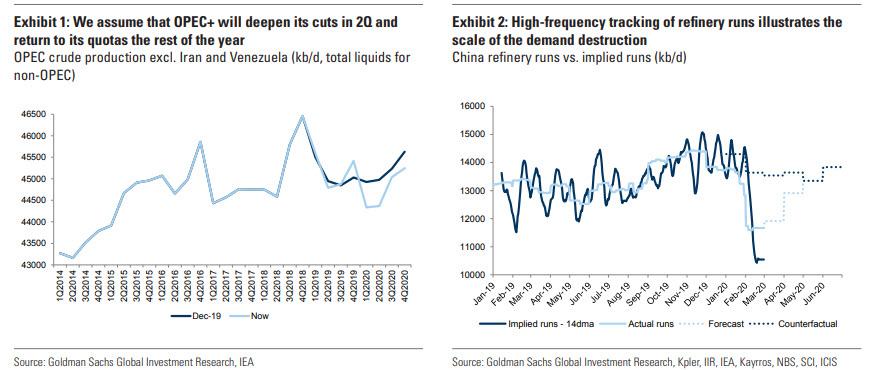

Assuming a gradual recovery by May would bring 2020 global oil demand growth to 0.6 mb/d yoy vs. 1.1 mb/d previously and the global market in a 1.0 mb/d surplus through 1H20, according to Courvalin. However, in case OPEC+ manages to agree to a 0.5 mb/d cut in 2Q20 with prior cuts extended through 2H20 that would lead to normalized inventories by year-end.

Focusing on China, Goldman writes that the current large oil surplus appears so far contained to China, “once again highlighting the importance of China and EM storage in smoothing out supply and demand shocks.”

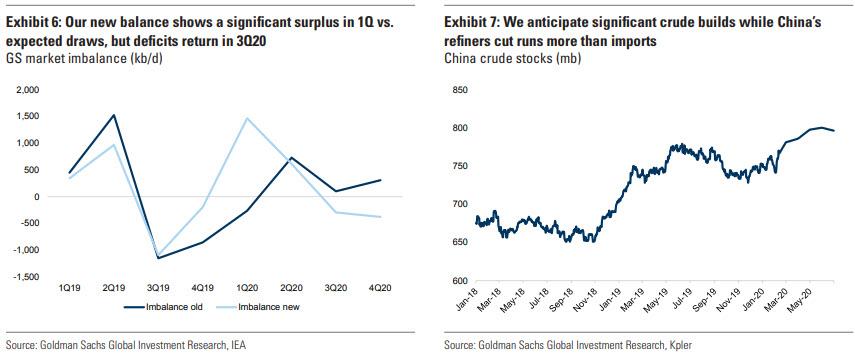

These supply and demand assumptions lead Goldman to expect a global oil market in surplus in 1H20, with a global cumulative inventory build of 180 mb, four times its pre-virus forecast. The bank then expects the oil market to shift back into a deficit in 3Q20 with a greater than seasonal global inventory decline of 90 mb in 2H20, bringing the oil market back to our pre-virus path by end-2020. Courvalin expects that China (and to a lesser extent other EMs) will be able to accommodate half of this inventory build. Specifically, China has large crude spare storage capacity with satellite imagery pointing to c.150 mb of ullage (with potential for more, either underground or should new tanks be quickly built). India, Russia and core-OPEC producers have at least a further 35 mb of spare storage capacity as well, leaving for a moderate OECD inventory build of 0.5 mb/d in 2Q.

Finally, given still relatively long net speculative positions, Goldman believes the oil market is not sufficiently concerned about this potential gap risk lower in prices, which means that a speculative capitulation could potentially send Brent into the $40s or even lower in case of a full-blown puke by CTAs and other levered accounts.