Fra Zerohedge:

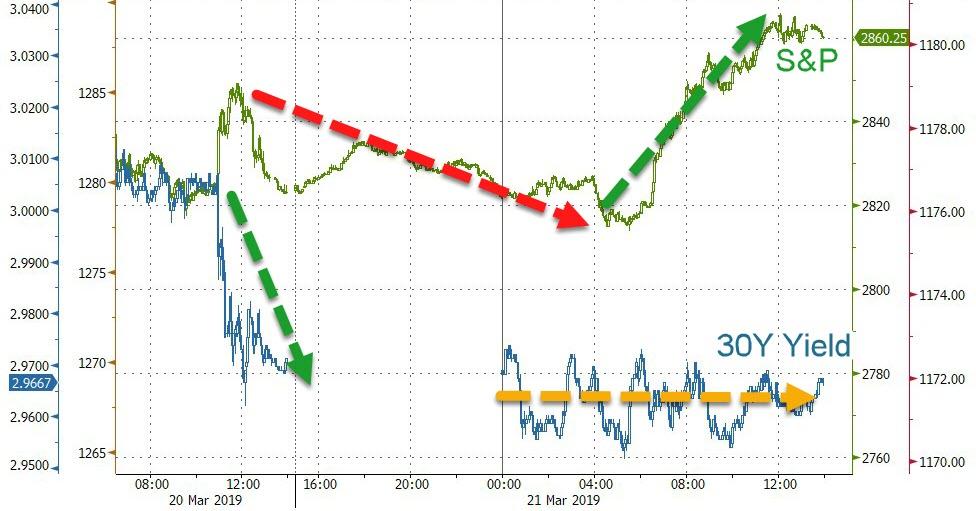

As the whipsaw in stocks and the dollar sank in today – while the bond market remains unimpressed by the machine’s liftathon today – market participants are still shaking their heads at what just happened.

One of the more outspoken of those market participants is DoubleLine CEO Jeffrey Gundlach who took to Twitter this morning to express his disdain…

“Three months ago the Fed predicted totally different policy than where they are now. How can they predict 2020 policy with a straight face?”

Three months ago the Fed predicted totally different policy than where they are now. How can they predict 2020 policy with a straight face?

But he was not done, in a brief interview with Reuters after the close, Gundlach unleashed on Jay Powell and rest of the FOMC warning that their sudden cautious stance on raising interest rates could backfire by creating uncertainty in the economy…

“This U-Turn – on nothing fundamentally changing – is unprecedented,” Gundlach said in a telephone interview.

“Three months ago, we were on ‘autopilot’ with the balance sheet – and now the bond market is priced for a rate cut this year. The reversal in their stance is stunning.”

Gundlach, the new “Bond King” now that Bill Gross has ‘retired’, oversees more than $123 billion in assets (we offer that tidbit to suggest he is worth listenig to), said he feels the Fed’s massive shift in such a short period on quantitative tightening could hurt the U.S. central bank’s credibility.

“They aren’t telling you what they are targeting. It’s like they aren’t really telling you what their motivation is,” Gundlach said.

“Just because things seem invincible doesn’t mean they are invincible. There is kryptonite everywhere. Yesterday’s move created more uncertainty.”

Gundlach, who correctly predicted the S&P 500 would post negative returns in 2018, said the benchmark index is set for another negative year.

He said the stock market, for now, “likes the fact that they (the Fed) aren’t going to give them any problems.”

But things could change quickly and dramatically, he said, with his final comment, the most ominous:

“It feels eerily like ‘07,” he said.

“The stock market is near its high and the economy is noticeably weaker – and yet everyone is saying ‘Everything is Great!’”

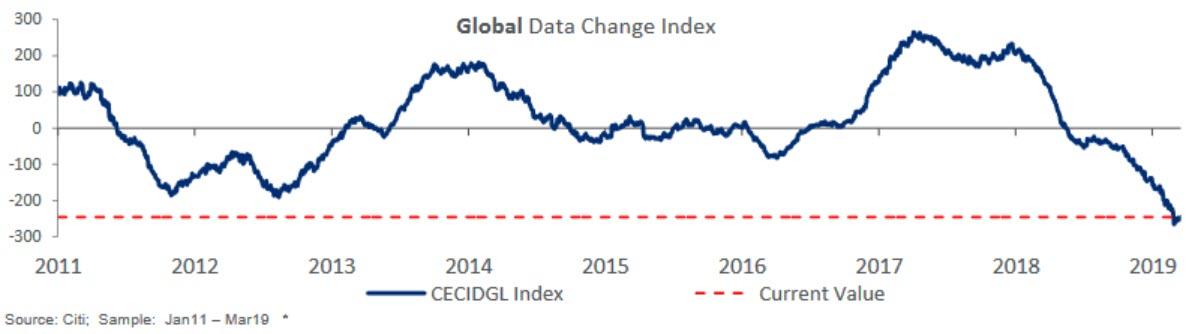

And just in case you wondered how bad the underlying is – despite equity market’s enthusiasm – Citi’s Economic Data Change index as its worst level since 2009…

Which is perhaps why Gundlach said he favors a plain-vanilla Treasury fund investing in maturities of one to five years.