Fra Zerohedge / By Bloomberg macro commentator Michael Msika

As 2020 draws to a close, here’s what’s on the minds of investors for the year ahead:

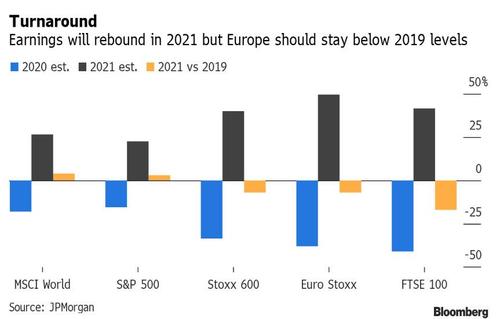

- Will Europe Ever Catch Up? Once again, this region is the laggard of the world. The Stoxx 600 ranks as one of the few major equity benchmarks still below pre-Covid levels. Whether you view that as more room for the catch-up rally or confirmation that Europe is a dud depends on whether you’re a bull or bear.

- How Long Until Peak Earnings? Everyone knows profits are bouncing back hard, but a full recovery could take a while. JPMorgan strategist Mislav Matejka says the trajectory could be similar to post-crisis periods of 2003 and 2009-2010. He expects euro-area EPS to surge as much as 50% next year, but still be about 7% below the 2019 level.

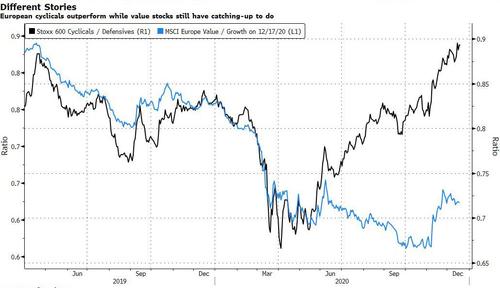

- Is 2021 the Year for Value? Most strategists believe the cyclical and value rally can keep going. Energy and banks are still down about 20% this year, but rallied hard since November. On the flip-side, watch miners and auto shares as both industries have nearly doubled since the lows in March.

- The revival of animal spirits, near-zero bond yields and higher expectations for inflation all argue for higher prices for cyclical stocks, plus investors are feeling more confident with the U.S. election over and Brexit nearing a resolution. Looking at the chart below, there’s still a way to go.

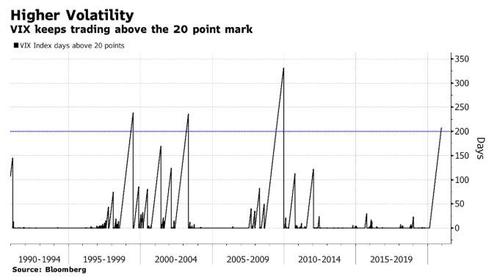

- Can Markets Survive Without Stimulus? Fragility is fast becoming a buzzword for markets that are vulnerable to investor stampedes and violent reversals. “With monetary policy taps still wide open, more fiscal stimulus likely coming, and the vaccine eventually helping to heal the underlying economy, the risks of an even bigger bubble and resulting fragility shock are real in 2021,” says strategists at Bank of America. The still-elevated VIX is one sign of unease among investors. The fear gauge has been above 20 for more than 200 days, only the fourth time that’s happened since 1990.

- Will Nordics Keep Trouncing the Rest of Europe? It’s been a year of split performances, with biotech and renewable energy shares fueling a huge rally in Danish stocks, while Spain and the U.K. stocks languish.

- How Big Will ESG Become? Investors are still pouring money into ethically-focused strategies like never before. This year, ESG funds saw took in $65 billion, triple the amount from 2019.

- What Could Go Wrong? The pandemic and higher taxes are some of the biggest tail risks for investors. But strategists agree that next year will be more normal year than this one.