Fra Zerohedge:

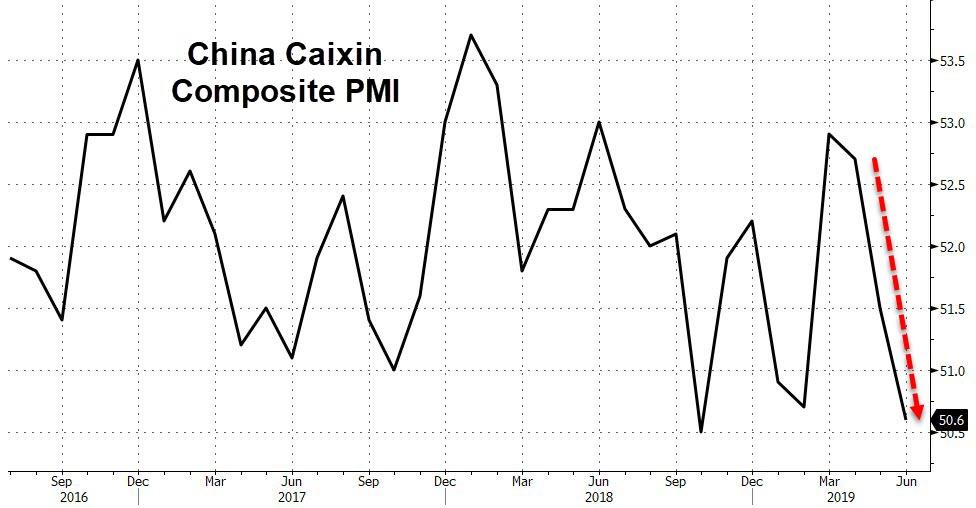

Both bonds and gold are extending their rallies from the US session with 10Y yields toughing a 1.94% handle for the first time since President Trump was elected as China’s Caixin Composite PMI tumbles in June.

One of the weakest levels since the financial crisis.

The Caixin China Composite Output Index fell further to 50.6 in June from the month before, dragged down by both the manufacturing and services sectors.

1) While the gauge for new orders dropped further it stayed in positive territory. The measure for new export business meanwhile returned to contractionary territory. The weakening of foreign demand was obvious.

2) The employment gauge fell further into contractionary territory, reflecting pressure on the jobs market, which was chiefly due to the reduced capacity of the services sector to absorb labor.

3) While the gauge for input costs inched down, the one for output charges edged up, pointing to easing cost pressure on companies.

4) The measure for future output fell to its lowest level since the survey added this gauge in early 2012, though it stayed in positive territory. This suggests sluggish business confidence.

Overall, China’s economy came under greater pressure in June. The conflict between China and the U.S. impacted business confidence rather heavily. Although its impact on exports hasn’t been fully reflected in the short-run, the longerterm situation doesn’t look optimistic. Future government policies to stabilize economic growth are likely to focus on new types of infrastructure, consumption and high-quality manufacturing.

The market is seemingly anticipating this weakness.

10Y yields are down over 7bps…

Gold has spiked up to recent multi-year highs, helped by the nomination of Judy Shelton for a Fed position…

Offshore Yuan is relatively unch but has plunged since the initial trade-truce euphoria…

The decoupling between global stocks and global bonds remains unprecedented…

But, as Alhambra Investments’ Jeffrey Snider explains, the Asian PMI picture is one of a dollar shortage, not trade wars.

It’s actually one of the few areas that has been studied in mainstream Economics. The links between global financial upset and broader economic consequences are pretty well understood. Trade gets shut down, therefore economies which are highly dependent upon the exchange of goods experience the effects first. When you see these bellwethers under pressure, it’s a bad sign.

The mysterious part is where these financial problems might come from. It’s one of the more uncomfortable aspects of the 2019, being in agreement with Economists who can clearly see that “trade wars” just aren’t significant enough to be this much of a disruption. In addition, it’s a huge stretch to believe that worries over a few billion in future US tariffs on Chinese goods would’ve produced such a decline in trade conditions starting all the way back to the middle if not earliest days of 2018.

The latest flood of PMI’s particularly dealing with manufacturing make both points. This slowdown becoming a full-blown downturn isn’t a new development, and it’s getting serious to the point that US-China geopolitics are set aside as immaterial.

In South Korea, IHS Markit’s Manufacturing index dropped to 47.5 in June 2019 from 48.4 in May.

The continued weakness exhibited by the South Korea Manufacturing PMI during June primarily reflects the ongoing global trade slowdown. Panellists [sic] reported that this is taking its toll on their businesses, weighing on demand for goods and subsequently leading to cuts in production.

The Japanese are starting to see employment weakness develop as a second order effect.

Subdued export demand resulted in the sharpest drop in new work from abroad since January. An associated decline in pressure on business capacity led to more cautious staff hiring in June, with employment growth easing to its weakest for just over two-and-a-half years.

This doesn’t mean that China isn’t included. The problem, in fact, seems to be the Chinese economy. No one can account for what’s going on there because there is no official or mainstream explanation other than trade wars. Tariffs are the only thing anyone talks about; therefore, it must be them.

Understanding instead the monetary mechanisms behind all this, we can see how the current disruption in global trade isn’t really different than the prior bouts of weakness. It is the repeating succession of monetary issues.

Both versions of China’s manufacturing sector PMI’s came in at 49.4 in June. The official index maintained by the government’s National Bureau of Statistics includes all the state-owned behemoths which at times can reflect more of what the government is doing than the rest of the economy. The other survey, the Caixin PMI, attempts to isolate conditions in the private economy by including mostly smaller and medium sized businesses.

That the two now equal suggests a couple of important points. The first is “stimulus”, or the distinct lack of it. The Communist government, as we’ve pointed out for a while, just isn’t coming to the rescue despite all the Western disbelief. Instead, what seems to be the official if undeclared doctrine of “managed decline” remains in place.

The second point is the second part: decline. China’s vast manufacturing sector appears to be doing just that. And it is China’s economy, not the trade stuff, which is where weakness originates. From Caixin:

Overall, China’s economy came under further pressure in June. Domestic demand shrank notably, foreign demand was still underpinned by front-loading exports, and business confidence fell sharply. [emphasis added]

According to these figures, Chinese industry is being supported right now by “trade wars” as firms seek to stuff global supply channels ahead of anticipated tariffs (obviously at the expense of future production).

The rest of China’s economy is slowly being squeezed another external problem – the same one that so negatively impacts global trade unrelated to protectionism. Chinese monetary growth has ground to a halt as a result of the latest eurodollar squeeze, a global dollar shortage which not only acts as an external drag it also becomes the operating baseline for RMB.

The October-December landmine.

This is why, I believe, on a day like Monday the stock market can surge to record highs while investors cheer the prospects for a trade deal while at the very same time the bond market remains unimpressed either way.

The issue is entirely liquidity risk, meaning dollar shortage. The bond market sees this in global monetary conditions and hedges against it in a manner consistent with forecasting imminent FOMC rate cuts. This global PMI data therefore confirms the economic consequences of something that must already be substantial.

That isn’t trade wars.