Fra Merril Lynch:

What We Learned in 2020

With this being the last Capital Market Outlook publication of 2020, we thought it would be a good time to look back on the key lessons of an extraordinary year. 2020 is replete with teachable moments, and in that spirit, here are our top 10 lessons of 2020.

Lesson 1: All Crises Are Accelerants—And Coronavirus Is No Different. Vladimir Ilyich Lenin―a Russian revolutionary, politician, and political theorist―once quipped that “there are decades when nothing happens, and then there are weeks when decades happen.” That’s what we think 2020 was in a nutshell.

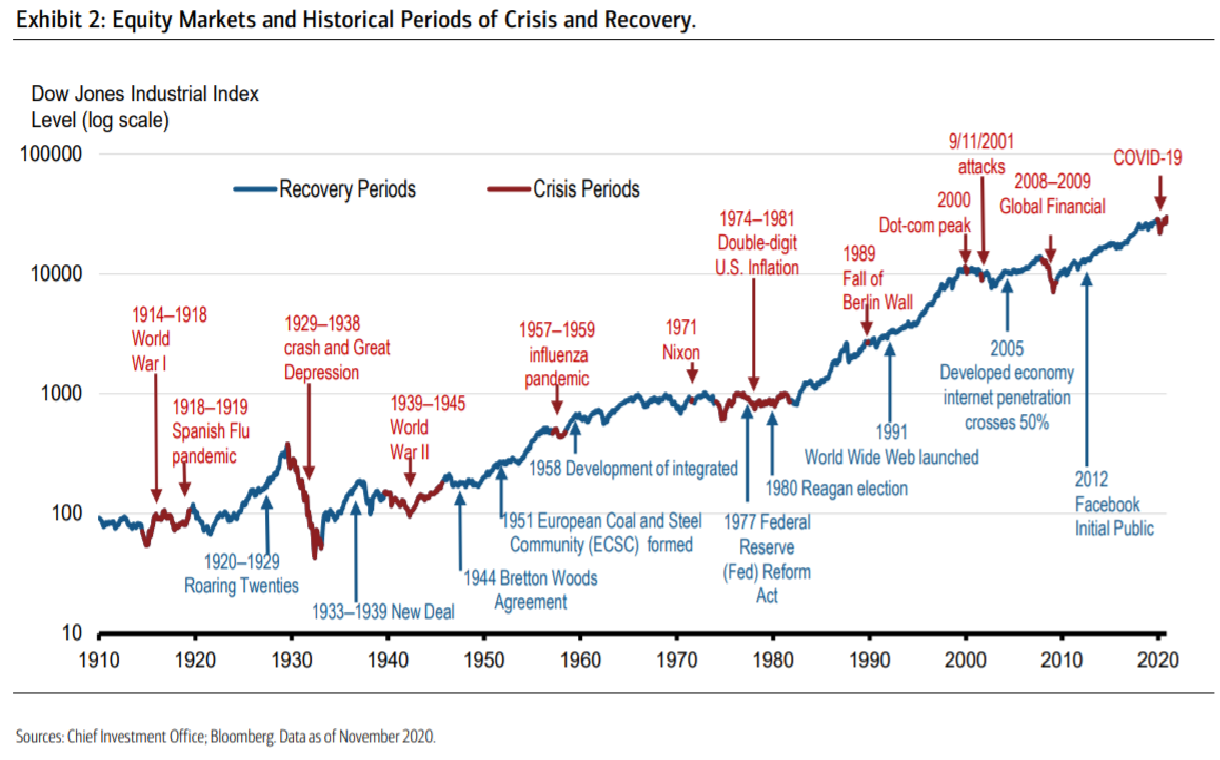

Past crises or shocks often pull forward the future and give way to rejuvenated periods of growth, innovation and development (Exhibit 2). As we wrote earlier this year, “the early 20th century included a world war and a global flu pandemic. The 1930s saw an economic depression and military conflict on an even larger scale. The 1970s was a period of economic stagnation and high inflation. And the first decade of the new millennium brought the collapse of a stock market bubble, the rise of global terrorism and a financial crash. Crucially, each of these historical crisis periods was ultimately succeeded by an 4 of 9 December 21, 2020 – Capital Market Outlook economic revival, a more favorable investment environment and sustained price gains for equity markets.”1 The pandemic of 2020 will be no different. Exhibit 2: Equity Markets and Historical Periods of Crisis and Recovery.

Lesson 2: Policy Makers Learned And Applied The Lessons Of History Fortunately, policy makers took to heart one of the key lessons of the Great Financial Crisis: Go big and go fast when it comes to the policy response amid collapsing economic growth and cratering confidence in the capital markets. The pandemic’s unprecedented shock to the global economy was matched by unprecedented policy responses from around the world. Think “double-barreled bazookas”—with policy makers (fiscal) and central banks (monetary) flooding the capital markets with trillions of dollars of liquidity as the coronavirus jumped borders. The numbers: America’s stimulus (central bank + fiscal) totaled nearly 50% of GDP between February and December 2020. Ditto for the eurozone.

Japan: 74.1% of GDP.2 This spending not only contained the collateral damage from the pandemic-cum-global recession but was also instrumental in laying the foundation for a Vshaped global economic recovery.

Lesson 3: Health = Wealth

If we have learned anything from this pandemic, it’s that health is a fundamental determinant to economic growth. The healthier the population, the stronger, more dynamic and competitive the economy. Sick nations, in contrast, are handicapped in terms of production, consumption and aggregate growth.

That said, it took a pandemic to expose the fragility of the global healthcare infrastructure. Global healthcare expenditures, according to the World Health Organization, have climbed steadily over the past two decades, reaching nearly $8 trillion in 2017 (the last year of available data). However, spending on global healthcare as a percentage of world GDP has barely budged, flatlining at around 9% to 10% over the past two decades. So even before the coronavirus hit, the world’s healthcare infrastructure was straining at the seams. In the post-pandemic world, global healthcare expenditures are set to accelerate, a bullish

prospect for world leaders in pharmaceuticals, diagnostic equipment, medical software/hardware, tele-medicine, and related medical goods and services.

Lesson 4: The “Commanding Heights” Now Belong To The Government Ronald Reagan once said, “Government is not the solution to our problem. Government is the problem.” Not anymore. Times have changed. Along with the rise of China, the unprecedented global healthcare crisis has swung the pendulum of control of the “Commanding Heights”—or the most important elements of the economy—back to the

state, away from the markets. This seismic shift was underway before the crisis but has gained more momentum. There is rising bipartisan support for a U.S. industrial policy in such key sectors as aerospace, electronics, rare earth minerals, telecom, agriculture and other sectors deemed vital to national security. Similar strategies are currently being adopted overseas. Governments are becoming more actively involved in imposing conditions on which goods, services and technologies can be bought or sold, and which foreign partners are deemed trustworthy. The fostering of “national champions” is gaining traction. A global battle is currently brewing over data ownership and rights of privacy. Future market returns may increasingly be influenced by the delicate balance in who controls the “Commanding Heights.”

Lesson 5: It’s Too Soon To Write Off Globalization Populism, protectionism and the pandemic are headwinds to a more integrated global economy and have sparked a debate about the risks of de-globalization. We are more sanguine. A more multilaterally minded President-elect Biden administration; “sticky” global supply chains; the stronger-than-expected rebound in global trade; and greater crossborder service activities as the world goes digital—all are signs that augur for greater globalization, not less. As we recently noted, there is no better example of globalization being alive and well than the Pfizer/BioNTech vaccine—the world’s first coronavirus vaccine approved for mass use. As the Financial Times recently noted: “the vaccine was developed in Germany by the children of Turkish immigrants; tested in Germany, the U.S., Turkey, South Africa, Brazil and Argentina; manufactured in Belgium and first approved in the U.K.”3 We learned this year that globalization is malleable—it is changing, adjusting and mutating. It is far from dead—a bullish prospect for U.S. and global equities.

Lesson 6: U.S.-China Relations: Is This Time Different There were glimmers of hope that U.S.-Sino relations would improve this year, buttressed by the signing of the Phase One trade deal in January 2020. The pandemic, however, only served to amplify the differences between the two nations in trade, technology, foreign investment and a host of geopolitical hot spots (Hong Kong, the South China Sea, etc.). We learned this year that it’s different this time in our view—that the U.S. and China have entered an era of great power competition that will likely play out over the next few years, if not decades. The rivalry is considered significant given the global economic weight of the U.S. and China, their high degree of economic interdependence, and aftershocks to the rest of the world. Escalating tensions have the potential to increase market volatility and could put at risk numerous U.S. firms reliant on China for future earnings growth (and vice versa—Chinese firms doing business in the U.S. and elsewhere).

Lesson 7: Europe—More United Than Divided

When the pandemic struck early this year, Europe did what it does best: It dithered and became more divided in fashioning a policy response. Border restrictions among member states were erected in a confusing and uncoordinated way, growth declined, nationalism soared, and the risks of Europe collapsing skyrocketed. Thereafter, however, Europe’s principal institutions—the European Commission, the European Council and the European Central Bank (ECB)—swung into action and crafted a number of pro-growth policies that stunned investors and even the most diehard Euroskeptics. To wit, the ECB stepped up its asset purchasing program; the Stability and Growth Pact’s ceilings on debt, deficits and inflation were suspended; the European Investment Bank was given fresh funds; and topping it all off, the European Council agreed to a 750-billion-euro Next Generation European Union (EU) fund, including more powers for the European Commission to raise capital in the financial markets. The latter marks the most significant step toward an EU “transfer union” and was hailed as a Hamiltonian moment for Europe. Yes, there is a great deal of work to be done in Europe, but the pandemic and fears of stretching intra-EU ties

to the breaking point have passed. We learned this year that Europe is more united than divided—a bullish prospect for U.S. firms considering that more than half of U.S. global earnings (foreign affiliate income) emanates from Europe.

Lesson 8: Some Cuts Are Deeper Than Others

Early in the pandemic, and with the coronavirus mutating all over the world, coronavirus was described as the “great equalizer”—i.e., that everyone was at risk from the disease. In practical terms, that’s true. In reality, it’s not even close. The pandemic has taught that we’re not created equal—some cuts are deeper than others. Think of the front-line healthcare worker versus the work-from-home professional. Think

of thousands of inner-city school children in Philadelphia with neither a computer nor the internet, rendering remote learning a cruel joke. Think of the mental health of a worker without healthcare versus one with healthcare. Think of the single mother, with children at home, who has to physically show up for work. Or the millions of workers (the majority women and ethnic minorities) who have lost their jobs due to cratering service activities.

And think of the millions of people (some 88 to 115 million based on World Bank estimates) who will fall back into extreme poverty this year—the first time in twenty years the numbers have increased. In a nutshell, the pandemic has exacerbated and exposed numerous inequalities, a lesson investors and policy makers ignored at their own peril.

Lesson 9: Climate Change Can Be Slowed

Something untoward happened when the world went into shutdown earlier this year: The skies in Delhi, one of the most polluted cities in the world, cleared, while in other parts of India, the majestic Himalayas became visible for the first time in decades. In China, another major global polluter, emissions dropped by roughly 25% at peak shutdown over March. In some of the largest cities in the world, like Delhi, Sao Paulo and New York, levels of fine particulate matter known as PM2.5 fell dramatically, by 25% to 60% in many cases.

Nitrogen dioxide levels in northern Italy dropped by 40% beginning in early March. In Venice, meanwhile, the canal waters suddenly cleared in the absence of thousands of tourists thronging the city. When air travel came to a near halt (at one point, over 16,000 passenger jets were grounded worldwide) and global road transportation activity halved from the 2019 average, the world grew quieter, and the earth vibrated less, with seismometers around the world recording reductions in movement along Earth’s crust. The key point of all of the above: The pandemic and attendant shutdown of mankind serves as a telling lesson of the stresses and strains everyday human activity places on Mother Earth. The coronavirus did not halt climate change—greenhouse gas emissions are on the rise again—but it did demonstrate that the unrelenting rise in greenhouse gas emissions is not inevitable. The globetrotting coronavirus also illuminated how delicate and vulnerable Planet Earth is to ecological shocks. Heeding this lesson, mitigating climate risks remains a key objective of governments and corporations around the world, creating investment opportunities across a spectrum of industries—solar, wind, electrical vehicles, water, waste management, storage and distribution, and related activities.

Lesson 10: Never Bet Against America

The final lesson of 2020 is never bet against the dynamic, resilient U.S. economy—warts and all. Yes, the war against coronavirus has yet to be won—we are not out of the woods yet. In addition, the nation confronts a number of structural issues heading into 2021. But think how far we have come since the dark days of March and April, when the markets and economy were in a “free fall”. As we close out the year, the S&P and other major indexes are hovering at all-time highs—a turn unimaginable back in the dark days of spring. The pandemic is a lesson on how adaptable the country is to extraordinary change—or to a

once-in-a-century shock.

We end were we began: The key lesson/takeaway of Exhibit 2 is that history is always replete with crises and challenges, but these event risks are also opportunities for investors who can see the forest before the trees. History shows that markets and the economy tend to bend but not break. That’s another way of saying stay long U.S. equities.