Fra Zerohedge:

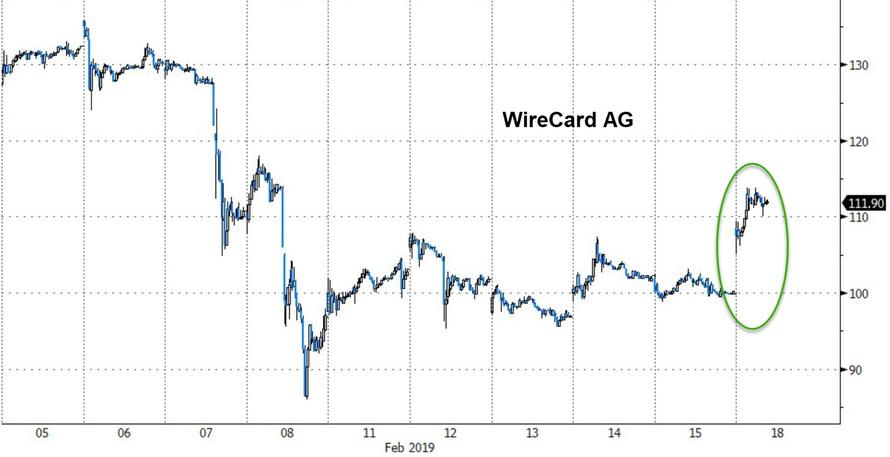

Clearly worried about the possibility that a sustained blowup in shares of fintech darling Wirecard – which replaced troubled lender Commerzbank in Germany’s DAX 30 index last year – could create a drag on the country’s benchmark index – if not European markets more broadly – German financial regulators have decided to employ a strategy pioneered by regulators in Beijing: Over the weekend, German financial regulator BaFin banned shorting shares of Wirecard, citing the risk of a “further downward spiral” in the company’s shares, according to the Financial Times.

Wirecard shares imploded last month after the FT published a story alleging fraud in the company’s Asia operations which was exposed by a whistleblower who explained how managers at Wirecard had been encouraged to report fraudulent figures to local regulators as the company sought to expand its business in Asia. While there was initially some doubt about the veracity of the FT’s reporting, another story published last week reignited the selling pressure thanks to leaked excerpts from an internal investigation conducted by a prominent Asian law firm which found evidence of widespread fraud and “creative accounting”, substantiating the FT’s earlier report.

Shares of Wirecard have nearly quintupled in value over the past four years as the firm cemented its position as one of the largest payments processors in Europe.

And as if the ban on short-selling wasn’t enough to provoke comparisons to the Communist Party’s reaction to a 2016 blowup in Chinese shares, a German newspaper reported on Monday that prosecutors in Munich have opened an investigation into the FT journalists who broke the story, per Reuters.

The FT said allegations that its reporters engaged in market manipulation were “false” and “baseless.”

Bafin said in a statement on Monday that the ban was the first for an individual stock:

Bafin said the ban was its first such ban for an individual stock, though it outlawed shorting of bank shares in 2008. Short selling is when an investor borrows shares to sell in the hope of being able to buy them back later at a lower price.

“The last few days have seen massive uncertainty in financial markets. This was triggered in particular by the price development of the Wirecard AG share in recent weeks,” Bafin said in a statement on Monday.

The European Securities and Markets Authority has said that the selloff in Wirecard constituted “a serious threat to market confidence” and risked “contagion” in Germany.

Though, as one trader was quick to point out, bans on short-selling rarely have the desired impact (see China’s ban on short sales).

“Thinking back to other short sell bans elsewhere, it rarely has the desired effect,”Mark Taylor, a sales trader at Mirabaud Securities, said, adding that some short sellers would likely just wait for the ban to lift, while others would “keep the core idea short” and refrain from buying the stock.

Meanwhile, UK hedge fund titan Crispin Odey, who has an open short position against Wirecard, said he’s now more excited about taking BaFin to court than he is about his short position in Wirecard.

In an interview Monday, Odey said he’s now more excited about taking BaFin to court than his wagers on the Aschheim, Bavaria-based company. BaFin prohibited investors from taking new short positions in Wirecard or increasing existing ones through April 18 after the shares were whipsawed over the last month following a series of reports in the Financial Times alleging fraud at the payment company’s Singapore unit.

“It’s a very dangerous thing that they have chosen to do over the weekend,” Odey said. “We are very excited about what we might be able to make in litigation against BaFin.”

The regulator needs to be sure that Wirecard’s employees haven’t engaged in any wrongdoing before having taken such a step, he said. BaFin, which had banned naked short sales on 11 firms during the global financial crisis, said it opted to ban such bets on a single company because the recent price volatility risks undermining the broader stock market.

So far, at least, the ban has had the desired effect: Wirecard shares soared on Monday, even as US traders were mostly absent for the President’s Day holiday.