Fra Zerohedge:

Global stocks and US equity futures eased further on Thursday as the latest dismal Chinese data missed across the board and showed further economic slowdown, with investment growth printing weakest since 1998…

… adding to worries about the global growth fallout from the U.S.-China trade war. U.S. futures were down 0.14%, following a record-high close on the S&P 500 on Wednesday. Futures bounced briefly after news that China customs have lifted restrictions on US poultry meat imports, with China’s Global Times acknowledging saying the move comes “amid the continuation of tradetalks, paving the way for hundreds of millions of dollars worth US meat export to China”; the US exported $390MM worth of poultry to China in 2014 before the ban. Yes, million, not billion.

With earnings season ending, Cisco Systems tumbled in early trading after its quarterly sales forecast fell far short of projections, while WalMart surged after the company raised its full year outlook. Altice Europe NV beat earnings estimates, while Burberry Group Plc climbed after reporting six-month earnings that exceeded expectations.

The MSCI All-Country World index was down 0.14% after start of trading in Europe. European shares initially fell, but later rebounded after data showing the German economy just barely missed a recession, rising 0.1% in the third quarter, avoiding a contraction thanks to consumer spending, and beating expectations of a second consecutive contraction.

While a recession was averted, the news was hardly good as Germany grew at just half the pact of the overall eurozone as growth across the entire continent grinds to a halt.

“Obviously it’s better than expected, but actually I would argue is that it’s a hollow victory because in effect it makes a fiscal response less likely,” said Michael Hewson, chief markets analyst at CMC Markets in London. “I think if they’d gone into a technical recession, the pressure to loosen the purse strings so to speak would have been much much greater.”

In Asia, stocks fell after very poor economic data in China and Japan showed the trade war between Beijing and Washington was hitting growth in some of the world’s biggest economies. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.3%, while Japan’s Nikkei index fell further, dropping 0.8%. Asian stocks slid for a second day, led by material producers, as China’s economy slowed further in October, with factory output, retail sales and investment all below estimates. Most markets in the region were down, with Japan leading declines. The Topix fell 0.9%, dragged down by Sony and Toyota Motor, as Japan’s economy slowed sharply in the third quarter amid shrinking exports. Q3 GDP in Japan printed at just 0.1% – the same as Germany – and missing estimates of 0.2%.

The Shanghai Composite Index reversed earlier losses to close 0.2% higher, supported by Jiangsu Hengrui Medicine and Kweichow Moutai. Shanghai blue chips were supported by expectations that the gloomy figures would add to the case for stimulus. Hong Kong’s Hang Seng Index retreated as violent protests disrupted public transport for a fourth day in the city. India’s Sensex climbed as positive earnings continued to fuel optimism among investors Australia’s S&P/ASX200 wiped earlier gains to close 0.5% higher.

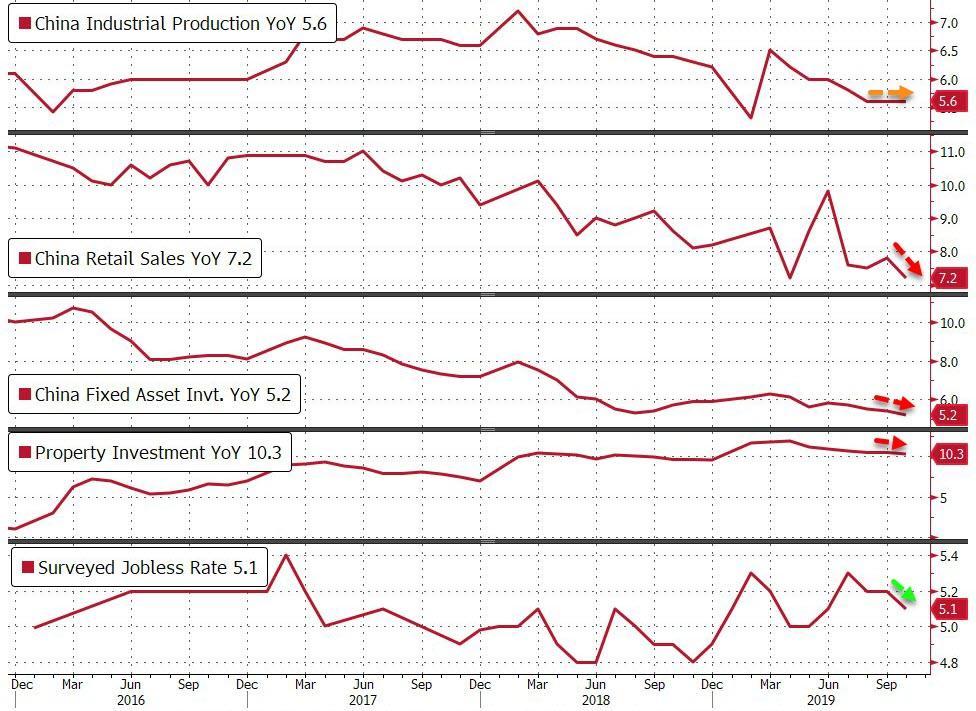

As reported last night, China’s factory output growth slowed significantly more than expected in October, as weakness in global and domestic demand and the drawn-out Sino-U.S. trade war weighed on broad segments of the world’s second-largest economy.

Fixed asset investment, a key driver of economic growth, rose just 5.2% from January to October, against expected growth of 5.4% and the weakest pace since Reuters record began in 1996. China’s industrial production growth slowed sharply in October, with the 4.7% year-on-year rise well below forecasts for 5.4%. Investment growth hit a record low and retail sales also missed expectations.

China and the United States are holding in-depth discussions on a “phase one” trade agreement, and cancelling tariffs is an important condition to reach such a deal, the Chinese commerce ministry said on Thursday, indicating it now believes it has leverage over the impeachment-scarred Trump, and something which the US president will likely balk at. Specifically, China’s MOFCOM said cancelling tariffs is an important condition for achieving a trade deal between US and China; degree of tariff cancellation should entirely reflect importance of a Phase One agreement, sides remain in discussion an a Phase One agreement.

The weak figures also came as market confidence about a resolution being reached weakens, with a new Reuters poll showing most economists do not expect Washington and Beijing to strike a permanent truce over the coming year. Trump offered no update on the progress of negotiations in a policy speech on Tuesday. The Wall Street Journal reported on Wednesday that talks had snagged on farm purchases.

Worries about spiraling violence as anti-government protests intensify in Hong Kong have also soured investor sentiment. Protesters paralyzed parts of Hong Kong for a fourth day, forcing school closures and blocking highways and other transport links in a marked escalation of unrest in the financial hub. Hong Kong’s Hang Seng fell 0.8% to a fresh one-month low.

In FX, safe havens such as the yen and Swiss franc gained as did the dollar whilethe euro brushed off news that Germany had avoided a recession, while implied pound volatility surged ahead of the U.K.’s December election. The yen was quoted at 108.70 per dollar, close to a one-week high. The Swiss franc traded at 0.9875 versus the greenback, near the highest in more than a week. The pound edged up then reversed gains, as traders are starting to brace for larger swings over the one month into the election result. The Australian dollar dropped as the nation’s employment unexpectedly contracted putting pressure on the Reserve Bank of Australia to lower rates. The data “puts the market back on the scent of a possible December RBA rate cut, which is why we have seen such a strong reaction in the Australian currency,” says Ray Attrill, head of foreign-exchange strategy at National Australia Bank.

In rates, 10-year Treasury yields fell for a second day, dropping to 1.8410% compared with its U.S. close of 1.869% on Wednesday, and 1.973% one week ago.