Fra Zerohedge:

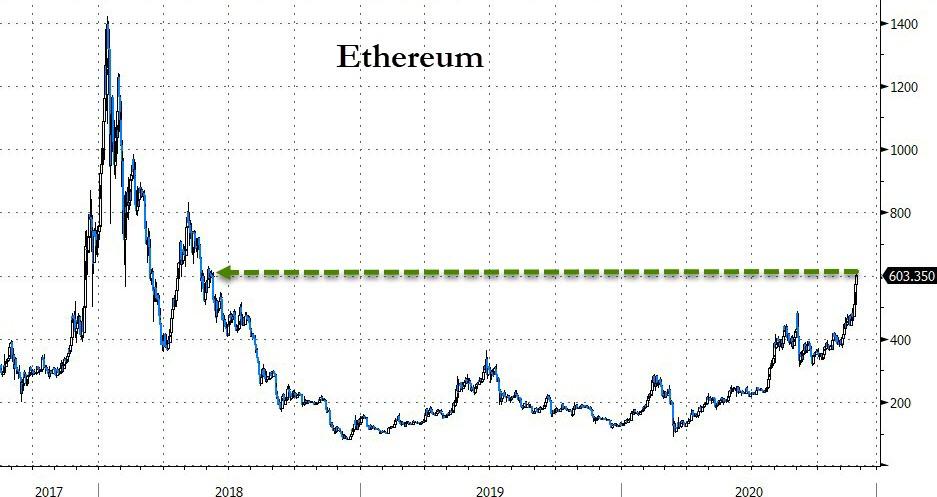

While Bitcoin has been stealing all the headlines, for the first time since June 2018…

Source: Bloomberg

…Ethereum has surged above $600…

Source: Bloomberg

…dramatically outperforming Bitcoin in the last few days…

Source: Bloomberg

Pushing ETH back towards its recent highs against BTC triggered by the DeFi boom…

Source: Bloomberg

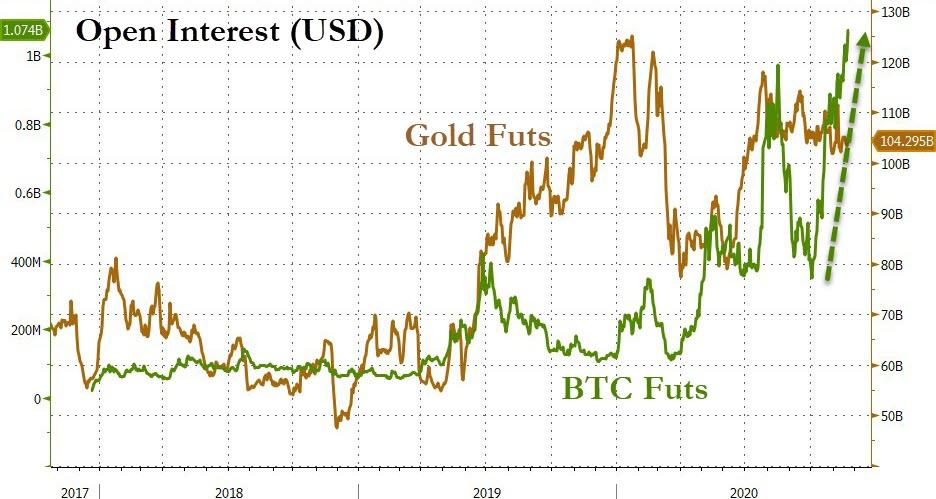

There are numerous catalysts for the recent resurgence of crypto, including institutional interest as governments deficit-spending goes to ’11’ and investors show a preference for ‘digital gold’ over gold…

Source: Bloomberg

…but specifically to Ethereum, as CoinTelegraph’s Joseph Young notes, the impending release of Ethereum 2.0 isn’t the only catalyst driving the current rally.

image courtesy of CoinTelegraph

Alongside the high anticipation for Ethereum 2.0, the high time frame breakout and daily gas usage on Ethereum remain key positive factors.

Eth2 momentum accelerates in correlation with price

The Eth2 mainnet will launch when the number of Ether (ETH) staked in the Eth2 deposit contract address hits 524,288.

Data from CryptoQuant found that the value staked in the Eth2 deposit contract address is showing a correlation with the ETH price.

ETH price versus total value staked on eth2.0. Source: CryptoQuant

Ki Young Ju, the CEO of CryptoQuant, noted that the correlation is seemingly growing as the launch date approaches. He wrote:

“As the ETH 2.0 launch date approaches, it seems to be a growing correlation between $ETH price.”

This trend has been anticipated by analysts because of the significance of Eth2. When activated, Eth2 is expected to improve the transaction capacity of the Ethereum blockchain network.

Since nearly $300 million worth of ETH would get deposited into the Eth2 deposit contract address, it could also decrease the selling pressure on ETH over the long term.

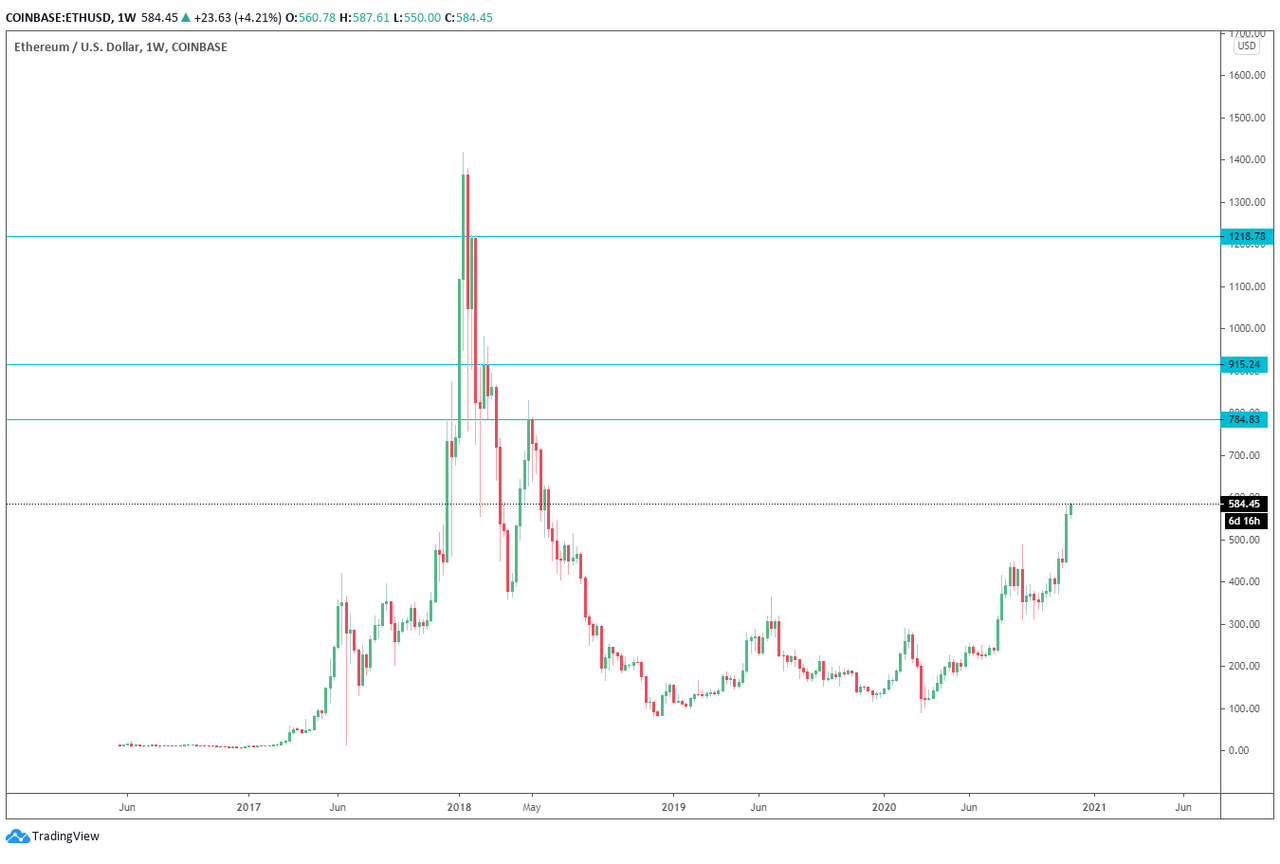

High time frame breakout

The price of ETH broke above $500 for the first time since May 2018, breaking out from a two-year range. It has already risen above $580 since, demonstrating strong momentum and with little resistance above $620.

If ETH surpasses $620, the next high time frame resistance levels are found at $784, $915 and $1,200.

ETH/USD weekly chart. Source: TradingView.com

Traders expect ETH to hit $620 in the short term and possibly consolidate under it until the next breakout occurs.

A pseudonymous trader known as “Rookie” said ETH could hit $620 in a matter of days, as it shows strong technical momentum.

Although both Bitcoin (BTC) and ETH prices pulled back during the weekend, analysts say that TWAP algorithms could cause the momentum to resurge once again. Qiao Wang, a quant trader and analyst, wrote:

“The reason why weekends exist is to shake out the weak hands before institutional buyers turn on their TWAP algos again on Monday.”

Fundamentals are backing the rally

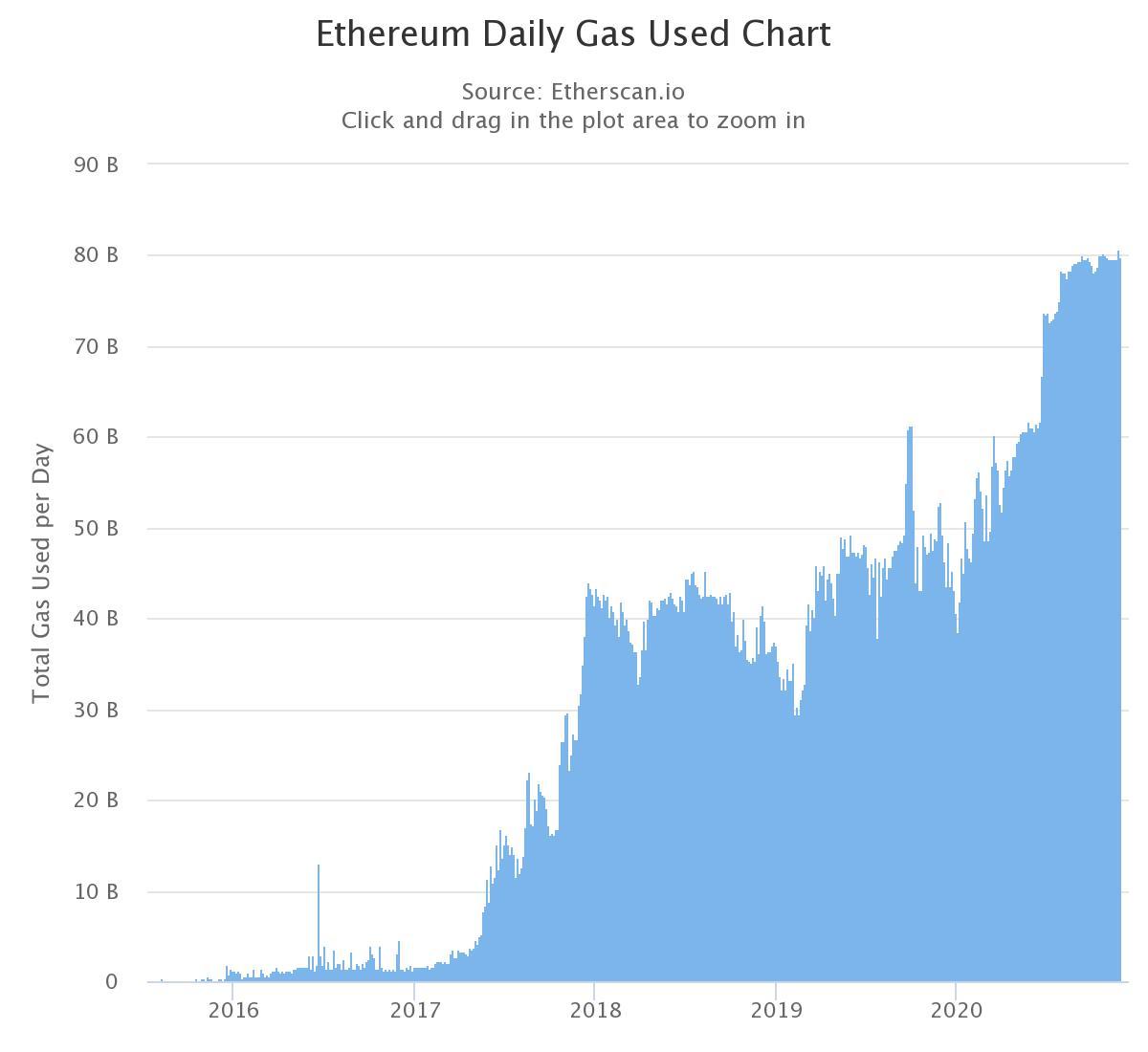

According to on-chain data from Etherscan, the daily gas usage on Ethereum is hovering at an all-time high.

The term “gas” refers to transaction fees on the Ethereum blockchain network. When gas usage is high, the on-chain user activity is rising.

Ethereum daily gas usage. Source: Etherscan

The increase in daily gas usage likely comes from two sources: deposits to the Eth2 address and growing number of decentralized finance, or DeFi, users.