Fra Zerohedge

Who would have possibly thought that Friday’s “Phase One” trade deal with China wasn’t worth the paper it was signed on?

If trade ties between China and the U.S. get back normal, it is “totally possible” for China to import $40b-$50b of agricultural products from the U.S., says China’s Taoran Notes

So even the agri deal is contingent/ not finalized

— zerohedge (@zerohedge) October 14, 2019

Oh wait, it wasn’t even signed, despite Trump’s tweeted assurance that the consequences of the deal with happen “immediately.”

Well, with futures initially rallying today in continuation of Friday’s sharp move higher, the rally first fizzled then futures tumbled just after 5am ET when Bloomberg reported that China wanted “further talks” as soon as the end of October to hammer out the details of the “phase one” trade deal touted by Trump before Xi Jinping agrees to sign it.

In other words, Friday wasn’t even Phase 1 – it was more like Phase 0.

As Bloomberg adds, Beijing may send a delegation led by China’s top negotiator, Liu He, to finalize a written deal that could be signed by the presidents at the Asia-Pacific Economic Cooperation summit next month in Chile. Why the delay? Because as we wrote over the weekend in “It’s All About The December Tariffs Now: “These Negotiations Look Much More Difficult Than Phase 1“, China now wants Trump to also scrap a planned tariff hike in December in addition to the hike scheduled for this week, something the administration hasn’t yet endorsed.

Meanwhile, as we also detailed over the weekend, the details of the “verbal agreement” reached in Washington last week between the two nations remain unclear, with many pointing out that nothing of matter was actually achieved and that China was desperate for the US agri imports anyway to avoid starving its population and prevent a social uprising. While Trump hailed an increase in agricultural purchases as “the greatest and biggest deal ever made for our Great Patriot Farmers in the history of our Country,” China’s state-run media only said the two sides “agreed to make joint efforts toward eventually reaching an agreement.”

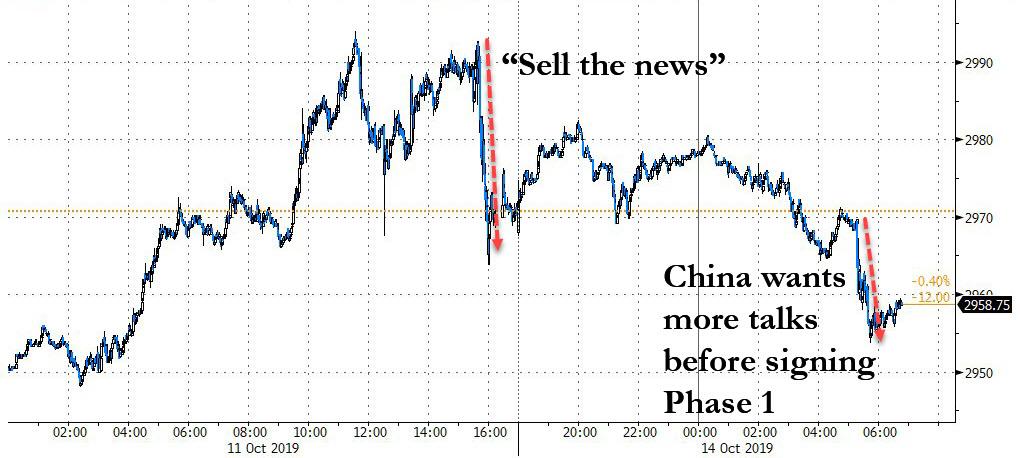

In any case, after initially trading higher following Friday’s late “sell the news” dump, futures reversed after rising to within 1.8% of a record close Friday and slumped to session lows as much as 0.4% after the report…

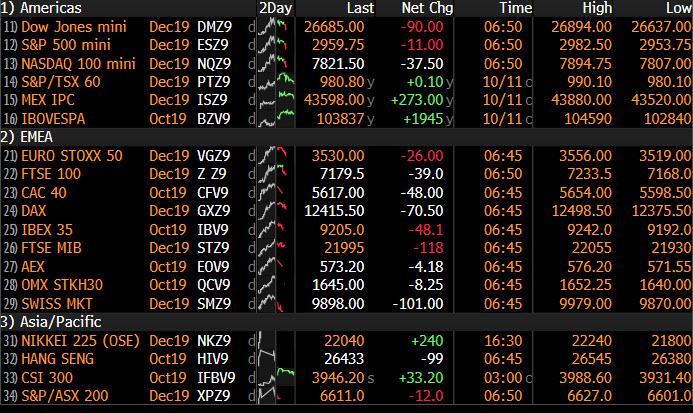

… while Europe’s Stoxx Europe 600 Index falls to session low, down as much as 1%, with rasic resources shares extending declines to as much as -2.8%, while banks remain as second-worst industry group, down 1.7%.

Stocks had climbed earlier from Sydney to Hong Kong, helping sustain a rally in emerging-market assets after after the positive conclusion of the latest round of trade talk. However, the latest negative trade deal news came after most of Asia had closed so expect all of this euphoria to be promptly unwound.

Add to this the unwind of the Brexit “hope” trade on Friday which saw cable explode higher amid optimism of a Brexit deal, as a result of murmurs of dissatisfaction from the EU and fears that Johnson’s ‘Queen’s Speech’ agenda might be voted down, becoming the first such loss for a government in 95 years, which rattled British markets, driving both the pound and British stocks lower, with the sterling down nearly 1% against the dollar at one point from a three month high, erasing a large swath of its gains from Thursday and Friday, its largest two-day rally in ten years.

UK PM Boris Johnson told his Cabinet on Sunday that a Brexit deal is achievable but added that that while a pathway to an agreement could be seen, there is still a significant amount of work required and the UK must be prepared to leave on Oct. 31st. Furthermore, it was also noted that EU negotiators warned his plans are not yet good enough to be the basis for an agreement, while it was also reported that Brussels is demanding further Brexit concessions from UK which has prompted warnings that a deal based on additional compromise would be rejected by Parliament. The main issues, following a briefing by EU Brexit Negotiator Barnier to the EU27 are: rebate system is complex, plans will not be ready for the end of the transition and it’s unclear how we can ensure goods for Northern Ireland remain in Northern Ireland. EU Source notes that a deal at the summit is very difficult, but not impossible.

With the US bond market closed for Columbus Day – it remains a mystery why equities trade today when the Treasury market is on vacation – traders bought what safe assets they could, and the dollar strengthened against all other G10 currencies except the Swiss franc and the yen as Brexit euphoria waned and investors waited for further progress on the trade front.

The Bloomberg Dollar Spot Index gained for the first time in four days as risk-on trades are unwound, mostly to take profit, according to two traders in Europe. Haven-currency short positions were also trimmed by leveraged names during London hours; the yen hit a day high after a report that China wants further talks as soon as the end of October to hammer out the details of the “phase one” trade deal touted by Donald Trump before Xi Jinping agrees to sign it.

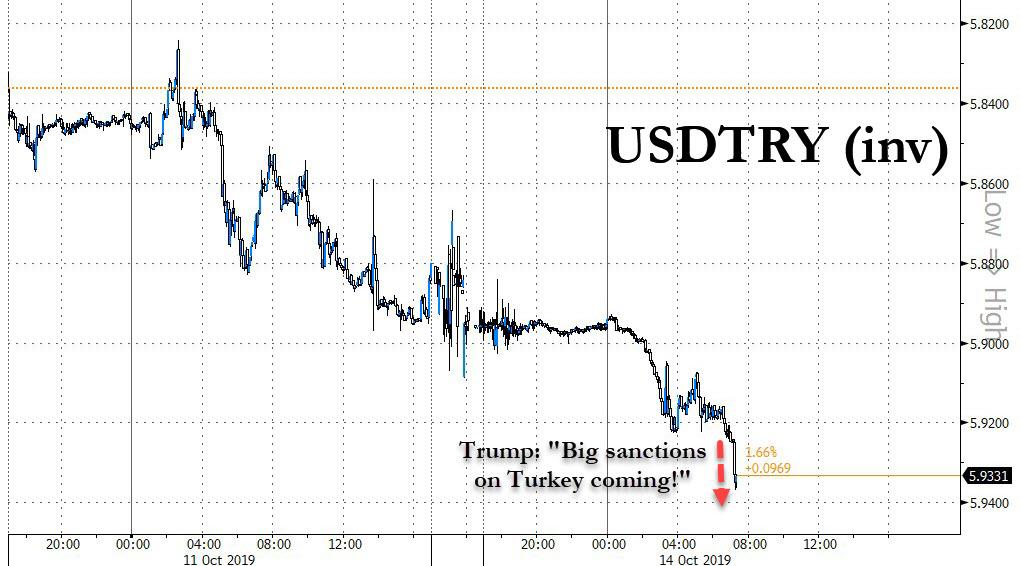

The Turkish lira tumbled as suddenly Erdogan finds himself in the middle of a diplomatic scandal where virtually every western power is bashing his invasion of northern Syria and Trump moments ago warned on Twitter that “big sanctions are coming!” sending the lira plunging to session lows.