via Knowledge Leaders Capital blog,

On Tuesday of this week we wrote about the four possible scenarios the Fed could adopt in their Wednesday policy decision. In order of most hawkish to most dovish, those scenarios were:

- Fed does not cut rates and signals that a rate cut may be appropriate later in the year (read the September meeting). Balance sheet policy remains unchanged.

- This is a the most hawkish of the likely outcomes. The financial markets would likely read this is policy being too hawkish, causing long bond yields and equities to fall as a further slowing of economic growth is discounted.

- Fed does not cut rates, but instead signals a rate cut of 25bps is likely in the near term (read the July meeting). Balance sheet policy remains unchanged.

- This too is a somewhat hawkish outcome since the first rate cut is typically the largest rate cut. The long end of the bond market is likely to rally (lower yields) as the market views the move as less than what is needed to arrest the slowdown. Impact on equities would be small.

- Fed does not cut rates, but instead signals a rate cut of 50bps is likely in the near term (read the July meeting). Balance sheet policy remains unchanged.

- Now we are getting somewhere, and even though this is a somewhat dovish scenario long bond yields are likely to fall in sympathy with short rates, though perhaps not as much as short rates. Equities would likely rally.

- Fed does not cut rates, but instead signals a rate cut of 50bps is likely in the near term (read the July meeting). Balance sheet runoff stops tomorrow and the Fed opens up the possibility of more QE down the road.

- This is the least likely outcome and also the most dovish. Short rates may fall while the long end would likely selloff, steepening the yield curve and ushering in a risk on environment. In this dovish case, equities are likely to do quite well as a reflation trade takes hold, a la QE2.

Well, it turns out the Fed indicated they will walk through door number 2 in July, but opened up the possibility of actually walking through door number 3 if enough voting members get on board with a 50bps rate cut. The market’s reaction to this news was pretty much as expected so far, though two days of trading is hardly enough to identify a lasting trend. The S&P 500 is higher by 1.1% (good but not great) and Treasury bond yields are lower by a bit in aggregate. Gold of course is in the midst of a major breakout above $1400/oz while the US dollar is under pressure. So far so good.

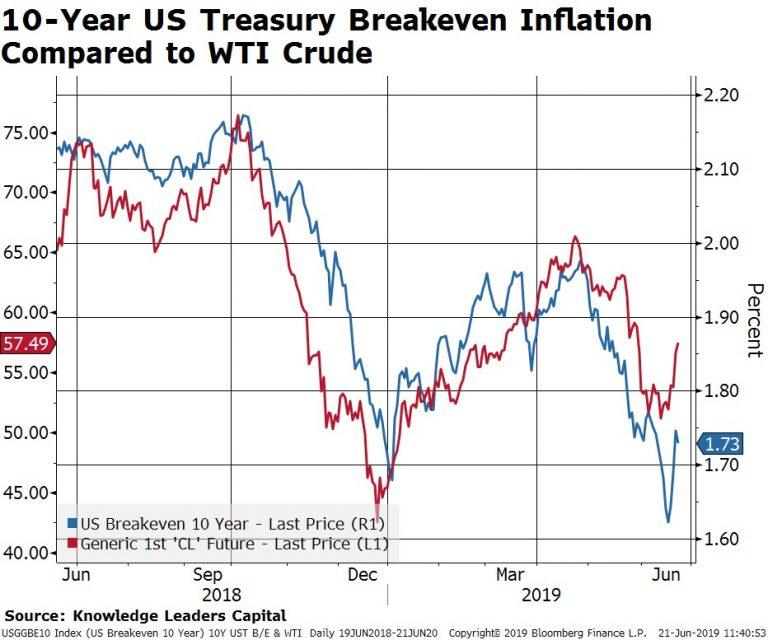

The bulk of the the rise in the inflation component of the yield is due to oil prices ratcheting higher by 12% since Tuesday, partly in response to geopolitical goings on. Therefore, but for the sharp rise in oil prices, the 10Y bond yield would be lower by 26bps since the Fed’s decision.

So what, you ask? The Fed signaled it was going to cut rates in July by either 25bps or 50bps so shouldn’t the rally in bonds have been expected?

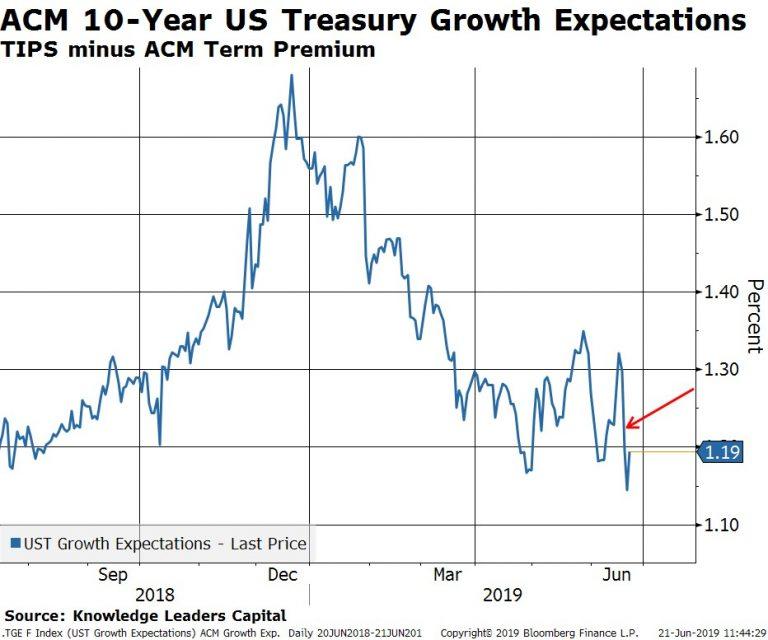

Not necessarily. Given the slowing economic backdrop, long bond yields could actually have risen strongly if bond investors thought a rate cut or two would stave off a recession or further slowdown. Instead, the growth expectations component of the yield fell by quite a lot.

This indicates that the bond market thinks a rate cut of 25bps (or even 50bps) in July is inadequate to stop the slide in eco activity. In other words, since the Fed meeting the bond market is discounting slower, not faster growth, which means that the Fed was not dovish enough.

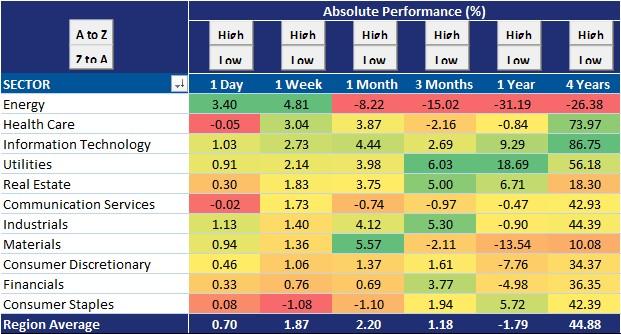

Interestingly, the equity market is sending the same message. Yes, stocks have rallied this week and especially since Wednesday, but the rally has been concentrated in defensive areas of the market. Below we show the equal weighted performance by sector for US large, mid and small cap stocks. But for energy, leadership for the week was in health care, tech, utilities, real estate and telecom – all areas with defensive characteristics be it quality (health care and tech) or low volatility (utes, real estate and telecom).

A few days of trading certainly does not make a trend, but we have our eyes on the nuanced message coming from the market – a message that has yet to give us an all clear signal.