Fra Zerohedge:

Facebook shares pumped’n’dumped after hours following a dramatic top- and bottom-line beat by the social media company, dismissing any concerns about social justice ad-spend boycotts.

“We had a strong quarter as people and businesses continue to rely on our services to stay connected and create economic opportunity during these tough times,” said Mark Zuckerberg, Facebook founder and CEO.

“We continue to make significant investments in our products and hiring in order to deliver new and meaningful experiences for our community around the world.”

Facebook’s revenue (3Q Rev. $21.47B, +22% Y/Y, Est. $19.84B) shows that the ad boycott from hundreds of big advertisers didn’t have a major impact. The company really relies on a lot of small advertisers, who don’t have many other places to place ads during covid. 3Q EPS also crushed it, printing $2.71 vs. $2.12 Y/Y, Est. $1.91

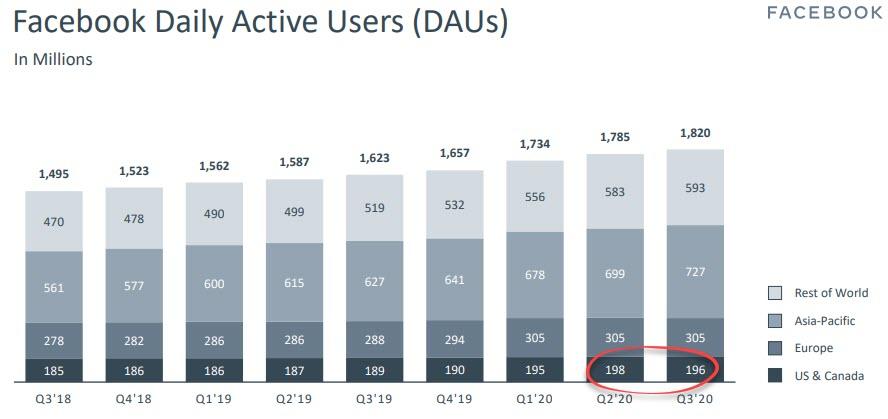

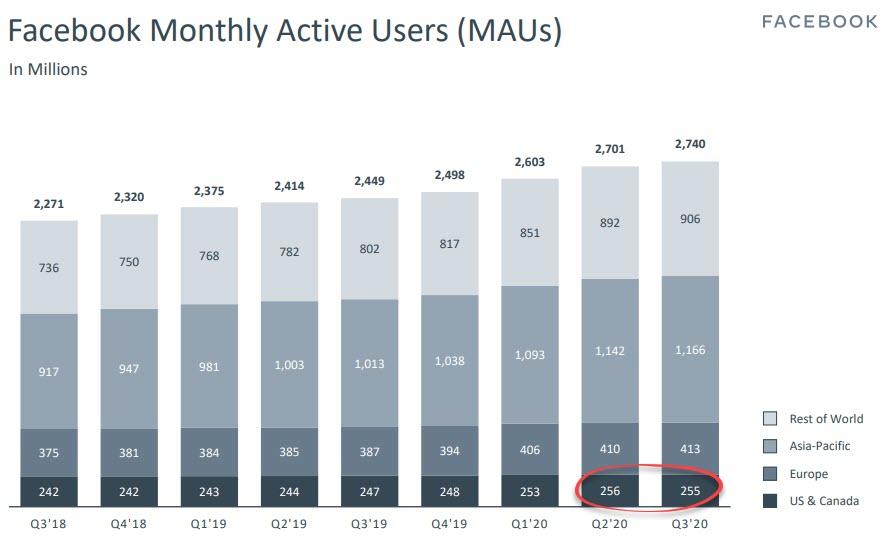

On the user side, Facebook claims the positive trends are continuing…

- 3Q Daily Active Users 1.82B, +12% Y/Y, Est. 1.78B

- 3Q Monthly Active Users 2.74B, +12% Y/Y, Est. 2.70B

However, there was a user slip in the U.S. and Canada, its most lucrative ad market…

The CFO added that

“We expect our fourth quarter 2020 year-over-year ad revenue growth rate to be higher than our reported third quarter 2020 rate, driven by continued strong advertiser demand during the holiday season…”

But while FB shares initially spiked higher, they are fading fast now, perhaps after the CFO commented: “Looking ahead to 2021, we continue to face a significant amount of uncertainty.”…

And this is with the help of a mere 4% effective tax rate…

One important thing from Facebook’s press release: The company received a big boost from the shift to online commerce, saying that online commerce is Facebook’s largest ad vertical. The CFO warns that if this changes, it would be a “headwind” for Facebook moving forward.