Fra Zerohedge:

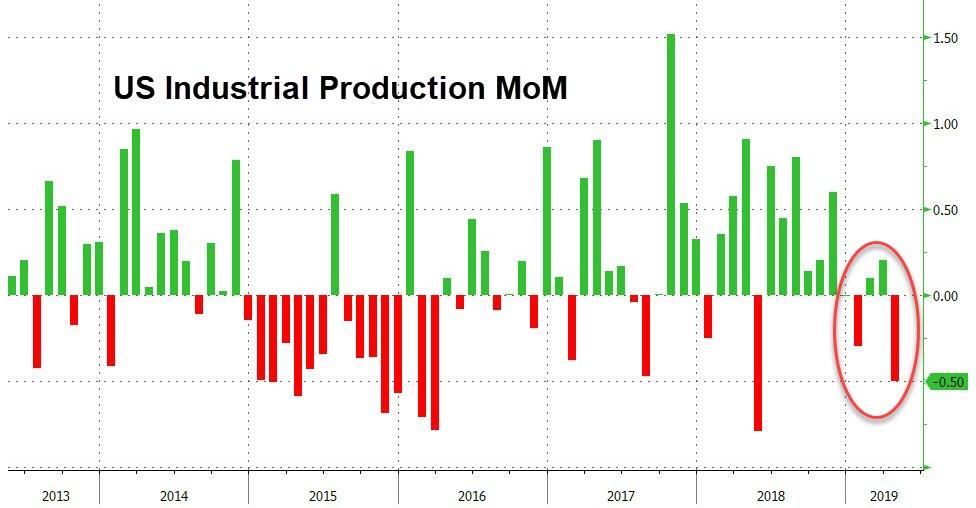

With US industrial production having stagnated for the last four months, April is expected to be more of the same – unchanged from March – but it didn’t, missing dramatically and tumbling 0.5% MoM.

The report shows manufacturing losing momentum amid a trade war with China that’s raised prices and complicated business decisions. Those headwinds are poised to strengthen after President Donald Trump this month threatened fresh tariffs.

Production of motor vehicles and parts fell the most in three months, while machinery output shrank the most since 2014. Business equipment fell the most since 2013 while output of consumer goods decreased the most since January.

This is the biggest headline MoM drop since May 2018

Capacity utilization, measuring the amount of a plant that is in use, decreased to a 14-month low of 77.9% from 78.5%.

And the slowest YoY growth since March 2017

And worst still Factory Output actually contracted YoY in April…

Most major market groups posted decreases in April.

The production of consumer goods fell 1.2 percent, with declines for both durables and nondurables. The index for durable consumer goods moved down 0.8 percent, mostly because of a drop in the output of automotive products, while the output of nondurables was held down by sizable declines for both chemical products and consumer energy products.

Production decreased for business equipment (biggest drop since Jan 2013),construction supplies, and business supplies…

But output advanced for defense and space equipment and for materials. Among the components of materials, a drop for durables was more than offset by gains for nondurable and energy materials.

The output of utilities fell 3.5 percent in April, with declines in the indexes for both natural gas and electric utilities; demand for heating decreased last month because of temperatures that were warmer than normal.

More ‘hard’ data for The Fed to consider – time for a rate-cut?