Merrill mener, at investorerne i høj grad skal fokusere på forbrugerne som drivkraften i økonomien, og det gælder i særdeleshed i Kina, hvor forbruget er på 5300 milliarder dollar, og hvor det vokser ekstremt. Investeringsmulighederne ligger i en bred vifte af forbrugsorienterede virksomheder.

Uddrag fra Merrill:

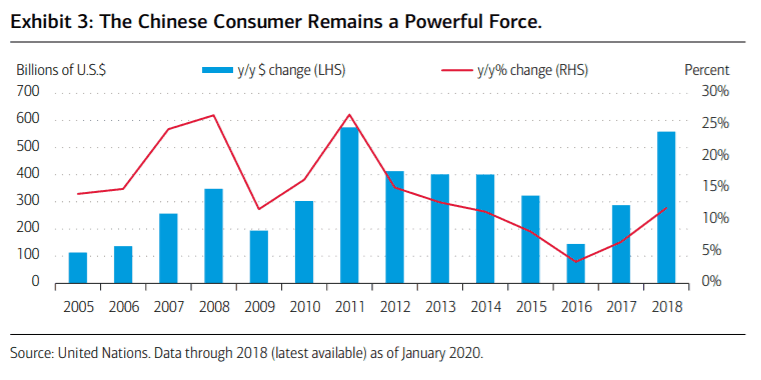

While Chinas economy has continued to slow over the past decade, the spending power of the Chinese consumer remains unmatched in the developing world, reaching a total of $5.3T for 2018. While the percentage growth of consumer spending pales in comparison to the 25%+ growth rates of the late-2000s, spending rose by $559B in absolute dollar terms, which is close to the fastest on record. The consumer has in turn become a bigger driver of Chinese equity performance, with consumer-oriented sectors like Consumer Discretionary/Staples, Technology, Healthcare and Communication Services accounting for 58% of market capitalization in late 2019, versus just 28% in 2010.

With the broader economy slowing down and shifting away from investment and trade, this supports a sector-specific approach

to investing in EMs like China, in our opinion. For instance, while the auto sector in China

remains under pressure, the rise of e-commerce could present opportunities for the major

internet retailers/e-commerce giants. With over 560 million online shoppers, China is the

largest ecommerce market in the world, totaling an estimated $1.3T in 2018 and making up more than 50% of global online spending.

Portfolio Strategy

All of the above serves as a reminder that the outlook for the global economy in large

part rests on the consumer. We believe investors should maintain exposure to wealthy

consumer markets in the U.S., Europe and Japan, in addition to select emerging markets

such as China. Examples include best-in-breed U.S. companies in sectors like consumer

discretionary and technology, as well as consumer-product leaders in Europe and Japan.

In EMs, investors can take advantage of the rise of e-commerce through exposure to

select internet retailers in China, while the surge in global obesity and rising incomes

could represent a major tailwind for healthcare. Other beneficiaries at the industry level

could be consumer electronics and department stores; household products and packaged

foods; and higher-end segments like tourism and luxury goods.