Uddrag fra John Authers:

The Italian Job |

Just in case anyone thought that the Taiwan Strait was now the only geopolitical flashpoint to worry about, take a look at the announcement from Moody’s Investors Service on Italy’s sovereign debt, which was published after the market closed on Friday. The country’s rating remains unchanged, but Moody’s has now downgraded its outlook to “negative.”

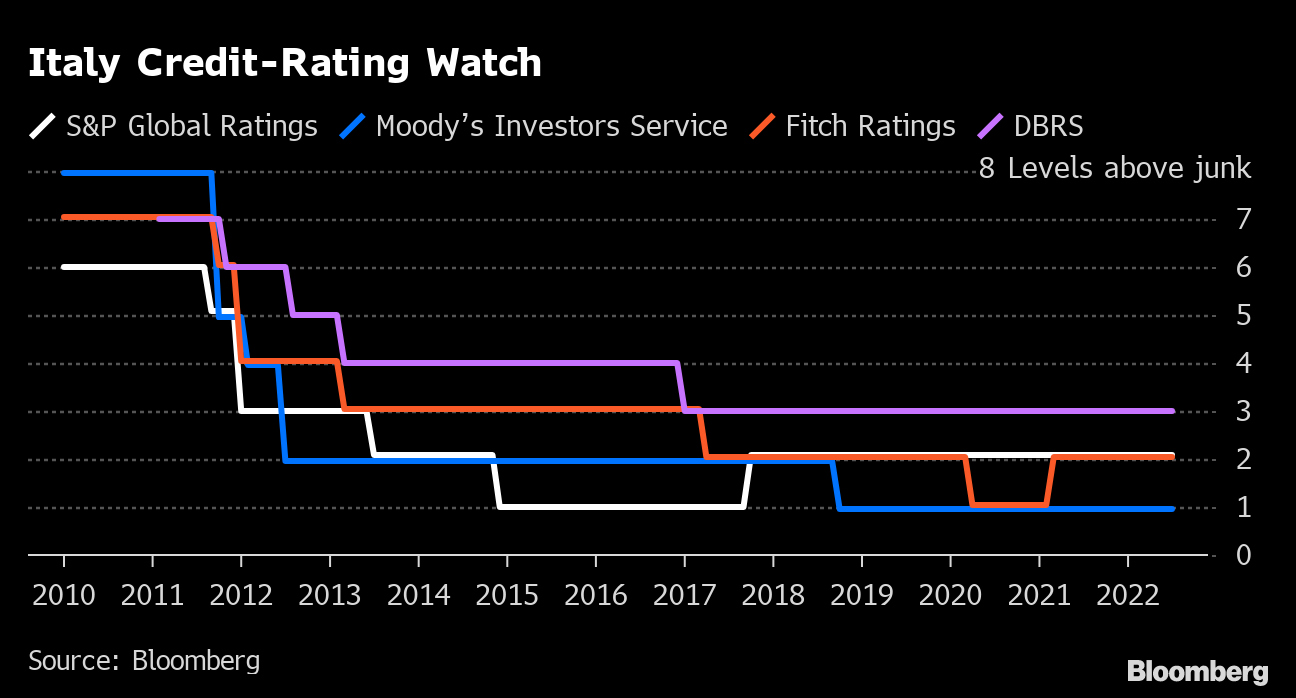

That’s a problem, because Italy cannot drop any further without losing its investment-grade status, as far as Moody’s is concerned. That would then force many institutions around the world to sell their Italian bonds, as many are required by regulators to avoid non-investment-grade debt. All the other significant rating agencies mark Italy slightly higher, but none see the credit as being far above junk, and agencies tend to follow each other.

What’s most alarming is that Italy’s debt was never rated this low during the worst of the sovereign debt crisis in 2011 and 2012 — although S&P also had it at only one notch above junk for two years starting in 2015. Financial confidence in Italy can’t go much lower without causing a serious accident:

The Italian government criticized the Moody’s move, which was motivated in large part by political risk. But Sunday’s news that the latest attempt to put together a center-left coalition had collapsed tended to confirm that the agency had reason to be concerned.

This heightens uncertainty for now, and will also be seen to increase the risk of a hard-right victory in the next elections, due Sept. 25. Polls suggest that the Brothers of Italy, which is descended from Mussolini’s Fascists, is on course to become the largest party in parliament.

These two very unwelcome news items come just as the bond market appeared to be gaining more comfort about Italian finances. The spread of Italian over German 10-year bond yields has spiked twice in the last few weeks, both times driven by concern that the European Central Bank won’t be able to keep Italian yields from ballooning once monetary tightening starts in earnest. A fall in the spread over the last week suggested returning confidence, and that will now be tested:

As one long-term Italy-watcher has cautioned me, it might be as well to brace for some unpleasantness in the BTP market this week.