J.P. Morgan har analyseret markedets udvikling i det seneste halvår contra det første halve år i 2021 og hæfter sig ved, at de små amerikanske virksomheder har klaret sig bedre end de store – med et afkast på 20 pct. Med den nye amerikanske finanspakke på 900 milliarder dollar tyder det på, at der er ved at komme en normalisering, og at en genoplivning af økonomien vil give de mere normale aktier en fremgang i deres performance.

Uddrag fra J.P.Morgan:

Thought of the week

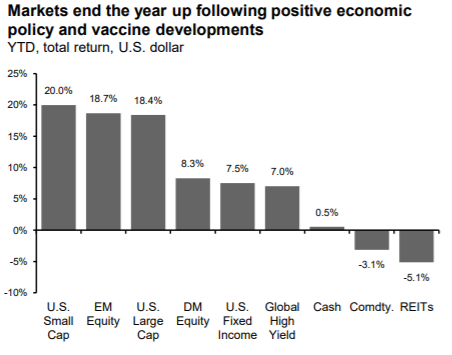

In contrast to the first six months of 2020, markets saw strong growth in the back half of the year, bringing year-to-date returns into positive territory as 2020 came to an end.

Investors looked past the continued spread of COVID-19, instead focusing on a combination of unprecedented monetary and fiscal stimulus, as well as positive news on vaccine development and distribution.

Small cap U.S. equities led the way, delivering a 20.0% return, a sharp reversal from the first quarter when it was the worst performing style.

Large cap U.S. stocks slightly underperformed vs. small cap, rising 18.4%, and international equity markets showed signs of life as well, with developed markets ex-U.S. up 8.3% and emerging markets up 18.7% in U.S. dollar terms.

Following the gradual restart of global economic activity and easing of oil-related tensions between Saudi Arabia and Russia, commodities began to recover but still posted a single digit decline for the year.

Fixed income continued to provide portfolios with ballast, with the U.S. Aggregate rising 7.5% as the Federal Reserve reaffirmed its commitment to maintaining low rates for the foreseeable future.

Looking ahead, the passage of a $900 billion stimulus bill should help alleviate fears about permanent economic scarring and provide markets with a solid foundation as the calendar turns.

2021 should see the beginnings of a return to normalcy, and the reopening of the economy should provide those sectors most geared to economic activity an opportunity to outperform.