J.P.Morgan peger på en række risikofaktorer for markedet som følge af de stigende renter, et voksende forbrug, en øget inflation og større omkostninger for virksomhederne. Derfor bør investorerne overveje at lægge mere vægt på value-baserede aktier.

Thought of the week

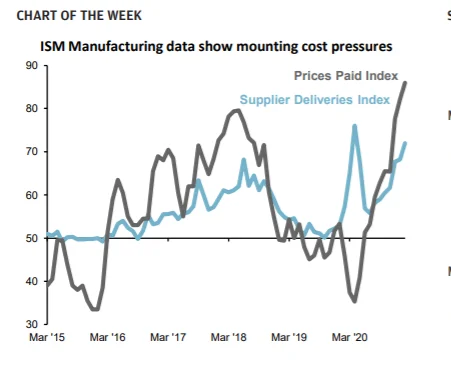

As the economy continued to slowly reopen in February, the ISM U.S. Manufacturing PMI came in at 60.8, indicating the strongest output growth since 2018. Even more notable, however, the ISM Prices Paid Index climbed to a decade high of 86, indicating rising inflation pressures.

The shortage of certain key materials and businesses taking the opportunity to rebuild margins have boosted prices higher and lengthened lead times, as is evidenced by the Supplier Deliveries Index reaching 72 in February.

In contrast to the manufacturing survey, the ISM Services PMI showed subdued activity in February due to the continued lockdown and cold weather conditions. Fortunately, the economic reopening should fuel a strong resurgence in the services economy in the coming months. However, this surge could exacerbate the pressure on prices as the services sector has also witnessed higher inflation pressures, with the services sector Prices Paid Index jumping to 71.8 in February.

As vaccine distribution ramps up and states lift business restrictions, the stimulus-fueled demand surge will confront a supply-constrained economy and lead to higher inflation in the coming months.

While this is not necessarily a risk for stocks yet, increased inflation expectations continue to boost long-term rates.

Because of this, investors should manage fixed income duration carefully and may want to consider rotating into value-oriented names.