J.P.Morgan ser tegn på en stigende inflation, men det vil ikke føre til rentestigninger i de næste to år. Men stigende renter vil dog få en gavnlig virkning på aktierne i traditionelle sektorer som industri, banker, materialer og energi – sektorer, der har været undertrykte under coronakrisen. Men skulle inflationen stige markant, bør investorerne i USA lægge mere vægt på internationale aktier, infrastruktur samt ejendomme.

Thought of the week

Massive monetary and fiscal stimulus has investors wondering if we are in store for higher inflation ahead.

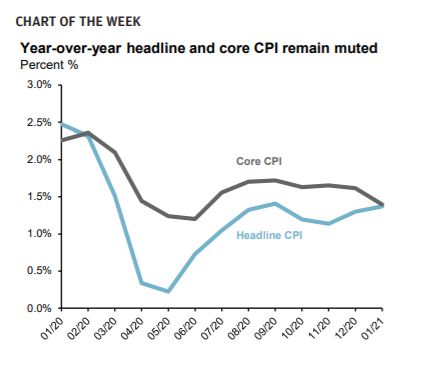

January consumer price indices (CPI) showed muted inflation pressures, with core CPI (ex-food and energy) flat month-over-month, up 1.4% y/y. Headline CPI, however, rose 0.3% m/m, primarily driven by a 7.4% m/m rise in gasoline.

Looking ahead, y/y headline CPI should accelerate further, reflecting higher current oil prices and inflationary pressures compared to plummeting oil and disinflation last spring. These effects may be largely transitory.

However, service consumption, particularly in restaurants and travel, should pick up later this year once the pandemic is under control. After losing many businesses during the pandemic, a limited supply met with a surge in demand could produce higher services inflation, although that should normalize in 2022.

We expect inflation to remain broadly in check over at least the next two years, prompting the Fed to hold rates steady.

However, as growth and employment improve, it should lead to a steepening yield curve, which is a challenge to long duration bonds but a support to cyclical equities such as financials, industrials, materials and energy.

If inflation does pick up more substantially thereafter, investors should consider international equities as the dollar weakens, infrastructure and real estate.