J.P. Morgan mener, at den finanspakke, som er på vej i USA, vil gavne investorerne i det nye år, selv om det endnu ikke er klart, hvor stor pakken bliver – på en eller to billioner dollar? Men pakken vil under alle omstændigheder styrke væksten i 2021, så USA i 2022 kommer tæt på at udligne tabet fra coronakrisen. Finanspakkerne i 2020 har vist, at de har haft en meget stærk virkning ved næsten at halvere nedturen.

Uddrag fra J.P. Morgan:

Thought of the week

At the time of writing, the passage of a $900 billion stimulus package, the fifth bill enacted in response to the pandemic, has been delayed due to the president’s request for larger stimulus checks.

While this is unlikely to be approved by the Senate, as it stands, the bill contains one-time $600 checks per adult or child, a $300 enhancement to weekly unemployment benefits extending to mid-March, $325 billion in aid to small businesses and roughly $190 billion towards education, transportation and COVID-19-related health care costs.

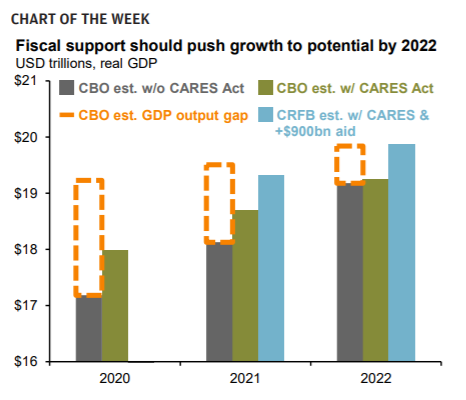

It should be emphasized that fiscal support has had a significant impact on mitigating the effects of the pandemic on the economy, and further aid should provide a boost to growth in 2021 and 2022.

The Congressional Budget Office (CBO) estimates that the CARES Act helped offset an expected 10% decline in real GDP by 4.7% in 2020 and could provide a 3.1% boost to growth next year.

Moreover, the Committee for a Responsible Federal Budget, a nonpartisan independent source of objective policy analysis, projects the most recent bill could add another $610 billion (or ~3%) to GDP in 2021.

As shown in this week’s chart, this bill could help fully close the estimated output gap inflicted by the pandemic by 2022.

We do expect additional fiscal support will be passed, providing a boost to growth in 2021. With both monetary and fiscal policy supporting the recovery, investors should be positioned for risk assets to perform well next year.