JPMorgan har analyseret virkningen af Joe Bidens plan for investeringer i infrastrukturen og grøn energi samt Bidens skattestigninger. JPMorgan hæfter sig ved, at analytikerne har en tendens til at overvurdere indtjeningen og undervurdere effekten af skattestigninger. Analytikerme forudser en indtjeningsvækst på 15 pct. i 2022 på grund af Bidens stimuli, men langsigtede investorer bør tage de positive nyheder med et gran salt.

Thought of the week

Last week, the Biden administration unveiled the details of its massive, 2-phase infrastructure package. The first phase will include $2.25 trillion in infrastructure spending, primarily focusing on traditional infrastructure, R&D, the electric grid, high-speed broadband and clean drinking water.

The proposal also has an additional $400 billion in clean energy tax credits that are not included in the headline total. Phase 2, which is expected to be detailed later this month, could bring the overall spend to $3-4 trillion.

If this initial bill is passed, we will likely see U.S. economic growth remain above trend for longer than previously expected, which in turn should provide a boost to corporate revenues.

While some of this robust top line growth should make its way into earnings, thereby helping to normalize valuations, higher corporate taxes are also on the horizon.

An increase in the corporate tax rate from 21% to 28% would offset some of the benefits of stronger revenue growth, and given that analysts are often slow to incorporate tax changes into their estimates, projections for 15% earnings growth in 2022 may be a bit of a stretch.

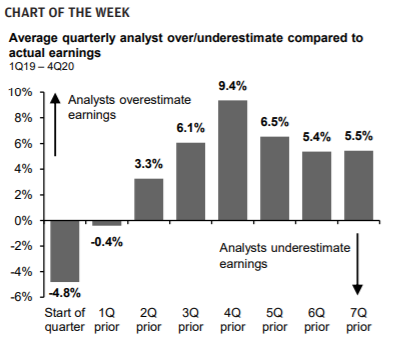

Furthermore, as shown in this week’s chart, analysts tend to overestimate earnings until one quarter out, when predictions more or less line up with actual results. As such, estimates will likely increase on the back of the proposed infrastructure package, but long-term investors may want to take these revisions with a grain of salt.