JPMorgan siger, at investorerne må komme ud af røret og investere i det kinesiske forbrugsmarked, da det er langt større end det amerikanske, og det vil blive endnu stærkere de næste år på grund af den store vækst i den kinesiske middelklasse. Alibabas Single Day-handel den 11. november satte rekord med 74 milliarder dollar. De tre store handelsaktiviteter i USA gav sammenlagt kun 50 milliarder dollar.

Thought of the week

China’s October activity data showed that the economy continues to recover, with annual growth rates in industrial production (6.9%), fixed asset investment (1.8%) and retail sales (4.3%) picking up steadily.

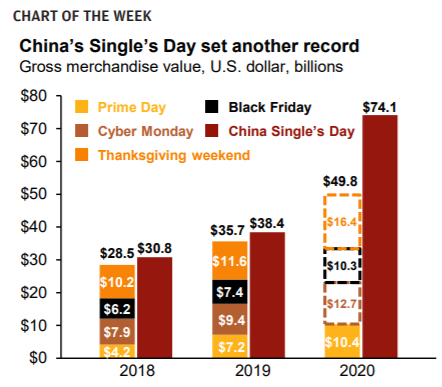

Notably, last month’s consumer spending came in below expectations, but the recent Single’s Day shows that demand remains strong in China. This week’s chart highlights that the 24-hour shopping event, held annually on November 11, has consistently surpassed U.S. holiday sales in previous years.

In 2020, Single’s Day was extended to an 11-day shopping festival and sold $74.1 billion of merchandise.

In comparison, Amazon’s 48-hour Prime Day event, which was delayed from July to October this year, sold $10.4 billion, and Cyber 5, the 5-day period from Thanksgiving through Cyber Monday, is expected to sell $39.8 billion according to Adobe Analytics.

This amounts close to $50 billion in sales in the U.S., which is still significantly dwarfed by Chinese consumption.

Going forward, we expect this trend to continue to hold over the next decade with the rise of the middle class population, and investors should make sure they have enough exposure to tap into this consumer story.