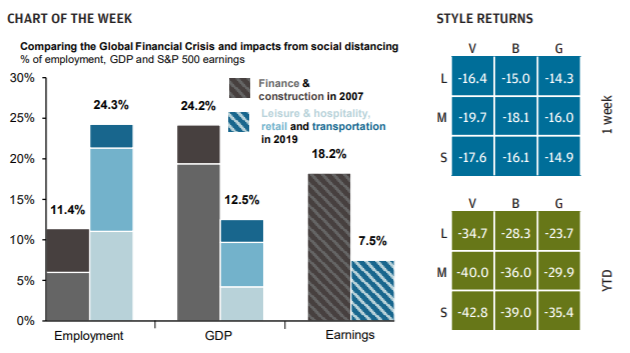

Recessionen i år bliver langt værre, men også anderledes end under finanskrisen. En større kreds af sektorer rammes. Til gengæld kan genopretningen blive langt stærkere og hurtigere end efter finanskrisen, fordi erhvervslivet ikke er ramt af ubalancer.

Uddrag fra JPMorgan:

Thought of the week

Financial markets have moved swiftly, and

are now pricing in a global recession, with

the S&P 500 falling into bear market

territory and both investment grade and

high yield bond spreads widening out

significantly. While we believe a 2020

recession is likely, it should be different

than the recession triggered by the Global

Financial Crisis (GFC).

The areas affected by

social distancing (leisure & hospitality,

retail and transportation) represent a larger

percentage of overall employment, but a

smaller share of GDP than the finance and

construction industries did during the GFC.

That being said, a very sharp decrease in

consumer spending concentrated in the

second quarter could subsequently lead to

broader economic weakness in the third

quarter. From an earnings perspective,

industries impacted by social distancing

represent a smaller portion of overall S&P

500 earnings than financials did in 2007,

but any impact on the aggregate figures

will depend on how badly earnings from the

affected industries are impacted.

While early indications suggest that this could be

a deep recession, the recovery that could

take hold, once effective treatments and

vaccines have been created and distributed,

has the potential to be more robust than

the recovery following the GFC as neither

the economy nor financial institutions went

into this crisis suffering from major

imbalances.