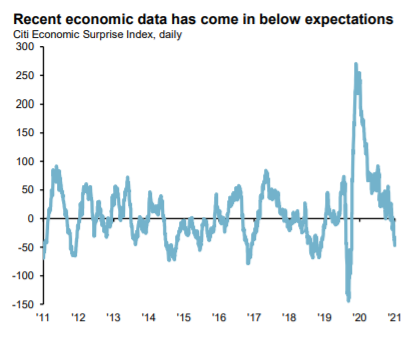

Ifølge JPMorgan er investorerne i stigende grad blevet bekymret for de økonomiske udsigter. Det udtrykkes af et såkaldt overraskelses-indeks. Det er faldet til under de gennemsnitlige forventninger. Generelt er der tegn på en solid økonomisk aktivitet, men flere data tyder på, at det bedste er ved at være overstået. Men fortsætter den igangværende vækst i en længere periode, vil det især gavne value-aktier i forhold til vækst-aktier, mener JPMorgan.

Thought of the week

Investors have become increasingly concerned about the outlook for economic growth; the flash August PMIs gave a first glimpse of economic activity at the end of the summer, and despite some modest deceleration, continue to signal the pace of economic activity remains solid.

At the same time, although durable goods orders missed estimates, they still increased ex-transportation and importantly, unfilled orders continue to move higher.

One highlight of both the PMI and durable goods data is that supply backlogs are ongoing, as the ratios of new orders-to-inventories and unfilled durable goods orders-to-shipments both remain above their long-term averages of 1.2x and 6.1x, respectively. This suggests that an inventory rebuild could act as a tailwind for growth over the coming quarters.

Turning to the demand side of the equation, consumer balance sheets remain solid, as personal income rose 1.1% in the month of July and the savings rate remained elevated at 9.6%; this dynamic should support a continued rotation in consumption away from goods and toward services.

Although prolonged supply chain constraints along with strong demand may lead inflation to be stickier than expected, a less concentrated recovery should support above-trend economic growth over the next 12 months.

For investors, an extended period of above-trend growth should provide support for value relative to growth, particularly given that long-term rates have yet to move higher from extraordinarily low levels.