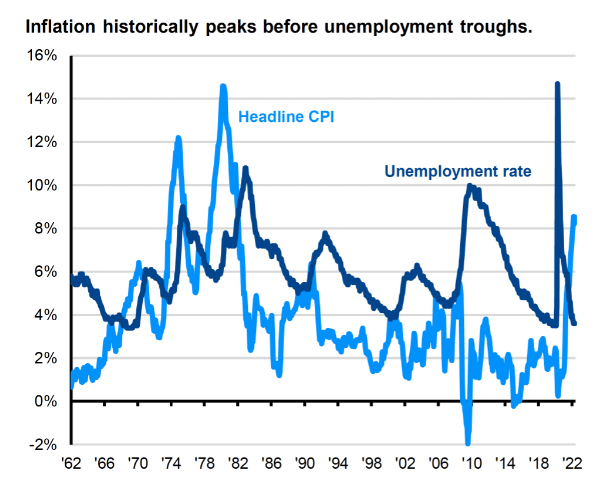

JPMorgan har analyseret inflationens historiske udvikling i relation til arbejdsløsheden. Inflationen topper normalt, inden arbejdsløsheden bunder. Det får JPMorgan og mange andre til at forudsige, at inflationen bliver moderat i andet halvår. Vi står midt i et bear-marked, men det er afgørende for investorerne, at de står pinen igennem. De skal ikke hoppe ud af markedet, men satse på kvalitetsaktier og defensive aktier.

Thought of the Week

On the heels of a 40-year high inflation print and decade high University of Michigan inflation expectations, the Fed voted to raise rates by 75bps at its June meeting. Guidance was hawkish, with the median FOMC dot showing rates up another 175 bps by year-end to a restrictive 3.4%. The Fed is “strongly committed” to cooling inflation and is willing to tolerate lower growth to do so.

Accordingly, the Fed revised down its GDP expectations to 1.7% in 2022 and 2023 from 2.8% and 2.2%. The Fed’s resolve to cool inflation also led them to inch up its unemployment targets to 3.7% in 2022, 3.9% in 2023 and 4.1% in 2024.

While the labor market continues to expand and growth is expected to recover through the middle of this year, the Fed recognizes the aggressive path ahead will cool labor demand and act as another drag on the overall economy into next year.

This revision implies ~800,000 fewer Americans on payrolls by 2024, if labor force participation remains constant. Different from the incredibly tight labor market we are currently seeing where the number of job vacancies doubles that of workers looking for employment.

As illustrated in the chart, inflation and unemployment exhibit an inverse relationship, with inflation typically peaking before the unemployment rate bottoms. While many economists differ on when peak inflation will hit (or if it has already), many agree that inflation will moderate in the second half of the year, which should in turn cool labor demand and be a turning point for the unemployment rate to tick back up.

Looking ahead, a “soft landing” may still be possible, but the Fed’s willingness to overtighten has increased recession risks, pushing U.S. equities further into a bear market and Treasury yields lower. While bear marks are certainly painful, enduring them is critical for long-term returns.

In environments like this, stay invested and opt for high-quality core fixed income and defensive sectors in equities.